OVERVIEW

A close save for the U.S. as Senators extended the debt ceiling last night, till early December, saving the largest economy from what would have been their first ever default.

Market focus turns to the U.S. employment data release today.

sa markets

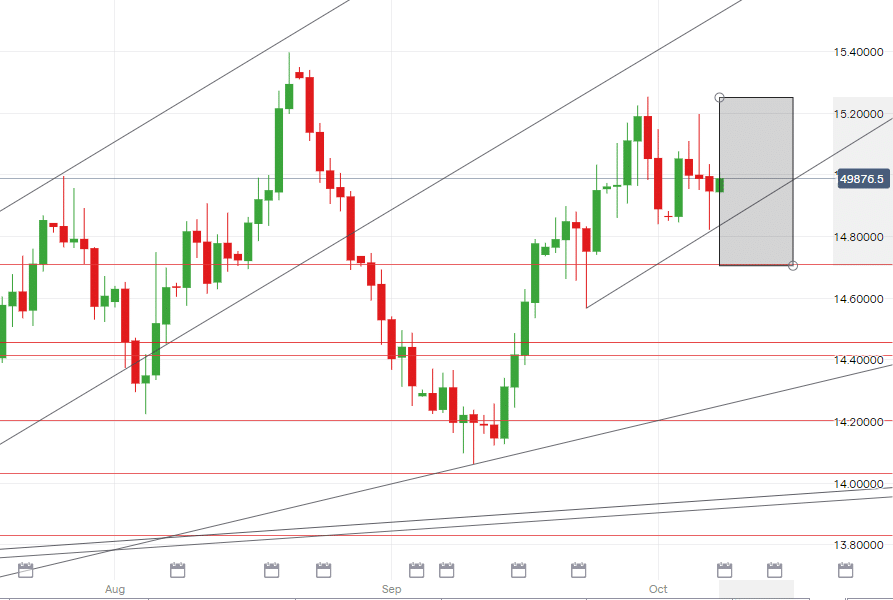

A wild ride for the South African Rand this week as it started on Monday around R14.90/$ and lost ground by mid-week touching the R15.20/$ level. Many speculators favoured further rand losses toward the R15.50/$ level but investors and market players seem to be moving with caution. It’s now clear that yesterday morning was the start of a short-term dollar sell-off, with non-farm payroll figures due later today and the concerns surrounding the U.S. reaching their debt ceiling which had investors fearful to hold dollars ahead of any concrete information.

Improving the mood globally this morning, the U.S. has come out unscathed once again with a close save by senators last night that extended the debt ceiling until early December to avoid the first U.S default ever.

Emerging market risk seems to be slowly regaining interest after last week’s damaging effects from China. Risk appetite is back but South Africa’s challenges remain. Just last night Eskom announced stage 2 load shedding to replenish emergency reserves. We can expect October to be quite an unstable month for the ZAR due to the budget speech looming and elections drawing closer. Credit rating agencies are also watching SA very closely and will wait till after the budget speech to make any official reviews.

Technically: If the US releases a strong employment report later today, we could see the dollar strengthen again toward R15.20/$ level or above but maybe not immediately. It is a Dollar holiday on Monday (Columbus Day) so the global anticipation is that many traders would want to go into take profit positions and we could see a weaker rand on Monday only to rally the Dollar on Tuesday. It’s also important to note that a strong employment report could almost certainly secure the start of tapering in November (Dollar positive).

A break of R14.80/$ will have the currency pair moving toward the 50% retracement level of R14.62/$ but only if there is a market moving event. Should the numbers today be in the Dollars favour, there is room for USD/ZAR to move oppositely and only a break of R15.20/$ next week would indicate a move toward the R15.50/$ mark.

european markets

ECB President Lagarde will speak this afternoon. The European Central Bank has been very accommodative and it will be interesting to hear if anything changes in that regard. The tapering news from the U.S could have lit a spark for all other Central Banks to follow where we could see the ECB start slimming down on asset purchases. The EU has recently reported they will bring forward new legislative proposals to combat tax avoidance which doesn’t essentially apply to illegal activities but the rich paying too little tax. Energy worries remain in the EU and unfortunately there are no quick fixes. Electricity prices are growing drastically due to higher demand and the natural gas price surge. Russia has put out their hand to assist Europe through this however leaving Europe vulnerable to a strategic transactional partnership from Russia.

