OVERVIEW

Investors Drop The Rand Due To New “Worst Ever Seen” Variant.

Investors Charge Away From Risk And Into Look For Cover In A Firm Dollar Safe Haven.

sa markets

The elevated levels we were expecting to gradually test have come with an unexpected bang as a new variant is spreading in SA.

USDZAR fell over 2% overnight as the UK placed South Africa on it’s travel ban red list and risk sentiment for emerging countries have folded.

It is a long weekend in the US and trading was expected to be thin for the close of the week, however now we can see volatility will be rife until shock news of the B.1.1529 variant is digested by the markets.

Risk appetite will remain off for many Asian and African countries as advanced nations begin to restrict travel.

The dollar was always going to strengthen today once trading resumed after positive job and GDP data in the US however price action would’ve been muted if it wasn’t for the travel ban news.

Restrictions remain low locally but with the new strain, rising cases and looming festive season – the cabinet and covid council are due to meet in coming days and discuss courses of action to combat the next approaching wave.

Factors currently weighing down the rand:

- New Covid strain prevalent to SA and a looming lockdown

- Dollar strength due to growing US economic conditions.

- Collapsed Turkish Lira and weak environment in emerging nations.

- Risk off appetite due to growing pandemic concerns globally.

- Load shedding as the local power crisis impacts business confidence.

What to expect next week :

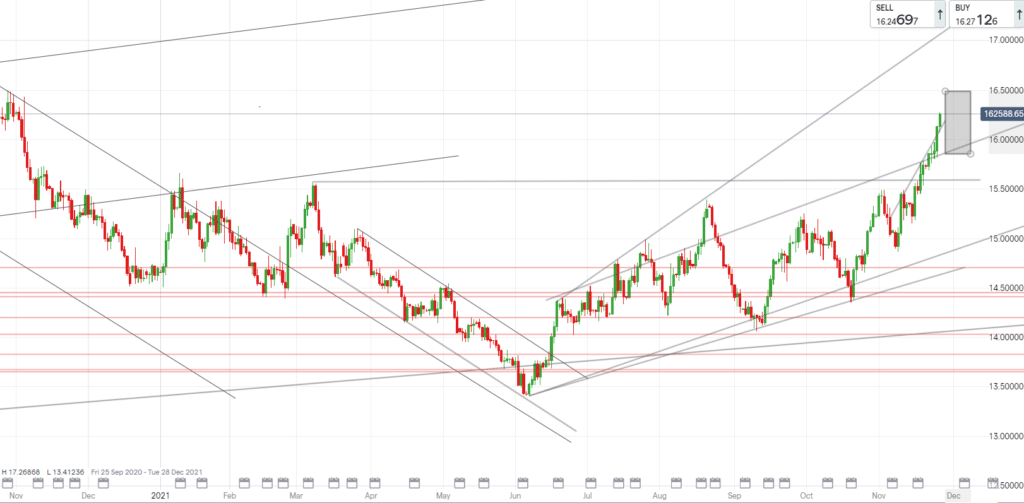

The outlook remains against the rand and next week we will have to see if this extension continues into testing of highs such as R16.50/$ or a correction will balance this impulsive move once market anxiety relaxes. Moving into December, attention will begin to shift to central bank guidance and moves to hike rates in the US and EU.

Technically:

The next high would be a R16.40/$, the USDZAR has broken through 4 resistance levels in the span of a few hours.

We are currently around a strong level of R16.25/$, closing above this would signal that R16.40-50/$ are on the cards for next week.

We would have to break lower to under R16/$ to expect a retracement back down to lower levels.

The bias is up and the rand is at mercy of global sentiment.

european markets

Bond yields in the EU rose significantly this week as market players have put their money where they think approaching rate hikes are.

Yields dipped slightly yesterday as caution arose before the ECB gave guidance on their October meeting.

The meeting minutes did not give a firm indication that EU rates would be hiked by year end, as President Lagarde took a dovish stance.

The ECB minutes had little affect on the markets as the content was similar to what has been seen in past meetings, member are keen on stimulus but hesitant to change policy like rates.

The euro was boosted against the rand by the international travel bans despite their own increasing lockdowns and restrictions due to cases surging.

Covid will be a theme ravaging the EU and the globe as the bloc’s strongest economy, Germany, has had their health minister state that by the close of winter everyone in the nation “will be vaccinated, recovered or dead”. The pandemic is still a big market mover, and if conditions worsen in the EU then the euro will experience pressure.

