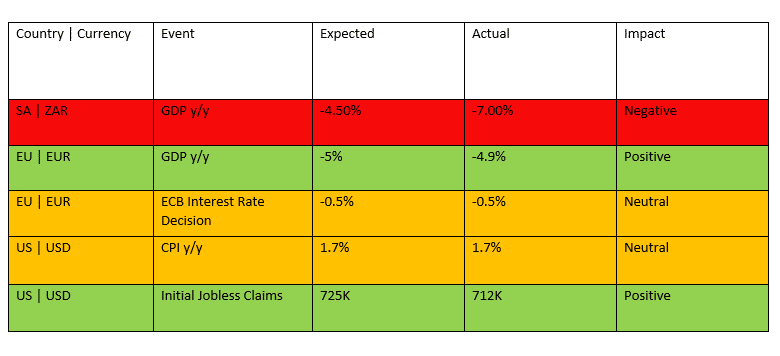

The Rand suffered a turbulent week with pressure from weak GDP figures and a volatile dollar rising after oil attacks and stimulus approval.

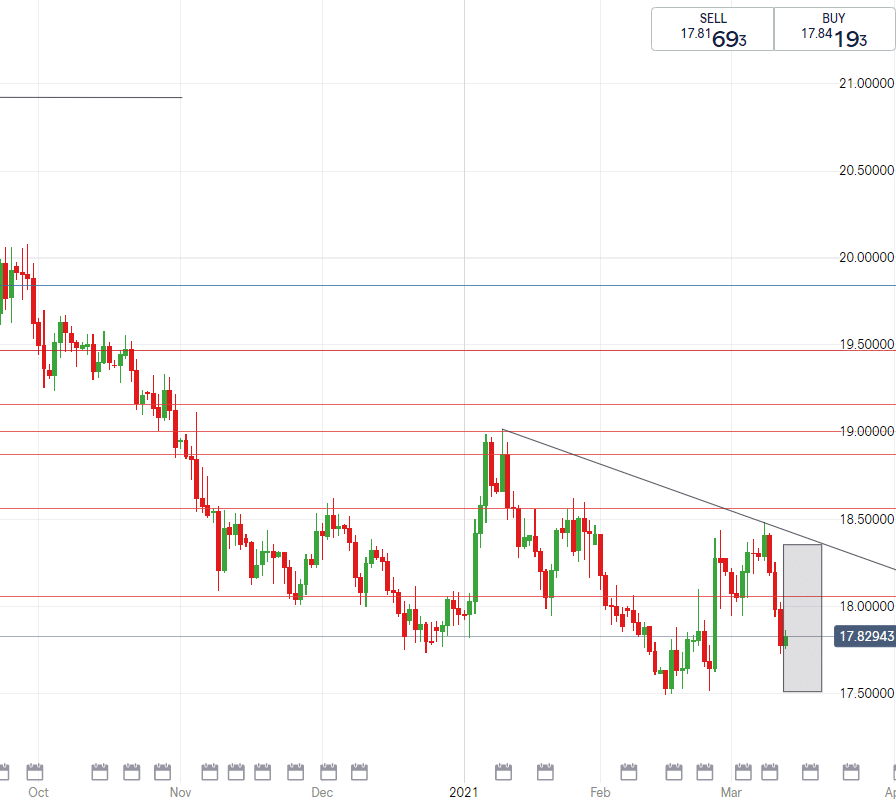

USD/ZAR News

The dollar remains largely unpredictable with this week’s price action serving as a prime example.

Tuesday saw the dollar strengthen to a week best on USDZAR after Yemini forces launched attacks on Saudi Arabia oil reserves, this event spiked concerns for the oil prices and effectively pushed the oil price higher and caused investors to run toward the dollar safe haven.

US Stimulus has finally run its full course and $1,400 checks will commence this weekend for US citizens who qualify.

President Joe Biden cites that the stimulus will fuel a speedier recovery but the employment crisis remains a tough mountain to surpass.

Technical talk:

We remain outside of our year long downward channel, straddling a strong support of R15.00/$.

USDZAR saw a spike to R15.50’s and a correction as market players rushed into emerging currencies mid-week.

Levels on the top end to look out for remain R15.40/$ and R15.57/$ should the dollar strengthen.

If the dollar loses steam and finds itself overbought then look out for a low of R14.63/$ on USDZAR after we break R14.70/$.