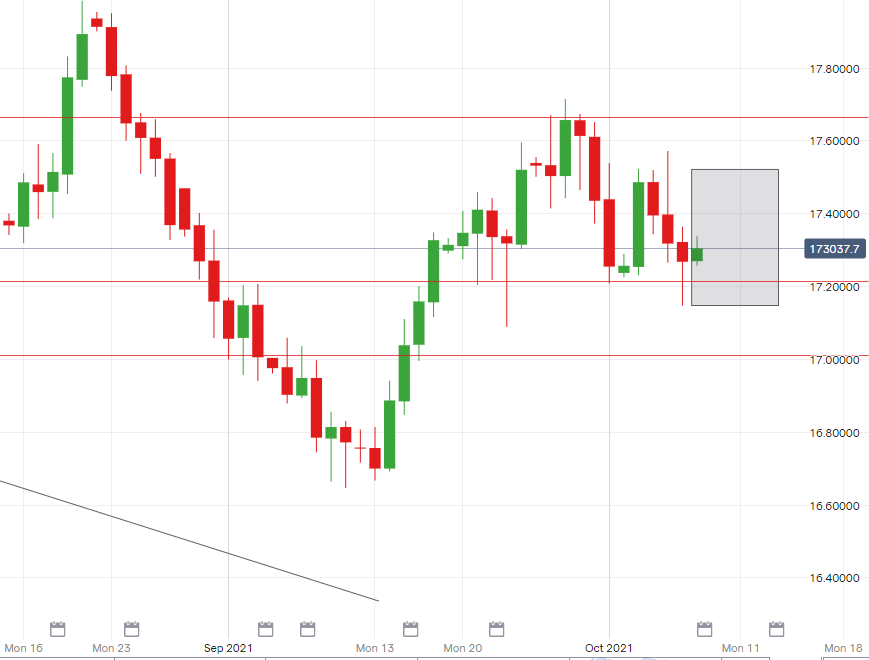

Technically: EUR/ZAR is trading close to a strong support line of R17.20. The currency pair has been trading range bound within 40 cents since 17 September and we could finally see a break soon. The data out today will indicate the direction the currency is going for next week. Any negative news from the USD would take the pair down toward R17.00 level but any better than expected news could bring back R17.50 levels.

uk markets

In great news for UK travellers and even better news for SA tourism, South Africa has been removed from the UK’s red list. Travellers will not need to quarantine and only produce their vaccine passport + negative Covid tests to travel to the UK. We can expect to see a boost in travel company sales etc which will filter into economic growth. The UK is reminding the public to get their flu jab to ensure full protection ahead of winter coming as Covid cases are still a big concern in the UK. The Pound remains strong as the UK economy opens up further.

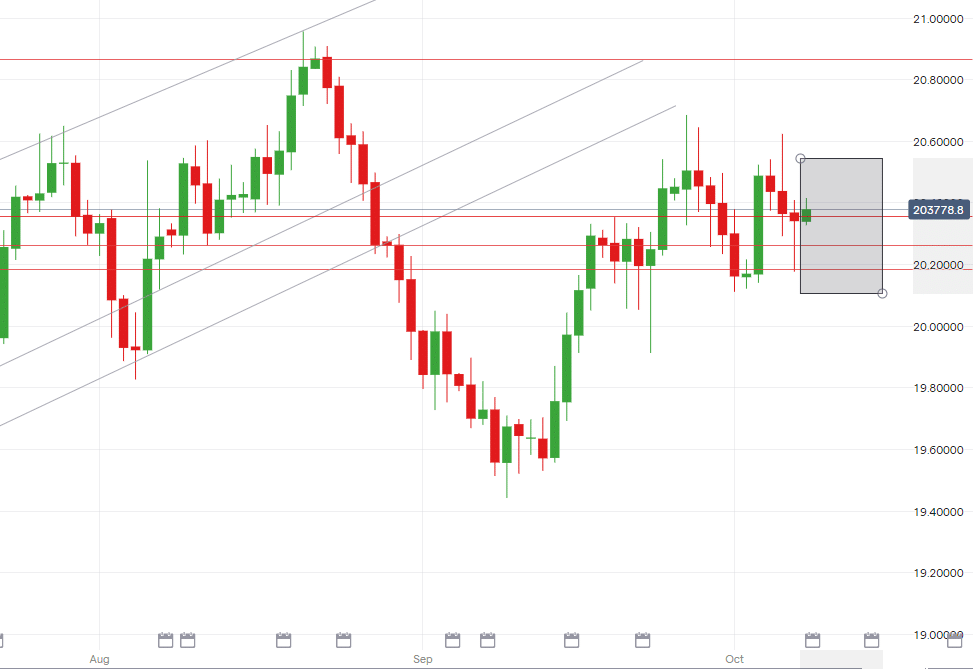

Technically: The GBP has also been quite range bound, following suit from the Euro. A break of the R20.18 level which is a key support line would indicate a move to the R20.00 mark. On the opposite end, should the USD attract massive support the pair will trade around the R20.23/£ – R20.48/£

Technical levels we are watching for the upcoming week:

USD/ZAR

- High – R15.25/$

- Support – R15.00/$

- Low – R14.74/$

EUR/ZAR

- High – R17.51/€

- Support – R17.31/€

- Low – R17.14/€

GBP/ZAR

- High – R20.54/£

- Support – R20.33/£

- Low – R20.10/£