OVERVIEW

An uppity week for the dollar, post local election day saw USDZAR hitting 8-month highs.

The rand saw a short working week with the spotlight firmly on the US Fed and BoE Monetary meetings.

SA MARKETS

The dollar and looming Fed decision dominated the market environment this week, Monday being a public holiday for elections meant that the rand forfeited price action participation and a strong dollar took advantage of this by jumping over 20cents to see us begin the week opening over R15.40/$.

Since then USDZAR has corrected that move and remains over the support of R15.20/$, closing lower than this today will signal a possibility of returning back to levels nearer to R15.00/$.

A threat to the rand’s recovery remains today’s US job market data which is anticipated to come out showing an addition of 450K jobs and overall unemployment rate to have dropped from 4.8% to 4.7%.

Should the outcome be better than expected then we will see the dollar to strengthen, alternatively if the results are on par the market may already have priced it in.

Current factors expected to influence the price of USDZAR in coming weeks include:

- Our local budget speech on the 11th November.

- Local load shedding troubles.

- Progress over Biden’s social and economic plan called the “Build Back Better plan” which will involve spending 185 times more on climate control than pandemic preparation.

- US-China trade conflict which is always a heavy market mover.

- Global economic recovery, troubles in Asia tend to seep over to fellow emerging country SA.

Technically:

The dollar remains well positioned to retest high levels like over R15.35/$, but currently a possible break below the support of R15.20/$ may come into effect – should this occur then we must watch out for a R15.13/$ and R15.05/$ before thoughts of returning to anywhere in the R14’s.

We expect USDZAR may resist for a but before dropping to lower levels, with dollar bias high a possible move back up is still on the table.

How markets react to the US job data will give a good indication of the pairs short term behavior.

european markets

Currently the euro remains under pressure with rising pressure over the pandemic and a strong dollar.

The pandemic continues to take it’s toll as a tidal wave of sorts is said to be approaching Europe, the continent is experiencing an increase of 55% in new covid-19 cases as a result of low vaccination turn outs and lessened preventative restrictions.

With transmissions increasing, winter looming and low mask usage, the WHO has cited that a possible 500,000 deaths may hit the EU and Asia by the end of January.

The implications of the EU falling part of the next epicenter of the pandemic would effect the euro and also investor sentiment, pushing buyers into safe havens. The bloc is still seeing effects of the contagion seeping through into economies and recoveries may be slowed even more should the next wave hit as hard as predicted.

Technically:

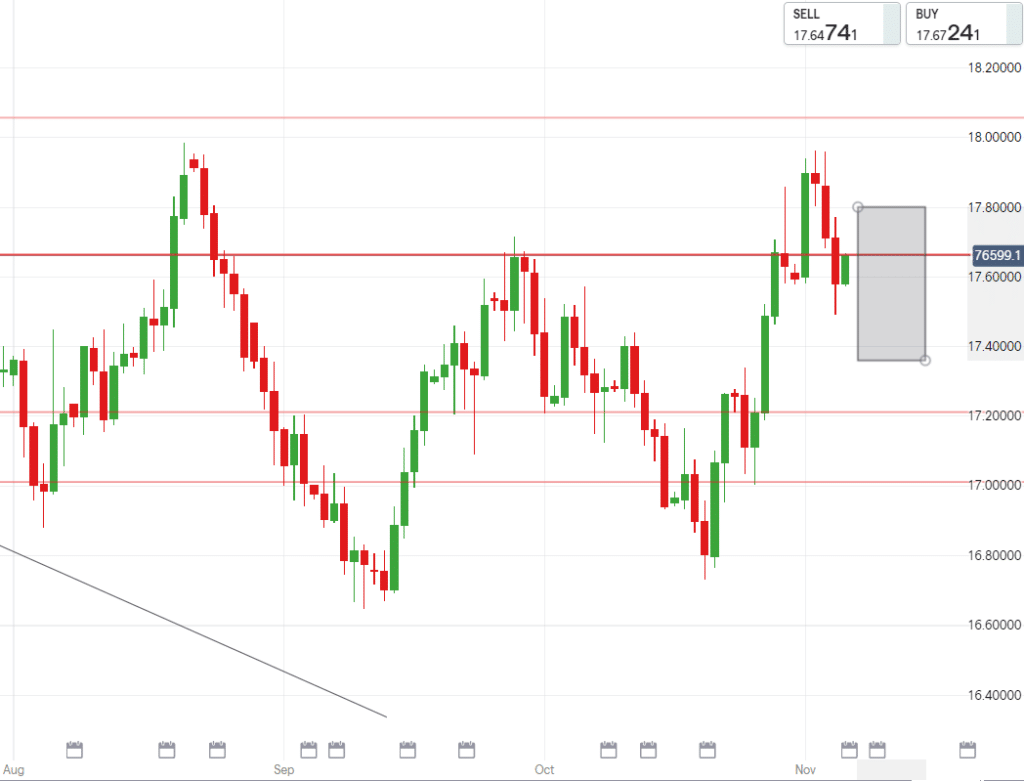

EURZAR stayed true to our predicted range from last week’s Weekly Round-up. We are now at the bottom of the range treading above a support of R17.54/€.

A 100% correction of the recent upward trend would bring us back to R17.20/€ but before this can happen we need to see the breaking below R17.50/€, R17.38/€ and R17.25/€ – expect a ranging above and around R17.65/€ before this can occur.

uk markets

The Sterling fell over 1% against the dollar and dropped significantly against the rand within a span of one day, on Wednesday we saw surges up until R21.17/£ and the very next day dropped down to R20.46/£ .

A contributing factor to the pound’s loss of gains besides major currency retracement is definitely the surprise to investors by BoE keeping rates unchanged at record lows of 0.1%.

Out of the 9 policy makers, 7 voted to keep rates unchanged and 2 pushed for a 15 basis point increase to help alleviate global cost pressures.

Policy makers advise that they want to see how the nation’s job market progresses after the salary aid was rolled out, with that “hard evidence” will the BoE then be able to make an assessment on rates.

Technically:

On GBPZAR we will be keeping an eye out for the R20.50/£ for an indication of a lower break.

The impulsive moves made at the end of October have subsided but a ranging around the R20.60/£ may precede a gradual relaxation back down to lower levels such as R20.40/£.

Technical levels we are watching for the upcoming week:

USD/ZAR

- High – R15.40/$

- Support – R15.20/$

- Low – R15.05/$

EUR/ZAR

- High – R17.80/€

- Support – R17.60/€

- Low – R17.35/€

GBP/ZAR

- High – R20.85/£

- Support – R20.55/£

- Low – R20.35/£