overview

Major central banks have finally changed their sentiment towards interest rates after promising hikes for the last year, a battle with rising global inflation and commodity prices. Investors have digested this as global economic recovery and Emerging Markets are reaping the rewards.

SA MARKETS

The greenback had a quiet start to the week in terms of economic data up until Wednesday when poor core retail sales figures were released. Core retail sales measures the change in the total value of sales at retail level and is a leading indicator measuring consumer spending. It dropped significantly from 4.4% last month to 0.2% this month, and the greenback sold off. Despite the sell-off, the Federal Reserve increased their interest rates by 25 basis points. FED Chair Jerome Powell’s choice of words were rather positive for the dollar. The tightening of monetary policy in the U.S has signaled to investors that the global economy is on a rebound and this has had a strong impact on the appeal of emerging markets, boosting the Rand to R14.90’s.

Yesterday President Cyril Ramaphosa appeared at the National Assembly to answer questions on his stance with regards to this Russian-Ukraine war and its impact on the South African economy. Much like China, the President has resisted calls to condemn Russia’s invasion into Ukraine and holds NATO responsible stating that. Ramaphosa noted that South Africa’s real GDP grew by 1.2% in Q4 of 2021. Furthermore he emphasized that the South African economy will not be spared along with the global economy should this war continue and we are already seeing the impact of the war on global commodity prices. The more commodity prices sky rocket, the higher public transport and fuel costs will go and food prices as well.

Technically:

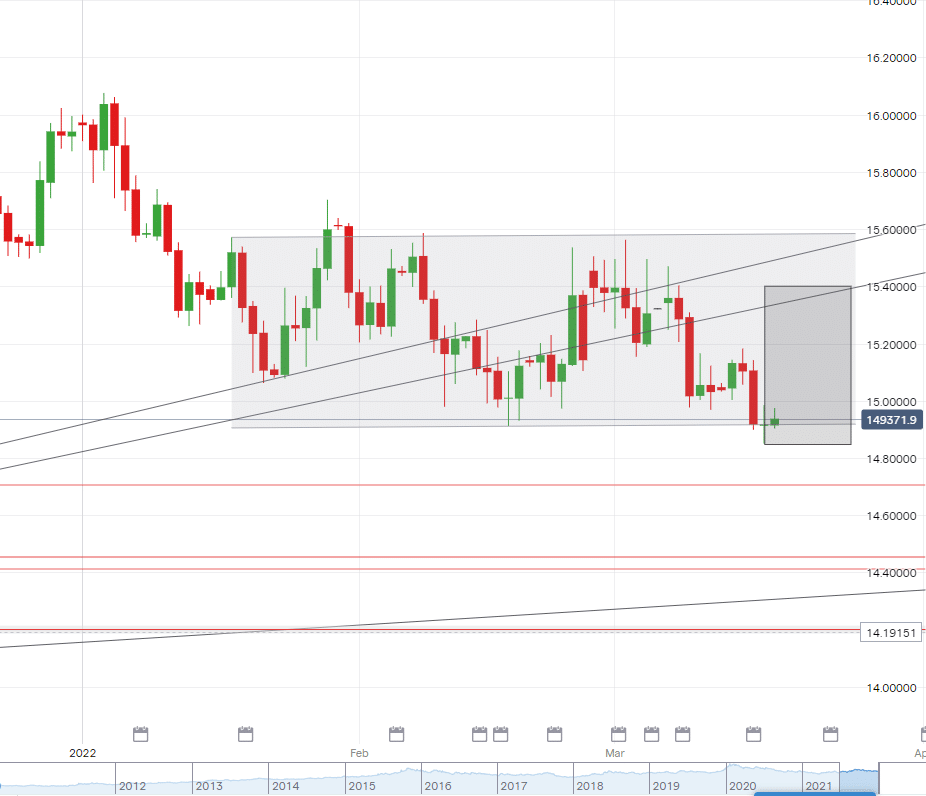

Before Wednesday the USDZAR ranged between R14.99/$ and R15.17/$. Investors were looking towards Wednesday’s FED interest Rate Decision, as it was widely expected for the rate to be bumped up by 25 basis points. It is from this time when volume was pumped into the pair, investors sold the green back and the pair fell from R15.17/$ all the way down to R14.85/$ from Wednesday to Thursday. The pair found strong support R14.90/$ and has since failed to break through it significantly as the pair has opened today at R14.90/$ and has bounced off the R15.00/$ support area. The Rand stands to weaken from a technical view, as the pair has found strong support at R14.90/$ and the dollar bulls may take the pair as high as R15.20/$.

european markets

There has been no significant economic data this week from the Euro Zone apart from CPI data that was released on Thursday. The Consumer Price Index measures the change in the price of goods and services from the perspective of the consumer. The CPI increased by 0.1%.

