overview

The dollar remained dominant in this week’s markets as investors moved to the greenback for stability.

Energy, supply-chain, health, employment and debt crisis’ ravaged the global scene in several nations – pushing investors away from emerging markets and towards the safe haven dollar.

sa markets

The long and short of this week is that the rand lost over 2% due to Chinese growth concerns leaking into local sentiment.

Views that the woes in China could affect our commodity prices and worsen inflation pushed market players away from the rand.

These fears seem more of a reality as a record breaking rise in oil will affect the economy due to higher consumer prices and thus pressure the SARB to keep inflation in check.

The damage has been done and currently the bias remains for the dollar to strengthen further.

Coming months hold expectations of a dollar policy tightening, China’s Evergrande debt problems worsening, looming credit downgrades for SA and commodity price pressure – all these factors are rand negative, and are expected to favor the dollar to a point of seeing a further 5% rise in the safe haven currency.

Fundamentals are not in our favor, an overbought dollar and technical retracement to lower levels are the only real players in our corner.

Local trade surplus sugar coated our current fiscal slippage this week, while SA job data disappointed and stocks dropped in emerging markets.

Importantly, moody’s credit rating agency recently cited a note warning of the growing credit risks of our nation.

Further downgrades for our country seem likely due to the current debt-to-growth ratio not being expected to stabilize until 2025.

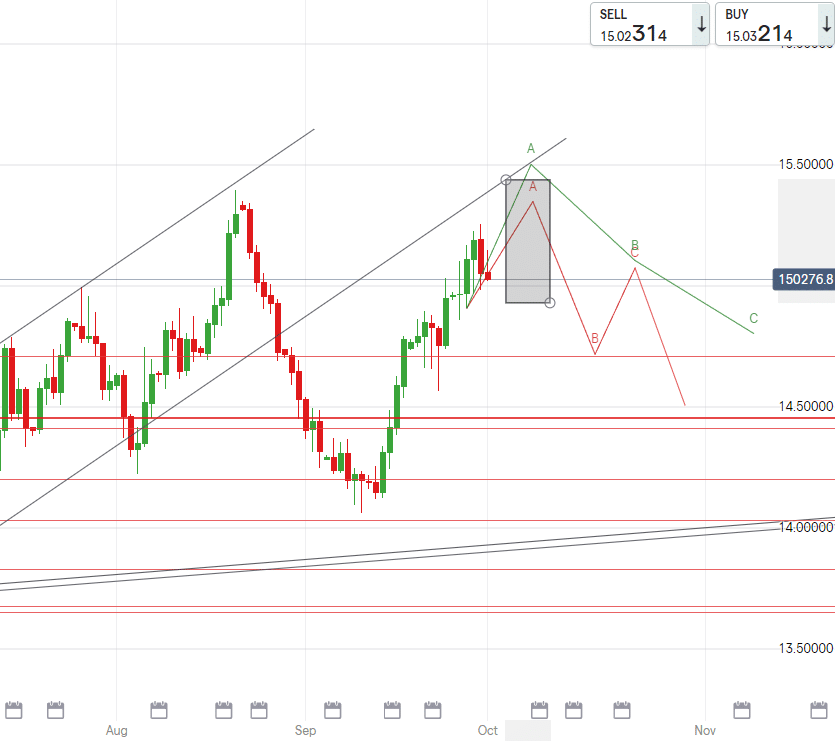

Technically – USDZAR broke convincingly over R15.00/$ this week with the pair failing to triumph over the strong level of R15.20/$ but still within striking range of breaking above this and testing a R15.38/$.

The pair should gather impetus by ranging near R15.00/$ until a breakout occurs and sees the pair test R15.30’s, if we fail to go to R15.50/$ from there then hope remains the pair will settle back to R14.80’s later in the month.

european markets

Consumer confidence improved slightly in the EU as their labor markets showed signs of strengthening and low borrowing costs.

Despite this steady confidence support, a market shifted to the dollar has pushed the European currency to 14-month lows against the majors.

European monetary policy is under pressure after the ECB maintains it’s lower for longer policy, while the US Fed has adopted a more aggressive approach – thus causing a depreciation in the euro as a result of sentiment being recovery is slowing in the EU.

An energy price crisis is not confined to China, as the EU is currently undergoing a historic spike in energy prices.

This crisis comes as autumn approaches in Europe and is feared to drag on and cause ripple effects in the eurozone’s recovery, household incomes and the move to more environmentally friendly energy routes.

