OVERVIEW

Uncertainty continues to reign globally, with rising global inflation battering economies. Emerging economies such as the Rand are experiencing the backlash as capital outflows increase and investments reduce. Traders need to accept that the R17’s/$ and R17’s/EUR are the new trading grounds, and R18.00/$ is not too far-fetched for the few months to come.

U.S AND SA MARKETS

The U.S has not released much data this week except for Thursday with the initial jobless claims having reduced from 228,000 last week to 222,000 this week. This data together with the ECB interest hike of 75 bps which came yesterday that signalled to investors the U.S might do the same, caused the USD/ZAR to break through the resistance level of R17.34/$ and pushed the pair up to R17.55/$. For as long as the U.S labour market continues to grow, the Federal Reserve will continue to favour an aggressive stance on the monetary policy, in order to get the economy to a point where growth is restricted, and inflation begins to cool down to reach the 2% target. FED Chair Jerome Powell had a s speech yesterday re-affirming the U.S central banks hawkish stance and bets have risen to 87% for a 75-basis point rate hike at their next meeting on the 21st of September 2022.

Other than hot inflation causing central banks to raise interest rates, what else is causing the USDZAR to keep rising?

Despite the dollar being over-bought, these high levels have been seen before around December 2015, and then again to around R19.00/$ when COVID-19 started in 2020. Importers need to consider thinking long term now as the R17’s/$ are prevalent and R18.00/$ may possibly be something to think about. Global instability and is causing investors to pull out of emerging markets like the rand and invest in safer currencies like the dollar. Although a correction may occur, it does not invalidate that R18.00/$ is likely on the cards for the months to come.

Locally, South Africa has had a bunch of data released this week that has not particularly favoured the rand. The Gross Domestic Product released by StatsSA on Tuesday shrunk by 0.7% in the second quarter of this year and this has not been good for the rand as the economy is smaller now compared to before the Covid 19 pandemic. Not surprisingly, South Africa’s current account has sent shock waves to the economy as it reported a current account deficit. Imports have far out-weighed exports, with a current account deficit of 1.3% on the annualised GDP compared to a 2.4% surplus in the previous quarter. Our research suggests that there is a lot of capital outflows this has negatively affected the rand as an emerging market. Eskom has clapped back again with national load shedding, with stage 2 being our current standing and may be extended into the weekend.

Technical:

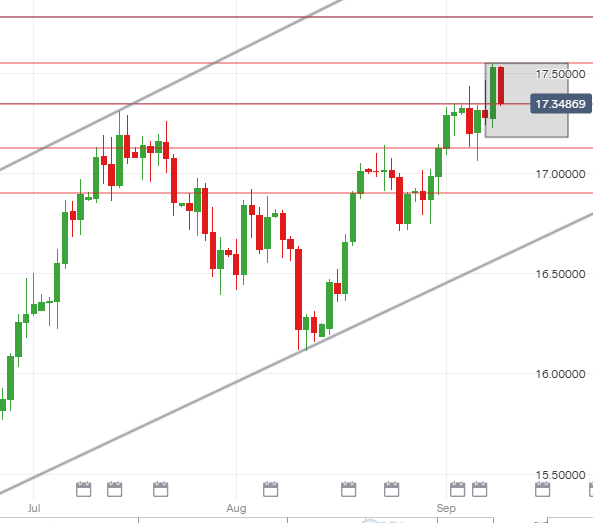

The USDZAR pair has had a bullish week from Monday straight through to today from a weekly low of R17.06/$ to a weekly high of R17.54/$. The pair has been respectfully trading along the upward trend line. The resistance level of R17.34/$ was broken yesterday after having been tested twice during the week, and the dollar stretched further higher to the much-anticipated R17.55/$ level last night. Today the market opened at R17.53/$ and the Rand has since strengthened and is currently trading at R17.40/$. Next week should the resistance level of R17.55/$ hold, we may see a strong support at R17.18/$. Should the R17.55/$ level not hold, R17.80/$ is the next level to look out for.