Russia’s advance in Ukraine is said to be applying its breaks as there has been four straight days of talks between negotiators of the two countries by video-link, but an agreement is yet to be reached due to the complexity of the situation. The United States has warned China on assisting Russia with military equipment, but Russia has reiterated that they are counting on China to help withstand blows to the Russian economy. About 3.2 million Ukrainian civilians have fled to neighbouring countries as a result of the war.

Technically:

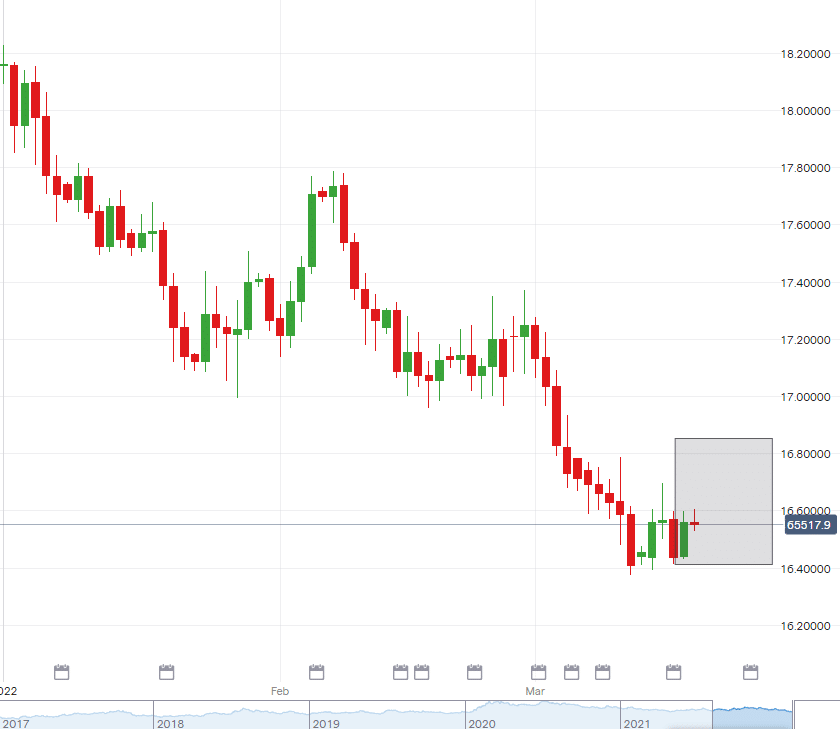

The Rand strengthened against the Euro for 5 straight weeks, but since the attempt of peace talks started this week, there is a turnaround. The Euro is now gaining a bit of strength against the Rand, finding support at R16.40/Euro. A double bottom was formed at this support level which is a bullish (upward) pattern. The pair may possibly retest this low for a third try, and should it fail to break, the Euro will most likely gain strength. The pair opened at R16.54/Euro, Euro bulls are pushing the pair up and may likely find resistance at R16.78/Euro.

uk markets

Much like the Euro market, it has been rather a quiet week economically for the Pound Sterling market as all eyes were set on Thursday’s interest rate decision by the Bank of England. The central bank softened its language about further tightening of monetary policy unlike the FED, but much like the FED, they bumped up their interest rates by 25 basis points, as it now stands at 0.75%, exactly where it was pre-pandemic. The Bank Of England signalled more hikes ahead but with more caution, as surging commodity prices fuelled by Russia’s invasion on Ukraine are likely to cause inflation to peak higher than previously expected, increasing the risk of an economic downturn. The central bank warned that inflation may reach 8% and possibly higher in the coming months. Furthermore, increases in energy, food and commodity prices increased by 5.5% in the year which is the fastest rate for the past 30 years. These stagflation shocks will put a lot of pressure on households as many will now be facing the worst cost of living crisis for generations.

Technically:

The Rand had strengthened significantly against the sterling for the past 6 weeks, but it now finds itself sitting at a major support level of R19.58/GBP. A double bottom pattern has formed on the four hourly chart signalling a bullish (upward) reversal and the sterling could start gaining strength again. The pair opened this morning at R19.63/GBP and may likely make its way back up to about R19.90/GBP.

Technical levels we are watching for next week:

USD/ZAR

High – R15.85/$

Support – R15.07/$

Low – R14.85/$

EUR/ZAR

High – R16.85/€

Support – R16.57/€

Low – R16.40/€

GBP/ZAR

High – R19.91/£

Support – R19.66/£

Low – R19.51/£