overview

The greenback gained extensively in the markets against major peers this week as investors are bracing themselves for the U.S jobs data. If the jobs data is pleasing, this will give the Fed more reason to hike interest rates

u.s and sa markets

All eyes will be on the U.S as we are due to see their jobs data today and economists expect that more than 300,000 jobs have been added in August, this will extend a hawkish outlook in terms of interest rate hikes from the Fed.

Investors have turned to the greenback as a safe-haven amid recession fears, global growth concerns and soaring inflation. Although investors currently have more confidence in the Dollar, they are concerned that if the Fed continues to tighten monetary policy too much, this could trigger a recession and send the economy tumbling.

Reports showed that the number of Americans filing for unemployment benefits declined further as of last week, signaling that we will be seeing a stronger job market from the U.S. This is cause for concern for the Fed as they still have a lot of work to do in order to bring down the economy demolisher being inflation.

Investors are already pricing in a 75 basis point interest rate hike from the Fed as they have been presenting themselves as very hawkish. It will be interesting to see how the Fed will act based on the Jobs data today. The Fed have made it clear that they will try to tame inflation at all costs and the the labour market would have to slow dramatically before they can deter from higher interest rate hikes.

China has implemented renewed Covid-19 lockdown restrictions in one of their biggest cities Chengdu in order to curb the number of infections. China has also seen its worst property earning in 14 years, 136 real estate companies reported that their earnings in Hong Kong and China declined to 87% for the first two quarters of the year. This has since sparked more global growth fears in investors and has resulted in more Dollar strength as well.

In South Africa, factory activity has increased in August and the business activity index increased above the 50 point mark for the first time in 5 months.

The KZN floods has affected the economy negatively and SA container imports have suffered from this, declining by 17.5% in the second quarter. Load shedding and reduced activity at the Port of Durban allowed exports to drop by a third in April and may.

Technical:

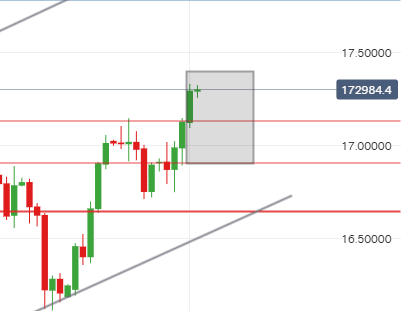

The USD took the markets by storm this week and the safe-haven saw a high of R17.33/$. The greenback gained momentum on the expectation of a strong labour market and a hawkish Fed. We anticipate that the USDZAR pair will continue to trade in a higher range. However, the pair will have clearer direction after the jobs data is released. We anticipate the the USDZAR pair will trade within the range of R17.00/$ to R17.40/$. We are keeping the range for USDZAR high as we await today’s day. Looking at the channel movements, the pair could possibly see R17.50/$ as a next possible high.

Low – R16.90/$

Support – R17.07-R17.20/$

Possible High – R17.40/$

european markets

The Eurozone released their inflation data this week and it came in at a new record high of 9.1% as energy and food prices continue to sky rocket in the EU. Energy inflation was at 38.3%, the highest annual rate seen.

With inflation being so high in the Eurozone, the ECB has a lot of catching up to do and will most likely deliver a bigger interest rate hike next week. The European Central Bank delivered their biggest interest rate hike of 50 basis points in 11 years in July and investors are expecting an even bigger hike of 75 basis points in their next meeting.

The head of economists at S&P Kenneth Wattret said that a recession seems unavoidable for the EU at this point. It is just a matter of when and how long it will last. He also mentioned that the ECB is behind the curve as inflation is exceptionally high and likely to remain this way and bleed into 2023. The main focus is to bring down inflation everywhere in Europe.

Technical:

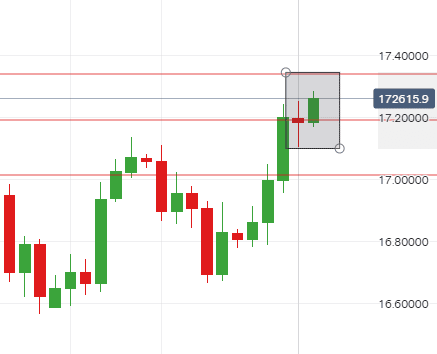

The EUR has been rather weak against major peers and is currently below parity with the Dollar. Although the EUR is weaker against emerging markets, it is still stronger than the Rand. The EUR saw a high of R17.25/€ against the Rand this week. We anticipate that the EUR will hold ground against the ZAR leading up to the ECB interest rate decision next week. We expect that EURZAR pair will trade within the range of R17.10/€ to R17.35/€.

Low – R17.10/€

Support – R17.20/€

Possible High – R17.35/€

uk markets

UK inflation remains at a 40-year, higher than all leading economies and the cost of living continues to increase. Forecasters believe that inflation could exceed 18% at the beginning of 2023, Goldman Sachs believes that if gas prices don’t fall, inflation could hit 22%. Several workers in the UK have gone on strike to demand higher wages as they are battling to come by with the high cost of living.

Britain’s new Prime Minister is in for a tough time as they will be met with a possible recession, surging energy and gas prices as well as strike from unhappy citizens.

Technical:

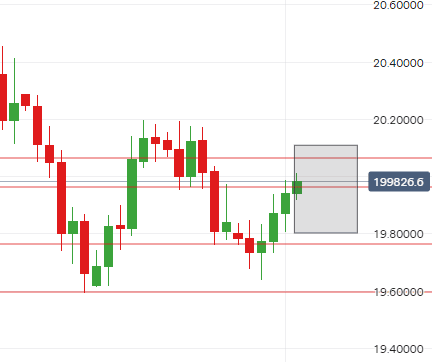

The British Pound is currently weaker than its major peers. The GBPZAR has been trading within the range of R19.80/£ – R20.11/£ throughout this week and we anticipate that the Pound will trade on a softer note as investors are concerned that the UK is on the verge of a long lasting recession.

Low – R19.80/£

Support – R19.90/£

High – R20.11/£