Inflationary Pressure Set The Tone Of The Week As Investors Await US Data And Further US Fed Guidance.

USD/ZAR News

American Markets

Inflationary pressure was the theme of the week for the dollar.

Fluctuation on the greenback came as a result of investor nerves over the connection between higher inflation signalling a likely hike in the interest rates.

However nerves were quickly calmed in the US and the dollar calmed lower after comments by the Fed urged the market players to understand that rate hikes aren’t near and inflation is expected to last longer than anticipated.

There has been a trend of inflation results being high in the states and feelings are that if today’s inflation data shows an increase then the dollar may surge higher due to the assumption the Fed will be under pressure to then raise interest rates.

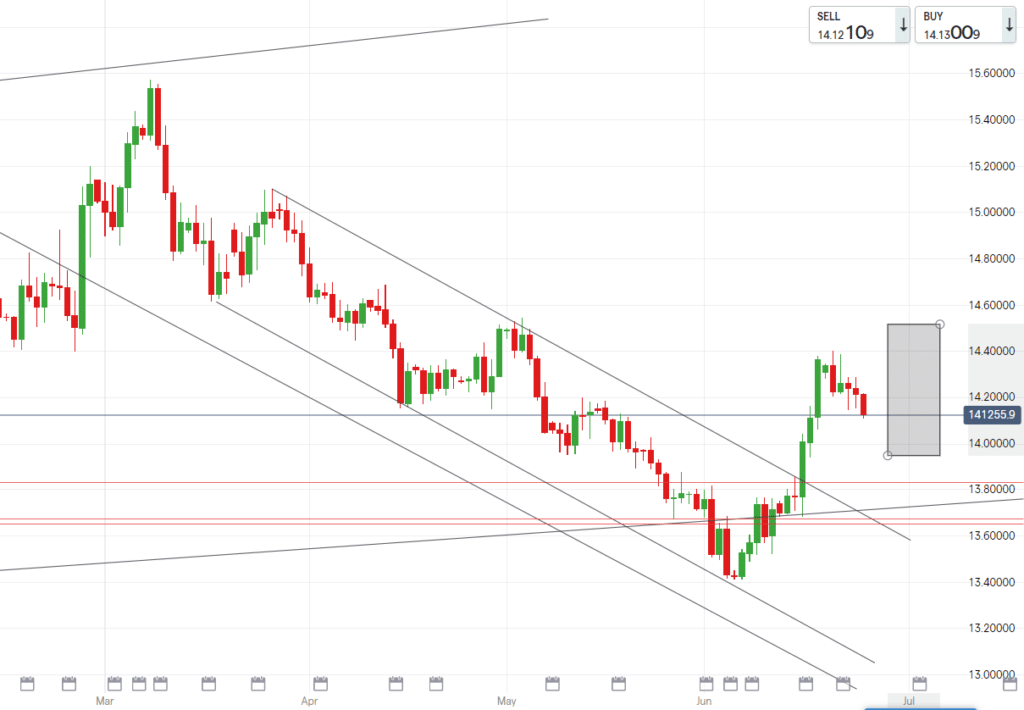

Technical direction forecast:

The USD/ZAR pair opened around R14.20/$ consistently this week, ranging around this support and now going lower than R14.14/$. Closing below the R14.20/$ will signal lower levels near R14.00/$.

Volatility is creeping and showing more similarity to pre-lockdown levels as the dollar has the impetus to shoot up to highs over R14.40/$ if data and Fed comments spurs investors.

Levels of R14.00/$ and R14.50/$ remain the strong support and resistance on either end of the spectrum.

EUR/ZAR News

European Markets

Business growth in the eurozone was shown to have accelerated at the fastest rate in the past 15 years.

Demand in the eurozone is beginning to flow over as lockdowns have eased in the region and consumers can promote growth in the manufacturing and services industries.

Despite this show of positive business growth, stocks have fallen in the bloc and losses were seen across trading sessions.

