Positive Data And Safe Haven Status Played In The Dollars Favor This Week.

American Markets

The dollar traded cautiously this week as investors await the key jobs report for June later today.

Yesterday’s initial jobless claims data reported a lower than expected result, causing the dollar to spike in late trade and hit multi-month highs.

Investors continue to believe that such promising data will signal an interest rate hike and stimulus withdrawal from the US Fed.

This sentiment from market players is contributing to dollar momentum as well as other positive economic data.

Additionally, the more the new covid-19 delta variant ravages the globe then the more investors are turning to the dollar for safe haven.

Technical direction forecast:

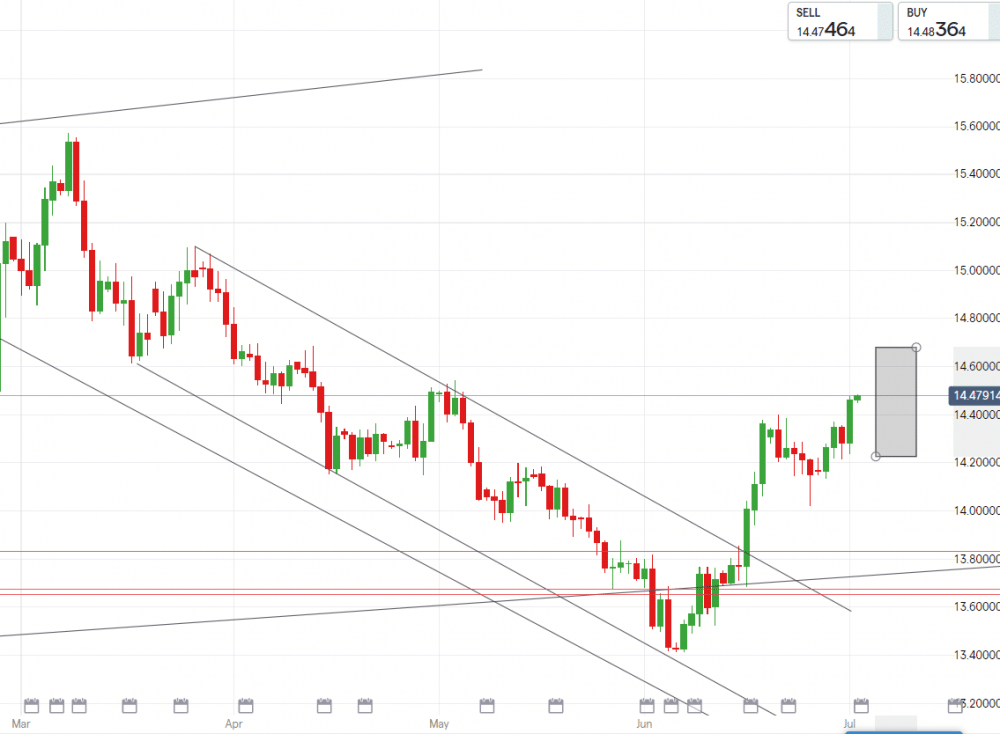

The USD/ZAR pair has made a 100% recovery from the drop the dollar experienced at the beginning of May.

After having failed to stay under R14.20/$ this week, the dollar looked to test R14.40/$ and now after closing above this strong level yesterday it shows momentum is building. Staying above R14.47/$ will give way to R14.50’s and impetus to test even higher.

European Markets

Economic confidence was boosted in the Eurozone after data showed recovery in the region.

Manufacturing activity expanded at its fastest pace on record last month.

An increase in factory headcounts prove the higher demand that has hit Europe since their reopening of much of the EU economy.

There is speculation that high manufacturing PMI points to more rises in consumer prices sooner rather than later.

Technical data forecast:

The EURZAR pair is testing the top of our channel at R17.16/€, breaking over this will see the EUR test highs next week of R17.30/€. Before this happens the pair will have to break our of channel at R17.25/€ – which is within reach given the current lack of rand impetus.

UK Markets

The pound is underperforming at the moment as it falters under disappointment over Bank of England Governor Bailey slamming thoughts of policy tightening, dollar pressure is also keeping the pound subdued and soft manufacturing data.

Even though the Sterling is falling short against major peers, it is still maintaining the upper hand over the rand as its gained 30cents since Monday.

Technical direction forecast:

The GBP/ZAR is headed to break the psychological resistance of R20/£, staying above this level will open up a path toward R20.07/£ followed by R20.17/£. Should risk appetite return then we may see a ranging around R19.90/£.

South African Markets

The rand lost ground this week off the back of a strong dollar and its positive data.

The rand lacks any backing with concerns over the current 3rd wave, the IMF having to loan a further $10bn for Covid-19 relief and Moody’s rating agency downgrading one of our capitals being the city of Tshwane.

Risk appetite helps the rand and at the moment there is none our favor – investors would rather invest in the safer dollar as uncertainty wallops the globe with variations of the coronavirus raking grip of nations.

USD/ZAR

High – R14.70/$

Support – R14.40/$

Low – R14.20/$

GBP/ZAR

High – R20.17/£

Support – R19.90/£

Low – R19.70/£

EUR/ZAR

High – R17.38/€

Support – R17.11/€

Low – R16.87/€