A Steadying Dollar Is Hot On The Heels Of Recovery, However The Rand Remains Resilient And A Safe Haven To Investors.

USD/ZAR News

Its been a turbulent week for the dollar, beginning with investor nerves over this week’s US Fed Monetary Policy Meeting.

Market shifting moves were assumed to be side-lined however the dollar took advantage of the apprehension and tested R14.40’s in the week.

The Fed reported that the economy is looking up with positive improvements being evident however fiscal support is to be continued.

President Joe Biden unveiled his wish to implement a $1.8 trillion stimulus package for the expansion of educational opportunities and child care – the package is expected to receive resistance from the republicans who would rather use the funds for infrastructure.

US interest rates remained unchanged as expected while opinions of analysts is that global economies are to see an aftermath of inflation as a ripple effect of the pandemic.

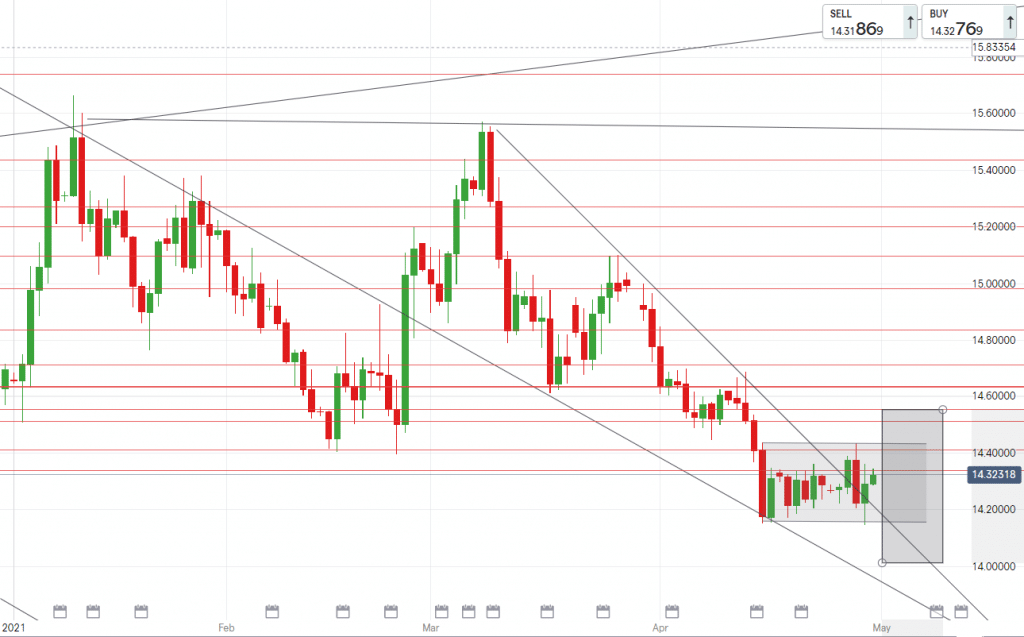

Technical direction forecast:USDZAR saw higher levels this week and broke out of our downward channel however can still be considered to be ranging sideways between support and resistance levels of R14.16/$ and R14.45/$.A close over R14.33/$ may signal higher levels next week however we are still watching a break below R14.15/$.The dollar is considered to be oversold, but if a retracement is on the cards it may only occur after we test a low closer to R14.00/$.

EUR/ZAR News

Positive news about the European vaccination campaign has aided euro strength of late.

Accelerating the jab progress in the eurozone with expectations of vaccinating 50-60% of the population by July.

Such an occurrence would lead to easing of restrictions and an improvement of investor confidence in regards to a economic recovery – thus likely benefiting the euro.

The euro has shaken off lackluster economic data and economic sentiment rose this week to 110.3 as reactions to nearing herd immunity continues benefiting the bloc.

