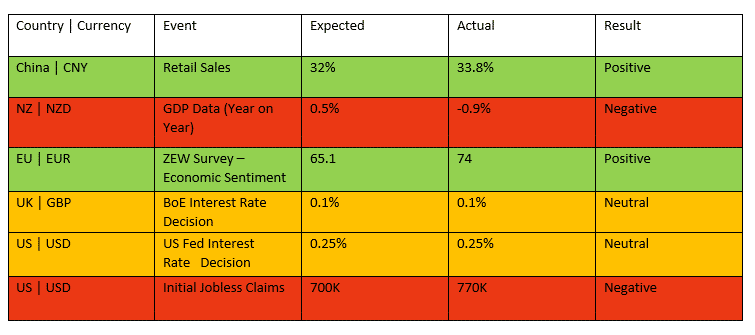

The Rand saw an easing this week as global sentiment improved over the US Fed’s comments over continued economic support.

USD/ZAR News

The dollar’s focus of the week was firmly set upon the US Fed’s Monetary policy meeting.

This meeting would reveal the outcome of the US interest rate decision and the forecast and expectations of US Fed Chair Jerome Powell in his post meeting statements.

Currencies treaded water as investors awaited the outcome of Wednesday’s meeting. The dollar started over R15.00/$ for USDZAR on Monday, ranging until risk-on sentiment, fears of inflation and a sell-off in US bonds pushed investors into emerging market currencies.

The Fed’s openness to continue fuelling support into the economy gives the impression to market players that the US economy and global economy may recover faster due to the aid – however this tends to push prices to unsustainable highs and we see reversals when prices run out of gas at monthly/yearly peaks.

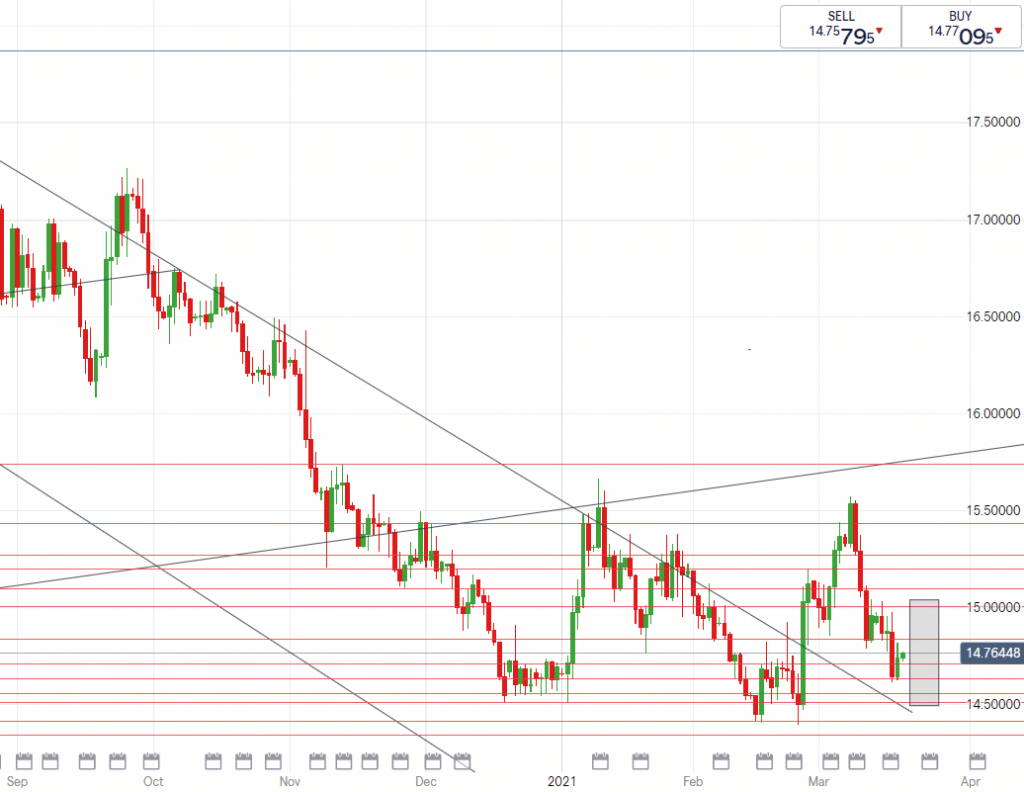

Technical talk:

USDZAR’s break out of our long standing downward channel seems to have been short-lived as the pair is possibly making its way back to the top line of that channel (see below graph).