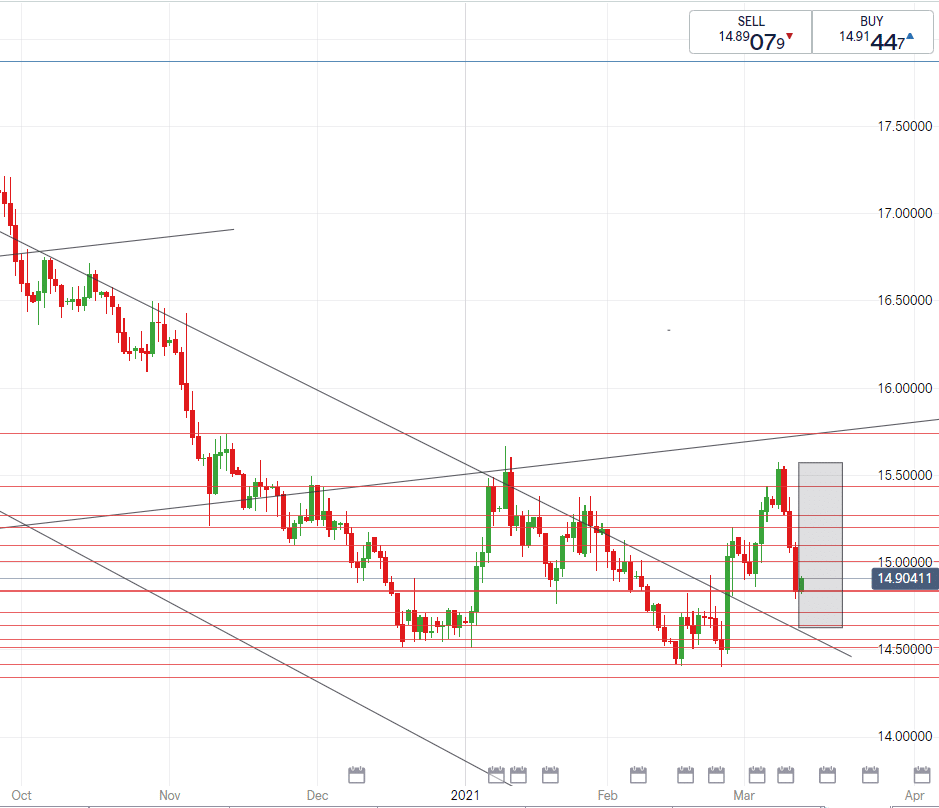

EUR/ZAR News

The event of the week was definitely the Eurozone interest rate decision, the decision’s result saw the EUR relatively unaffected after rates were kept unchanged at -0.5%.

The European Central Bank will step up its emergency purchasing in response to the pandemic and rising government bonds.

The efforts to inspire economic recovery are vast however often undermined by the sluggish and struggling vaccine rollout in the Eurozone due to delivery delays and vaccine efficacy concerns.

Technical talk:

The EUR is trading slightly sideways with a slight downward bias.

A support has formed around the R18/€ mark, we forecast a possible high of R18.35/€ should the EURZAR push to test the channel line on the graph image below. A break lower may see the pair test R17.74/€ followed by possible best buys at R17.51/€.

GBP/ZAR News

Brexit friction keeps pressure on the UK economy as it continues to result in a lagging of exports for Britain.

The bank of England stated earlier in the week that it wishes to remain cautious and yet positive in the effort to focus on inflation containment.

Furthermore, the BoE expects the UK economy to see a swift recovery in response to the set back of earlier quarters.

The Organization for Economic Cooperation and Development cites that the UK is set to see a recuperation of 5.1% in 2021 and 4.7% in 2022 due to the successful deployment of vaccines.

Technical talk:

The GBPZAR may see a triangle shape form on our below graph if we see a break through R20.65/£ down to a low of R20.26/£.

Support sees formation around R20.70/£. Should the UK remain consistent in their vaccinations and resolve the Brexit issues then we may see highs over R21/£.

South African Rand News

The SA economy contracted the most in a century as data this week showed a shrinkage of 7% in 2020.

After losing ground earlier in the week, the dollar exhausted its bullish run as investors ran to risk-on currencies and gave the rand the pullback it needed.

As a result we have seen the rand move from R15.57/$ to below R15/$ today – indicative of the correction our ‘Randela’ has made against its major counterparts due to emerging market strength and commodity price oomph.

The Rand isn’t out of hot water as economists expect that as US bond yields rise then demand for developing currencies will diminish. This fundamental reaction combined with SA’s looming downgrade may see a push toward R16/$ in coming months.

USD/ZAR

High – R15.57/$

Mid – R15.00/$

Low – R14.63/$

EUR/ZAR

High – R18.35/€

Mid – R17.95/€

Low – R17.51/€

GBP/ZAR

High – R21.10/£

Mid – R20.68/£

Low – R20.26/£