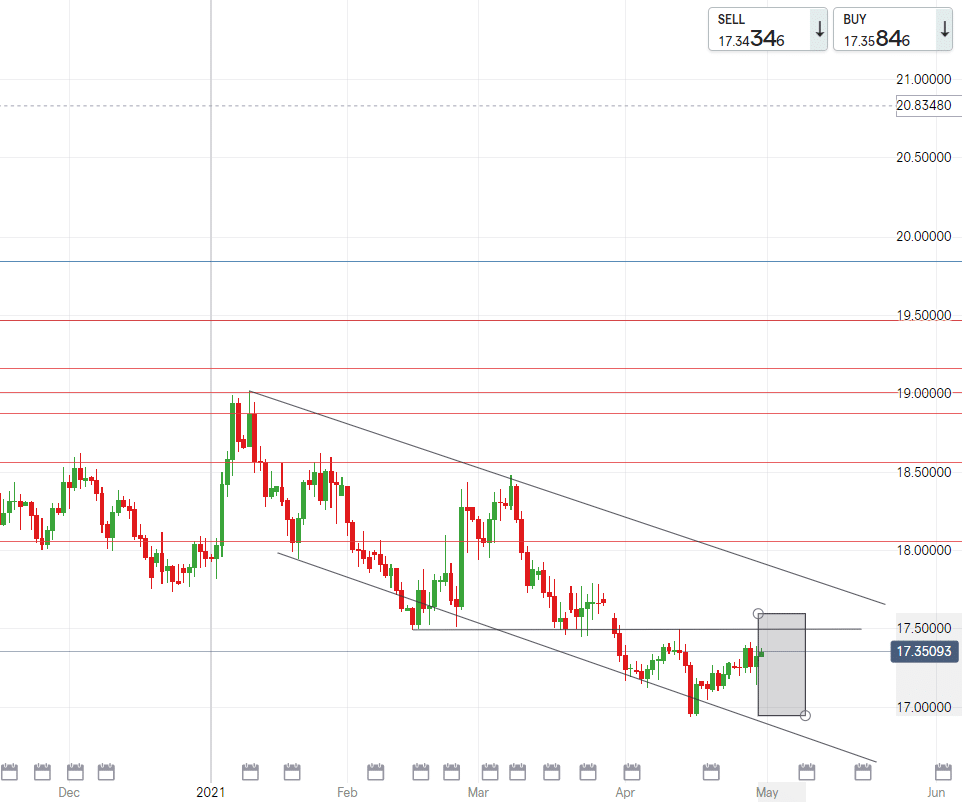

Technical data forecast:The EURZAR also ranged sideways with a slight upward bias for the most part of the week.Starting Monday on R17.19/€ and ultimately seeing a high of R17.38/€.If we don’t break a R17.40/€ then R17.50/€ is off the table. On the favored downward end, testing below R17.25/€ could open the path to R17.10/€.

GBP/ZAR News

The UK continues leading Europe in the vaccination efforts, with around 34 million citizens seeing at least one jab – around 2/3 of the entire population.

NHS officials have cited that now England will move for people over 40 to receive their injections.

As a result the UK is expected to move into a new phase of the pandemic seeing a boost in economic confidence. However the same issues plague Britain such as post-Brexit troubles and a nation like Scotland seeking independence.

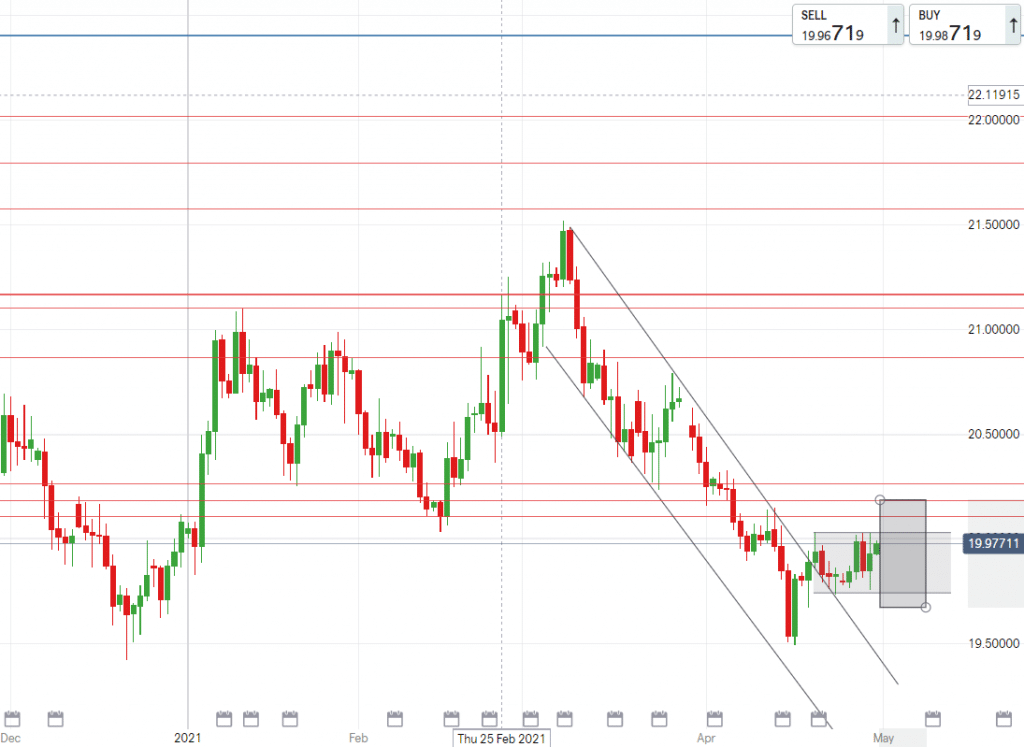

Technical direction forecast:GBPZAR broke out of our downward moving channel and is still finding support above R19.70/£.Seeing a 25 cent rise on Thursday means we are watching GBPZAR test around R20.00/£, breaking strongly above this means we can expect R20.12£/-R20.18/£.However a move downward is more expected and GBPZAR is likely to hover around R19.85/£.

South African Rand News

The rand remains leading the pack of emerging currencies having appreciated 2.4% in 2021 so far.

Despite our continuing woes of high debt, unemployment, corruption and lack of structural reforms – the rand is keeping it’s attractiveness to investors.

The dollar’s recent positive strength and uplifting data has stopped USDZAR on its downward path, but as long as other emerging market countries remain unstable then SA will remain the default for market players.

The biggest threat to the rand now remains the possibility of a third wave, seeing the current situation in India has lead our Health Minister to consider revising approaches so to keep the same from occurring here.

USD/ZAR

High – R14.55/$

Mid – R14.34/$

Low – R14.01/$

EUR/ZAR

High – R17.59/€

Mid – R17.25/€

Low – R16.95/€

GBP/ZAR

High – R20.20/£

Mid – R19.85/£

Low – R19.68/£