OVERVIEW

Rand sleighs to lower support levels this week as we approach Christmas.

Dollar suffers worst week of losses since September as sell-off see’s investors head to riskier currencies and assets.

sa markets

The dollar came up short against a myriad of currencies this week due to risk appetite support.

The rand saw better buying levels last touched in mid-November, rebounding off of a calming of fears over the Omicron variant.

What to expect:

Risk assets like the rand are likely to continue seeing relaxed levels during the festive season and briefly into the new year before price action becomes filled with influencing factors like higher trading volumes and new economic data for 2022.

US comments on tapering and rates, as well as omicron case progress will push investor sentiment but currently aren’t moving markets as much as early December.

Technically:

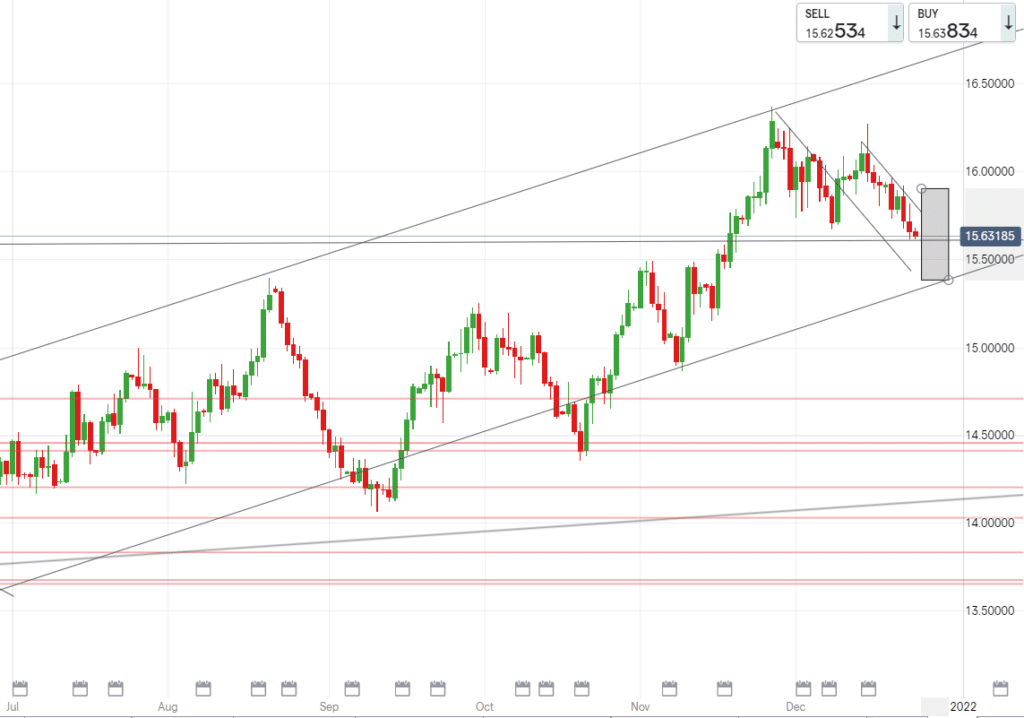

We are seeing a ‘santa-mental’ technical movement on USDZAR with levels released as mentioned in our daily market reports since Wednesday. R15.60/$ was the bottom of the range we expected to see before year end and we have arrived at this support. Breaking current levels will see the pair reach a next low of R15.50/$ and going beyond that will open doors to a R15.35/$. If we rebound then we can expect to revisit R15.90’s.

EUROPEAN MARKETS

EU Central Bank VP Luis de Guindos mentioned earlier in the week that inflation is not as temporary as expected.

European markets rose up this week off of reduced fears over Omicron.

Furthermore, the 5th kind of vaccine shot is now available in the EU for people over 18, this comes as the bloc has given the go ahead for Novavax’s shot.

Technically:

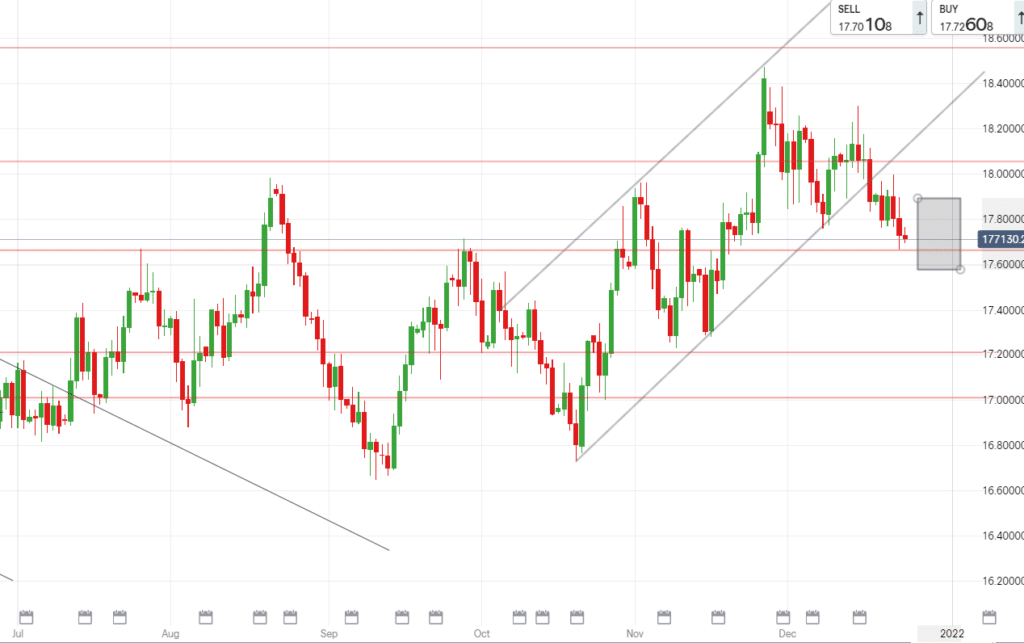

EURZAR is nearing the support of R17.65€, having dropped a moderate 30c since the start of the week we will be watching to see if this bearish trend continues.

UK MARKETS

No festive restrictions are expected for the UK next week, as speculatively advised by the UK health secretary.

Boris Johnson has reportedly already ruled out any restrictions before Christmas, so we will have to see if this carries through until after the holidays.

Technically:

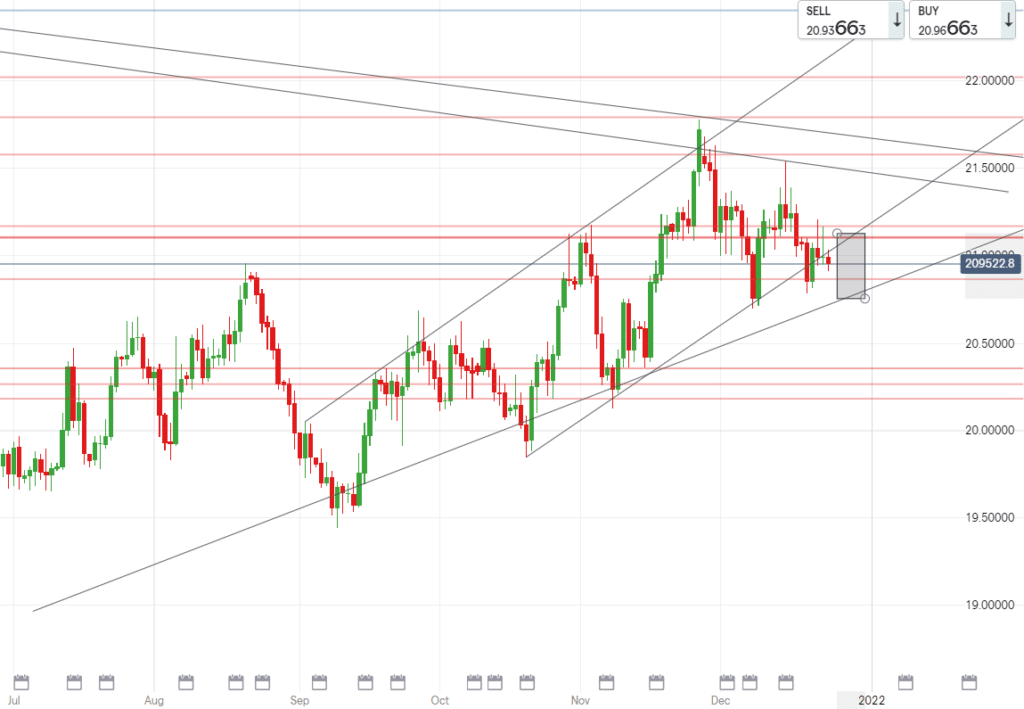

The GBPZAR remains elevated but has lost ground from being above R21.20/£ to current levels of R20.98/£. With the downward pressure ensuing we could see a R20.85/£ next week. If the price action turns then we may range around the R21.00/£ level.

Technical levels we are watching for the upcoming week:

USD/ZAR

- High – R15.90/$

- Support – R15.75/$

- Low – R15.40/$

EUR/ZAR

- High – R17.90/€

- Support – R17.75/€

- Low – R17.58/€

GBP/ZAR

- High – R21.15/£

- Support – R21.00/£

- Low – R20.78/£