This week we stayed roughly between R15.00/$ – R14.64/$, ranging around R14.75/$. Volatility is extreme of late and we can expect a wide forecasted spread for next week.

On the bottom end look out for a low of R14.50/$ and towards the top R15.05/$, breaks above or below will give us indication of new paths.

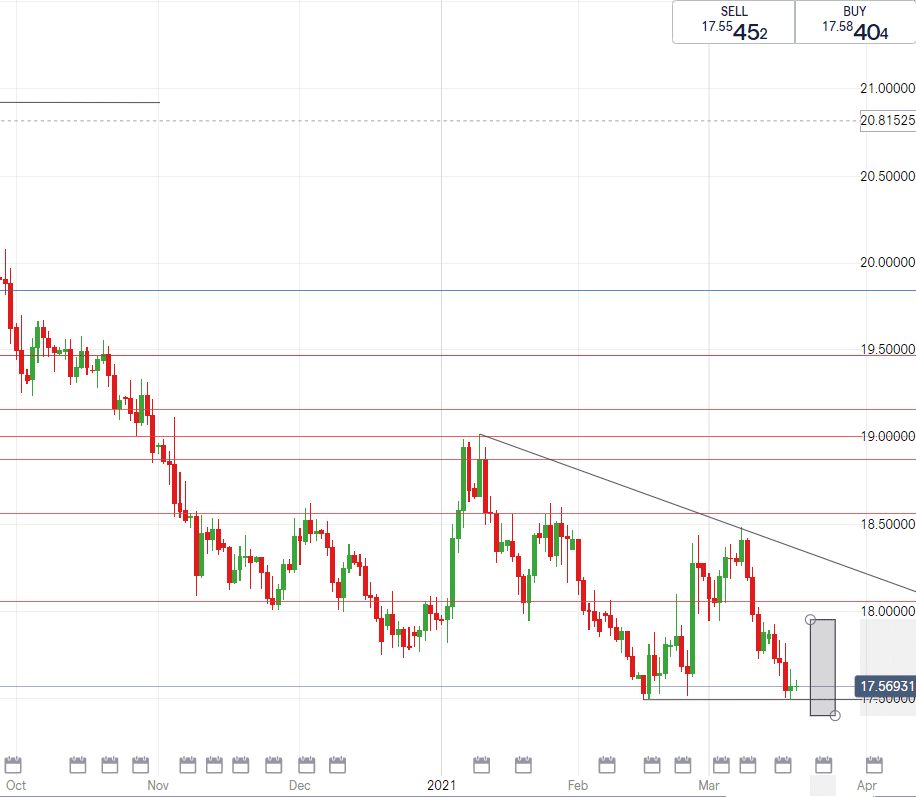

EUR/ZAR News

The European Central Bank president held a press conference yesterday with details around the latest economic outlook. A few of President Lagarde’s remarks were that downside risks remain in the near-term but the risks surrounding euro area growth outlook have become more balanced recently.

Additionally, the Pandemic Emergency Purchase Programme (PEPP) will be implemented flexibly according to market conditions adding that stimulus may take some time to show up. In the midst of EU’s vaccine shortage and after a number of EU countries suspended the rollout, the European Medicines Agency concluded yesterday that the AstraZeneca COVID vaccine is “safe and effective”.

As of yesterday, Italy along with France, Germany and Spain plan to restart AstraZeneca vaccinations.

Technical talk:

The EUR/ZAR pair has not traded below R17.50/€ since March 2020 which is 1 year ago.

The R17.50/€ line is a strong line and it will take some big price action to break through it. Based on the rand’s rally now, it is possible to get below this to the next low around R17.40/€.

On the other side of that coin, it is possible after our local MPC statement and other economic data being released next week that the pair could retrace back to R17.95/€.

GBP/ZAR News

The Bank of England’s Monetary Policy Committee voted yesterday to keep the lending rate at 0.1%.

This comes after the BOE cut rates twice from the start of the global pandemic when it was at 0.75%.