Range for next week: R17.18/$ – R17.55/$

Low – R17.18/$

Support – R17.30/$

Possible High – R17.55/$

EUROPEAN MARKETS

This week, all eyes were fixed on the European Central Banks monetary policy decision on Thursday, and the central bank raised their interest rates by 75 basis points as expected, lifting the interest rate from 0.50% to 1.25%. This hike is the largest hike the Euro Zone has ever seen in years. The ECB was clear that for the next meetings to come, they will continue to follow an aggressive monetary policy route. The ECB aims to bring down inflation in 2023 to 5.5% and down to 2.3% again in 2024 and in order to do so, they have to keep raising their interest rates ensuring that demand is dampened to guard against the risk of further rising inflation. Energy prices remain extremely high and reducing consumers buying power. The Euro strengthened tremendously against the Rand yesterday from R17.23/GBP to R17.52/GBP.

Technical:

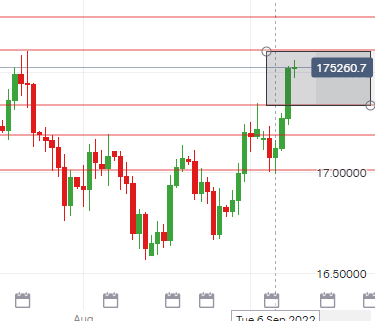

The Euro has performed well against the rand this week, rising from a weekly low of R16.99/EUR to a weekly high of R17.56/EUR. The pair priced in a 75 basis point hike prior to Thursday’s meeting that caused the pair to rise from R16.99/EUR to R17.30/EUR on Wednesday. The hawkish comments from the monetary policy meeting on Thursday further boosted Euro bulls pushing the pair higher to R17.53/EUR. Today we opened the market at R17.52/EUR. The pair is heading towards a resistance level of R17.61/EUR, some retracement may be expected afterwards to around R17.35/EUR before rising again to a possible high of R17.78/EUR.

Range for next week: R17.35/EUR – R17.61/EUR

Low – R17.35/€

Support – R17.40/€

Possible High – R17.61/€

UK MARKETS

It was reported yesterday that Queen Elizabeth II, the UK’s longest serving monarch has passed on at the age of 96, after having served as the Queen of England for 70 years. Her death has sent shockwaves to the nation and Buckingham Palace has attracted crowds of people who await updates on the Queen. The Royal Family is in mourning and the union flags will be flown at half mast on royal residences, government buildings, across the Armed Forces and on UK posts overseas. On Wednesday, the United Kingdom welcomed the new Prime Minister Liz Truss, replacing Boris Johnson, and comes into office in a storm of high cost of living challenges.

Technical:

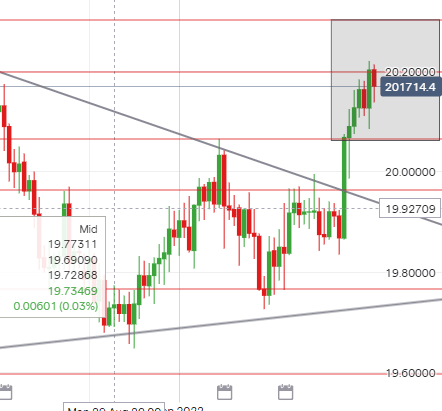

Just like the USD and the EUR, the rand has also been battered by the Pound Sterling this week, rising from a weekly low of R19.72/GBP rising to a weekly high of R20.22/GBP as predicted. The pair posted a clean break out through the resistance trend line at R19.97/GBP and bulldozed straight to R20.22/GBP. Should this resistance level hold, we may see the Pound Sterling retrace to a low of R20.06/GBP next week. Should GBPZAR break R20.22/GBP, we will see the next level at R20.30/GBP.

Range for next week: R20.06/GBP – R20.30/GBP.

Low – R20.06/£

Support – R20.10/£

High – R20.30/£