sa markets

Local markets lost ground this week due to the country’s civil unrest.

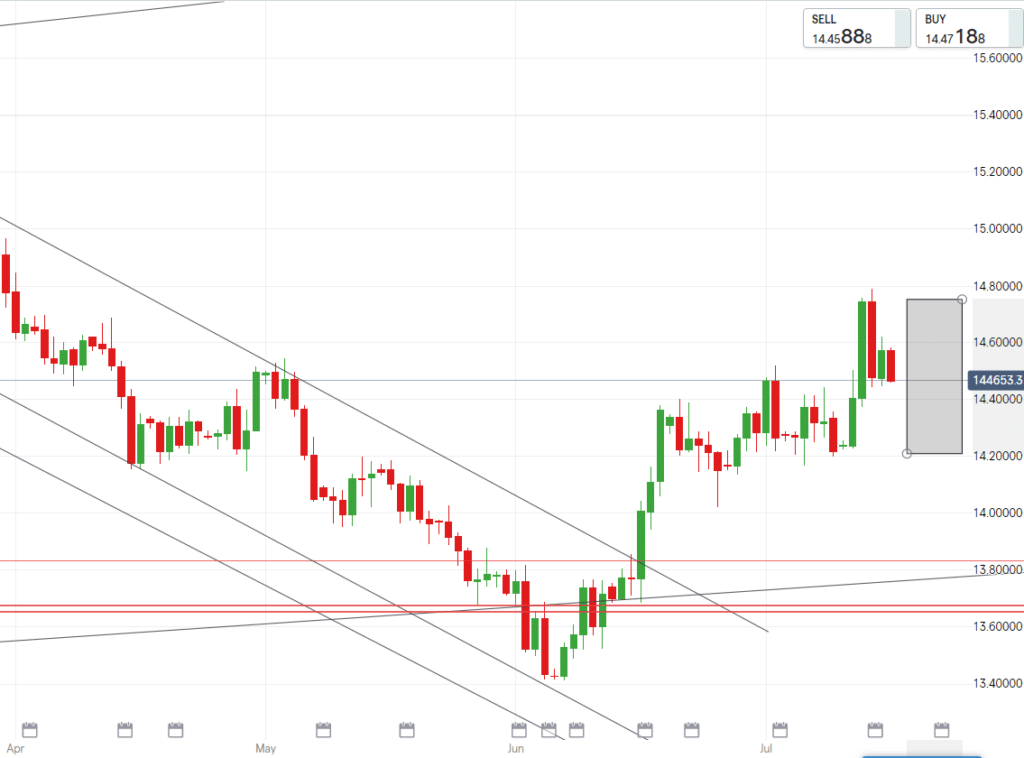

As provinces were gripped by violence, the USDZAR was also held hostage with the pair spiking from a low of R14.23/$ and reached a weekly high of R14.79/$ on Wednesday.

Africa’s most industrialized economic hub has made global headlines due to the riots, looting and loss of lives as a result of the violence sparked from the jailing of former President Jacob Zuma.

This implications of the current social unrest spill over into challenges for the economy, unemployment and even increased risks in a downgrade of our already suffering credit profile.

The nation’s peak is showing severity and WHO officials are expecting further extreme surges in local cases due to the rioting of large groups which may exhaust the countries health system.

Technically the dollar relaxed some what after US Fed chair Powell reiterated that its way too soon to taper monetary support.

The dollar began down this morning in Asian sessions however is expected to possibly gain strength off the back off heavy data releases which are felt will be positive.

R14.78/$ is a strong top line and we are likely to range around R14.53/$ with deciding factors being dollar strength and the progress of current local unrest.