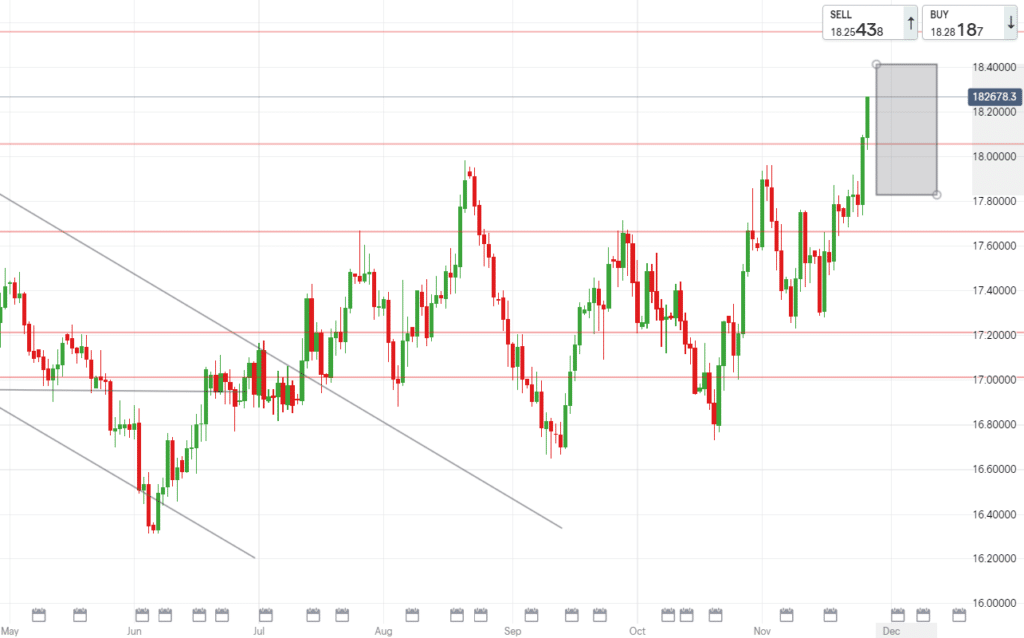

Technically:

EUR is expected to pullback while USD is expected to continue it’s run. Currently the EURZAR is pushing to test a high of R18.40/€. Getting to such levels will make it difficult for the pair to find it’s way back to R18/€ in a short amount of time. These elevated levels may be the theme for December given the state of the pandemic this year end.

uk markets

Immigration to the UK dropped by nearly 90% in 2020, it’s lowest influx since 1993. These stats will likely remain low, flights in and out will also dip now that the UK is adding to their red travel list.

The WHO announced a new variant spurting in South Africa and a few hours later the UK added SA to their temporarily suspended travel list.

The new variant has allegedly 30 mutations, making it harder to disrupt antibodies or current vaccine protections.

Due to inflation, the Bank of England is expected to act as many other central banks may and ditch stimulus soon.

Uncertainty remains around the officials intent as there is caution over whether inflation is permanent or temporary, this will translate to volatility in the sterling rates.

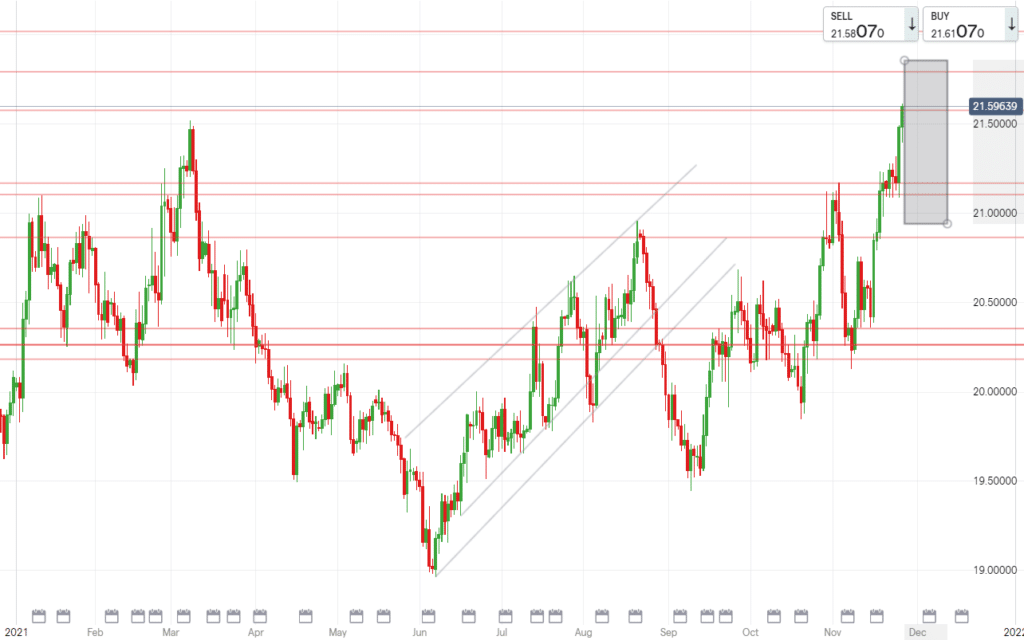

Technically:

Rising rates on GBPZAR are expected to continue and we are calling wide spreads as the rand off sentiment is pushing investors to sell rands. The pound rally can move to test R21.85/£ and near R22/£. Support is likely to be maintained around R21.45/£ until a correction occurs.

Technical levels we are watching for the upcoming week:

USD/ZAR

- High – R16.50/$

- Support – R16.15/$

- Low – R15.85/$

EUR/ZAR

- High – R18.45/€

- Support – R18.05/€

- Low – R17.85/€

GBP/ZAR

- High – R21.85/£

- Support – R21.30/£

- Low – R20.95/£