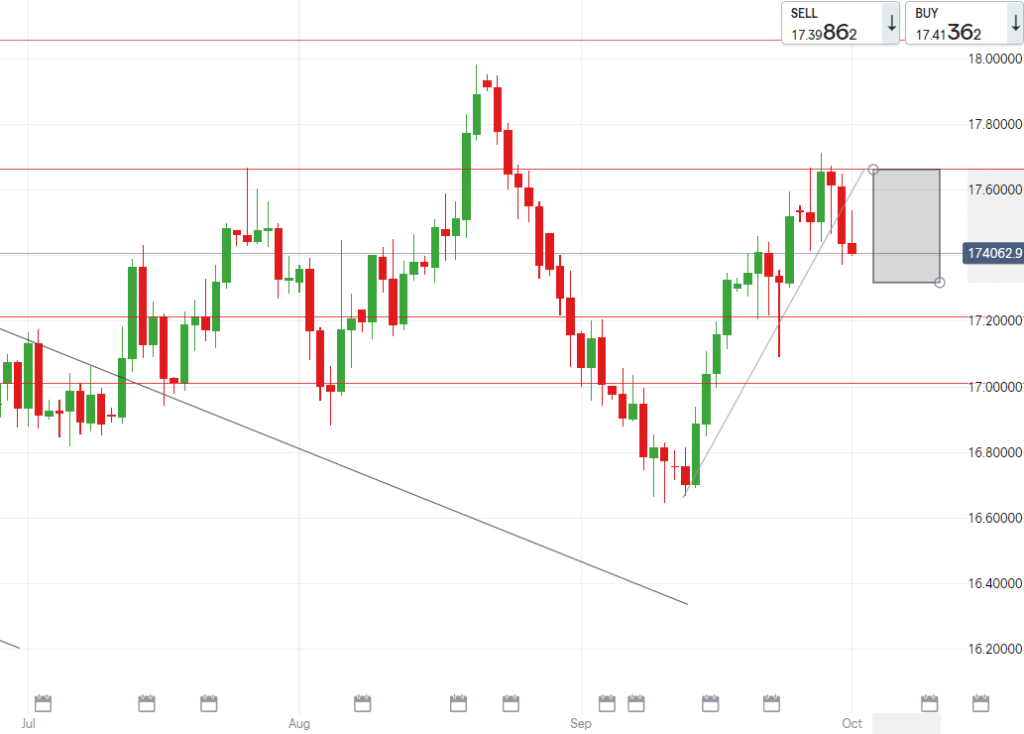

Technically – EURZAR failed to break R17.66/€ earlier in the week and now is posed to trade around R17.50/€ until the pair breaks lower than R17.40/€ or above R17.60/€ depending on how emerging markets fair in the coming week.

R17.36/€ is a seemingly near best buy on the pair, look out for this level and take advantage if we reach there.

uk markets

UK markets suffered this week as the pound was dumped due to fears of ‘stagflation’ – which refers to spiking inflation, stagnant growth and low employment.

These fears were calmed once data showed that the UK is on path towards pre-covid economic levels.

However this recovery has recently been threatened by a storm comprising of supply chain crisis due to lack of HGV drivers and rising energy costs due to global factors resulting high oil and natural gas prices.

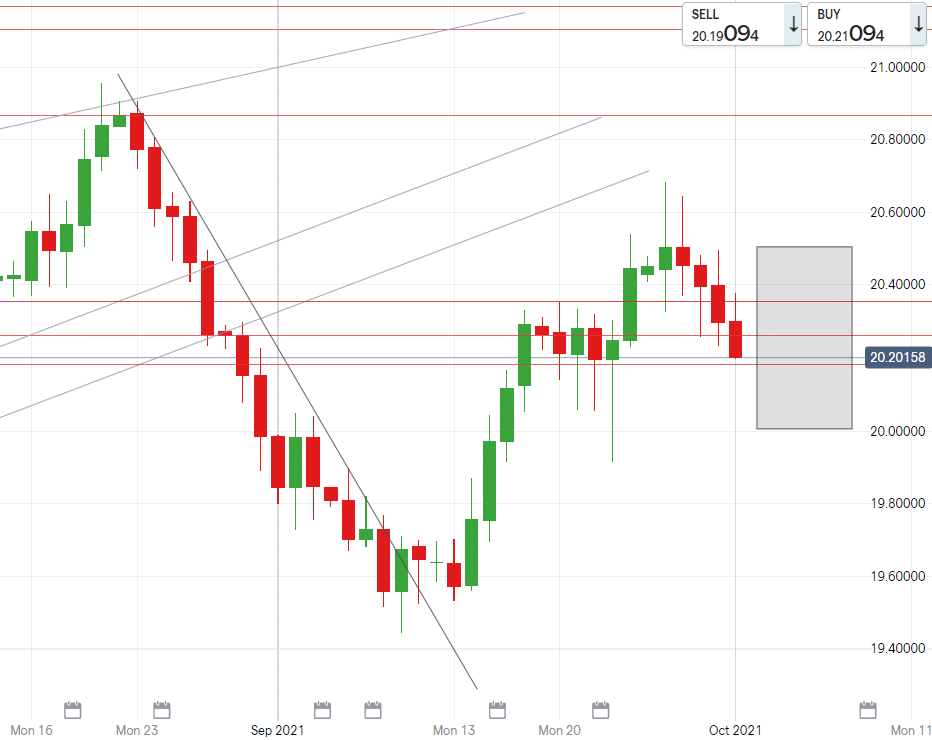

Technically – Normally if the dollar strengthens as it has this week, then the GBPZAR will also see a rise but this week was different.

A pound sell-off was reflected in GBZPAR as the pair dropped from R20.68/£ to today’s R20.28/£.

A support we can look out for in the approaching days is now formed at R20.15/£. Bouncing off of this support would result in a retesting of R20.75/£, however the pair will likely range around R20.35/£ for the next week.

Technical levels we are watching for the upcoming week:

USD/ZAR

- High – R15.40/$

- Support – R15.10/$

- Low – R14.90/$

EUR/ZAR

- High – R17.65/€

- Support – R17.50/€

- Low – R17.32/€

GBP/ZAR

- High – R20.50/£

- Support – R20.20/£

- Low – R20.00/£