The Dollar was down late in the week after US Fed Comments Pressured the powerhouse greenback. The Rand is set for an interesting upcoming days as a possible reshuffle looms next week.

sa markets

The week kicked off with President Ramaphosa easing lockdown restrictions and market focus eyeing the US Fed decision.

Uncertainty caused a pullback in risk appetite and saw the dollar test near R15/$, until the greenback was sold off due to the Fed’s lack of clarity for investors standards.

As expected the US Fed reiterated that no cause for new policy is at hand and now isn’t the time for monetary tools to be used to offset inflation until employment figures improve.

Employment was a big factor in the dollar’s sentiment, and figures showed yesterday that the US jobless claims declined to a pandemic low – this eases the worries of threats to global appetite and pushes market players back into riskier currencies like the rand.

Biggest threat to a retracement below R14.50/$ remains the after effects of civil unrest in KwaZulu-Natal as well the possibility of a cabinet reshuffle – this comes as certain ministers dropped the ball during the recent unrest and acting ministers becoming overloaded. A reshuffle may be seen positively if the markets see it as Ramaphosa making constructive moves towards good transformation.

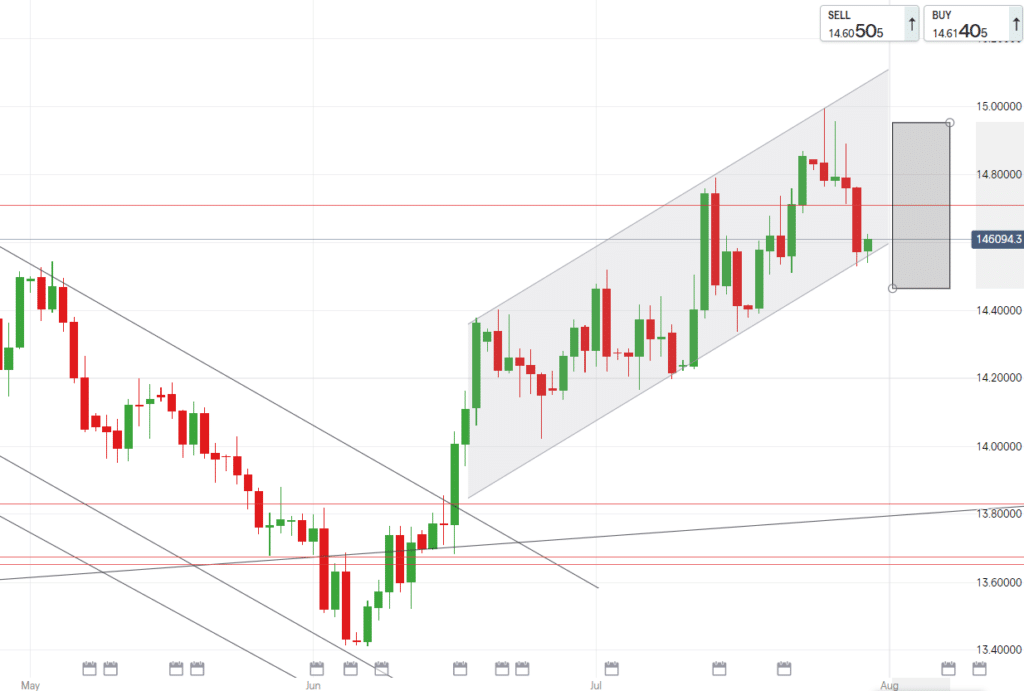

Technically, the rand needs a catalyst to push it under support of R14.50/$.

As much as we are enjoying a minor downward push, USDZAR remains in our upward trend when looking at a weekly graph.

Impetus is still towards a possible R15.00/$, without a rand positive event we will bounce off lows and then continue range bound in an upward motion as international influences decide our path.

european markets

Eurozone showed effects of the worst wave of the pandemic as consumer confidence in Germany continued at a -0.3.

With Germany being the biggest economy in the EU, this eroded the EUR’s strength against other majors.

Cases in the bloc are once again on the rise and vaccination drives have slowed even though there are more than enough vaccines available in the region – as a result consumer confidence is hitting a ceiling until this changes.

ECB officials noted that the bank will continue providing support during and even after the pandemics effects have subsided. The targeted support and QE tools are expected to benefit the European Central Bank.

Thursday trading in Europe saw stocks close higher off the back of corporate earnings.