European markets

European stocks saw a dip mid-week but lodged a quick recovery to escalated highs amidst a range of factors including the spread of the delta variant across the globe, anticipated increased US earnings and fiscal data

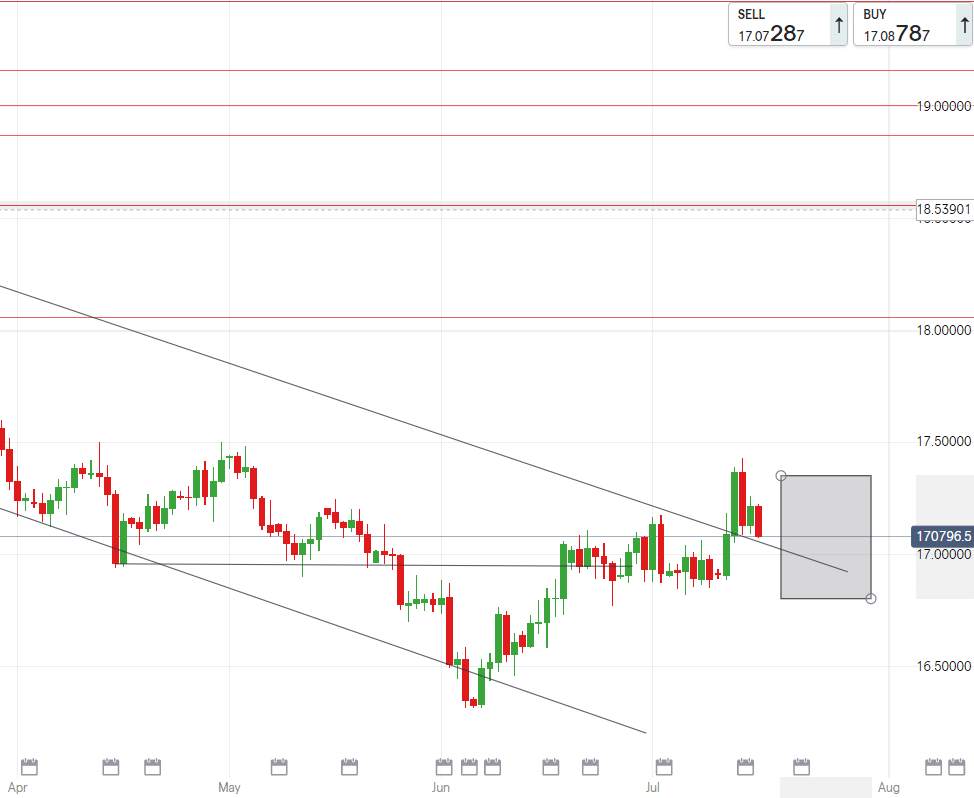

EUR/ZAR broke out of our downward channel and is currently being floated by a support of R17.08/€, until we close below R17.10/€ we are likely to continue seeing elevated levels on the EURZAR pair.

The European Central Bank officials cited that the economy is far from a recovery and support must be maintained. However contrastingly their words have indicated putting a limit on new bond purchases until a clearer economic picture emerges.

UK Markets

Escalating geopolitical pressure from concerns over Brexit continue to weigh on equities world-wide.

Stimulus in the UK is predicted to be cut sooner rather than later due to rising inflation, this even though the feel is that the Bank of England will be more tolerant of increasing inflation due to the global turmoil being linked to supply restrictions and slow economic recovery.

BoE chair of Economic Affairs Committee has expressed concerns over the amount of constant quantitative easing which he feels is a threat to public finances. Due to this argue for policy returning to normal parameters, expectations are that the QE approach may end if the officials are in agreement over this sentiment.

GBP/ZAR has made a 100% return of its spike from R20.47/£ back down to current levels of R19.99/£. Closing below R20.09/£ may keep the path open to trade in the lower R19.90’s.

USD/ZAR

- High – R14.75/$

- Support – R14.42/$

- Low – R14.20

EUR/ZAR

- High – R17.34/€

- Support – R17.04/€

- Low – R16.80/€

GBP/ZAR

- High – R20.20/£

- Support – R19.88/£

- Low – R19.66/£