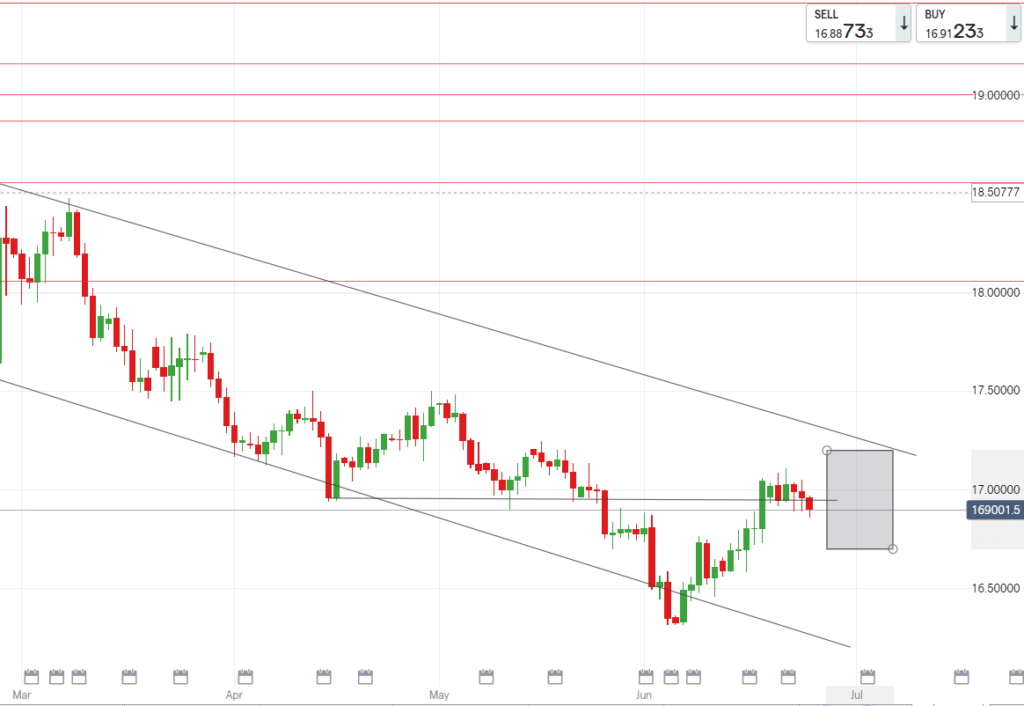

Technical data forecast:

EURZAR has been relatively flat this week, gradually moving downward away from the weeks high of R17.11/€ to breach under R17.00/€ as the rand benefits from investors waiting on US data to see how to approach their next moves.

Next lows to look out for on EURZAR will be R16.85/€ and then R16.70/€ if that is broken.

GBP/ZAR News

UK Markets

The pound suffered mild losses yesterday as the Bank of England strayed away from indicating any rate hikes.

Officials cited that inflation in the UK is expected to exceed 3% in coming months however this will be temporary and wont affect their current stimulus plans.

In short the pound fell as investors expected more market moving comments from the BoE, this weakness isn’t set to be long-term rather just until markets digest the ‘disappointing’ lack of fundamental changes in policy.

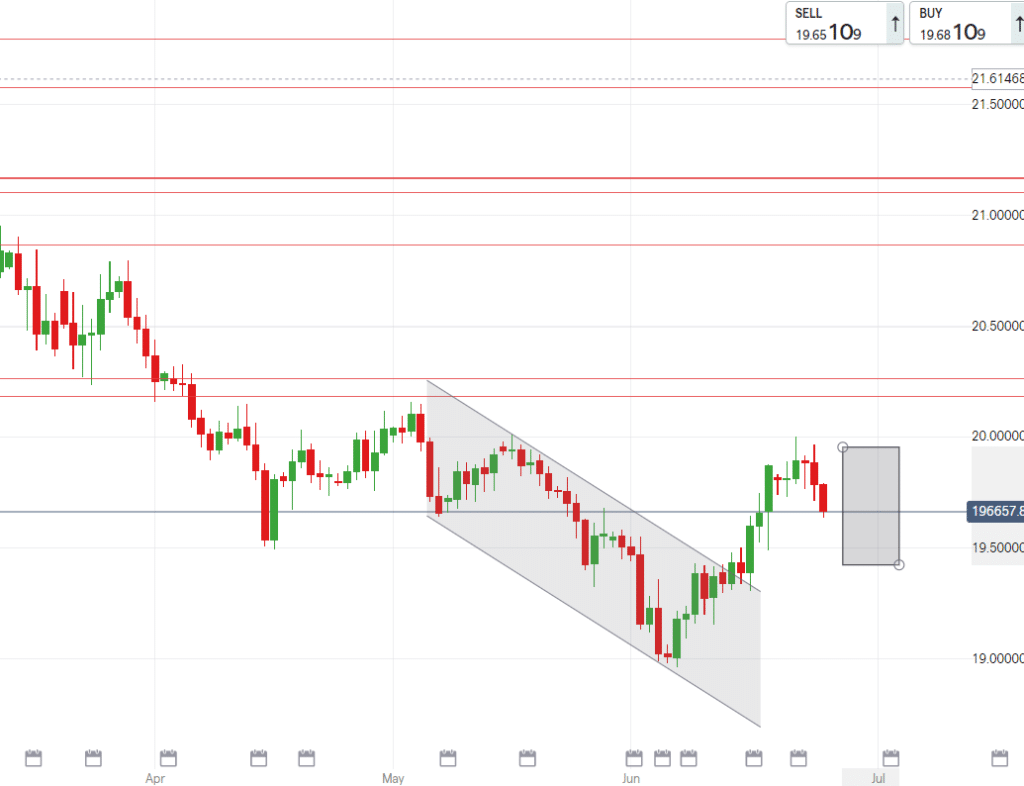

Technical direction forecast:

The GBP/ZAR suffered losses this week and is pushing towards the next support level of R19.59/£.

Such a move would be a 50% retracement of the breakout that occurred in mid-June and from a break down will signal lower levels or a bounce will prove an existential strength in the pound.

South African Rand News

South African Markets

The rand began the week as the worst-performing emerging market currency after losing 7% since the start of the month and after the US Fed flagged raising interest rates sooner than anticipated.

The rand since partially recovered losses, specifically after dollar nerves were settled on Tuesday.

Emerging markets have received a bit more of risk appetite after this occurrence and the rand remains tracking the dollars fluctuation.

Since then local worries have rose given the gravity of the looming 3rd wave expected to peak in early July.

Provincial officials yesterday stated that a return to level 5 in the economic hub of the country is unlikely and not required.

USD/ZAR

High – R14.50/$

Mid – R14.20/$

Low – R13.94/$

EUR/ZAR

High – R17.20/€

Mid – R16.95/€

Low – R16.70/€

GBP/ZAR

High – R19.95/£

Mid – R19.79/£

Low – R19.42/£