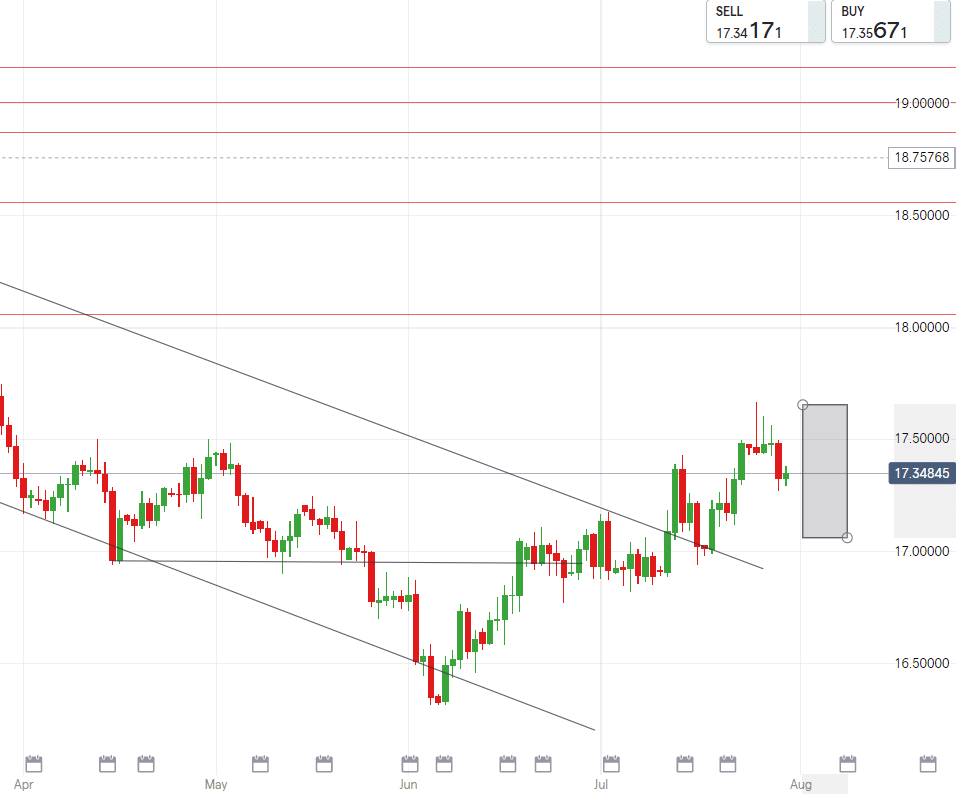

Technical readings on EUZAR also show a willingness of the pair to complete a move to R18.00/€.

The pair has failed to maintain upward trend in the short-term however so will probably push sideways and test R17.20/€, breaking this would open a testing of R16.99/€ barring any rand weakness which would reapply the upward pressure.

uk markets

The pound took advantage of a soft dollar and positivity around the Brexit progression as well as dropping of quarantining rules.

Fully vaccinated EU and US travelers are no longer held to the obligation of quarantining once entering the UK, this came off the back of Britain’s covid-19 infections falling consecutively everyday for a week.

Possible ‘herd immunity’ in the UK will benefit the GBP the more the media talks about it.

The sterling is gaining against the Euro, Japanese Yen and Aussie Dollar and will remain above support levels as reports suggest the UK’s vaccination campaign was a success.

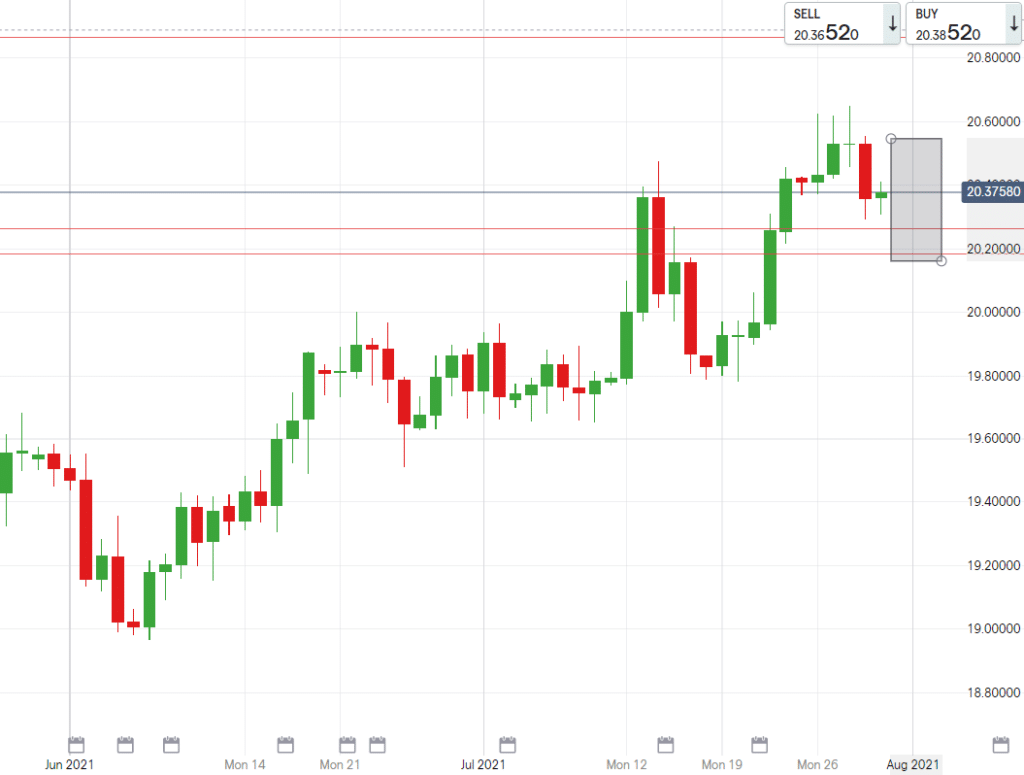

Technically, if GBPZAR closes around these levels then we will test R20.25/£ and likely test 10cents below that will direction is searched for in accordance to market conditions.

Technical levels we are watching for the upcoming week:

USD/ZAR

- High – R14.95/$

- Support – R14.60/$

- Low – R14.45/$

EUR/ZAR

- High – R17.64/€

- Support – R17.30/€

- Low – R17.06/€

GBP/ZAR

- High – R20.55/£

- Support – R20.35/£

- Low – R20.16/£