There are concerns around the world regarding bond yields that have moved higher over expectations of rising inflation and the result of that being the possibility that central banks can tighten their policies soon. We can see after the US Fed, ECB and BOE that this is not the case and central banks do not intend to tighten monetary policy until there is significant evidence to make such a move.

The GBP/ZAR pair is moving in favour of local importers as riskier assets like the rand look more appealing to investors, driving the price of the Sterling lower.

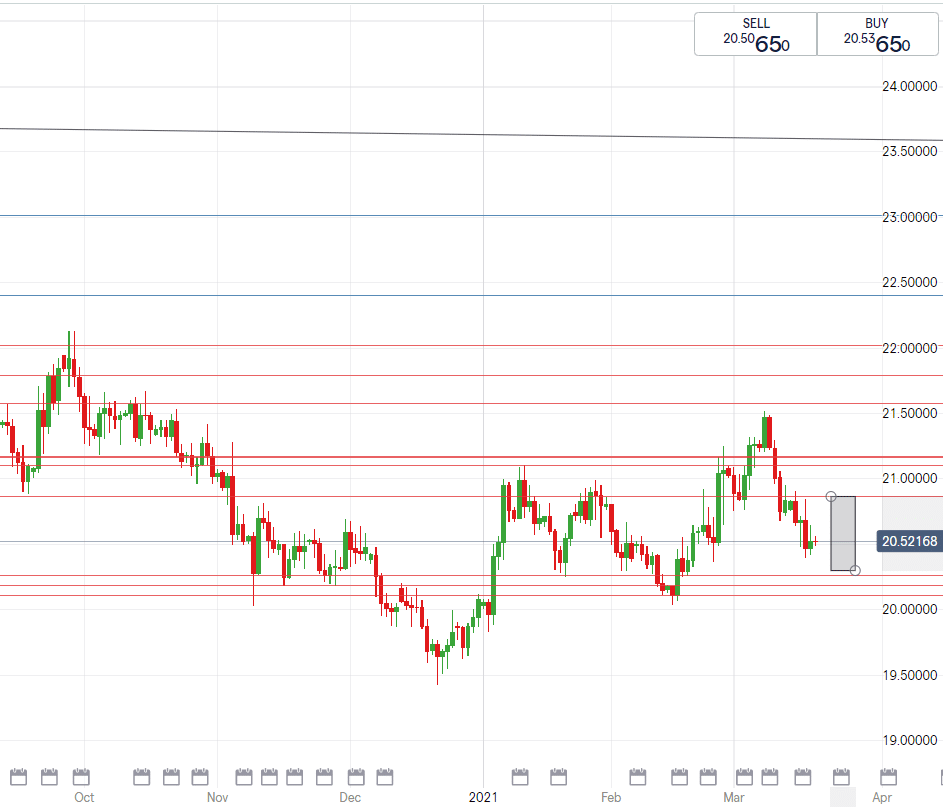

Technical talk:

Currently the GBP/ZAR pair looks like to could complete a triangle shape. For the low next week (if the rand’s rally continues) we could see R20.30/£ but if the currency should move the other way, we are looking at a retracement up to R20.85/£. A support line is where we are trading at now which is R20.56/£.

South African Rand News

The rand showed resilience this week once US treasury yields relaxed and saw us hit near month lows against the majors.

The outlook of the current rand’s movement is more likely attributed to risk-on currency appetite as opposed to dollar weakness.

Socio-political events are nothing out of the norm next week, focus will be shifted towards our Monetary Policy meeting which will culminate in our local interest rate decision being announced.

96% of economists predict that the interest rate will be unchanged, with but one analyst expected a cut of 25 basis points.

Secondly, will end of the month be the end of our current credit rating status as we may possibly move deeper into negative rating territory.

Finance Minister Tito Mboweni has cited concerns that the occurrence of a 3rd covid-19 wave, how this will impede growth and deepen debt will surely increase likelihood of a downgrade.

USD/ZAR

High – R15.05/$

Mid – R14.77/$

Low – R14.48/$

EUR/ZAR

High – R17.95/€

Mid – R17.75/€

Low – R17.40/€

GBP/ZAR

High – R20.85/£

Mid – R20.56/£

Low – R20.30/£