OVERVIEW

Investors turn to the Dollar for comfort after Fed chair Powell’s aggressive stance at the ECB’s forum.

u.s and sa markets

The Dollar has made a strong comeback in the markets this week and we can only see the greenback gaining exponentially against other currencies. This comes after the Central Banks Fed chairman Jerome Powell spoke at the ECB’s forum and his comments resulted in the greenback strengthening to its best in four weeks after investors evaluated the enhancement of a tighter monetary policy from the risks of an economic recession in the U.S. Powell said that a recession is avoidable however, there is a tough inflation battle ahead and there is no guarantee that the central bank can curb inflation without hurting the job market and the economy, they must accept higher recession risks to combat the economy hungry inflation.

Amid inflation and recession woes, MSCI (Morgan Stanley Capital International) global stock index declined by 20.9% for the fist half of the year, U.S benchmark S&P 500 has seen the biggest percentage drop in 52 years for the first six months of this year. Global investors are more fearful of a recession after Powell’s comments and are looking to the Dollar as a short term safe-haven with global growth concerns and global recession fears, the Dollar is ending the week on a high note. From past experience, we know the U.S Dollar holiday on Monday has also contributed to USD strength as many investors close off positions ahead of their long weekend. It will be interesting to see what Emerging Market traders do with a stronger Dollar On Monday whilst America celebrates the 4th of July.

Locally, South Africa has seen its worst week of loadshedding by far and this will weigh heavily on the JSE and the Rand. Today is the fourth day where we have experienced stage 6 of loadshedding and it has been noted that stage 8 could soon become a reality for us as well. The economy will take a hard knock from this if the country’s energy giant does not get the grids under control. Economists believe that the economic hit could be around R12 billion for the least and could likely be higher.

South Africa’s inflation data came out higher than expected in June and this points to a further interest rate hike from the SARB this month. The governor of the reserve bank has mentioned that he is considering a 50 basis point interest rate hike to curb inflation in the country. With the dire strains of higher energy and foods prices paired with Eskom woes, it is very likely that we will see a bigger interest rate hike this time.

Technically:

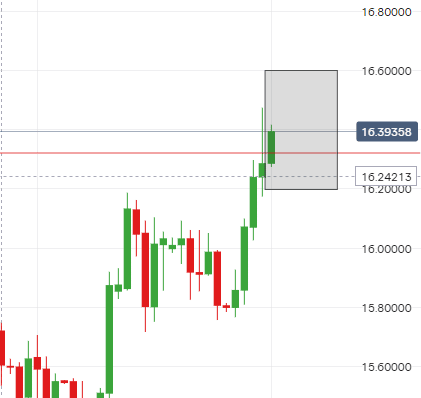

The USD is currently favouring the upside as investors run to the Dollar for support. The greenback has taken dominance over other currencies such as the Rand and we can see that the USD/ZAR will continue to trade in an upward trend for the foreseeable future. Prior to now, the USD/ZAR pair peeked over the R16.30/$ mark briefly in Nov 2021 and however, trading over the mark consistently was last seen in October 2020. We can expect this currency pair to trade within the range of R16.20/$ – R16.60$.

EUROPEAN MARKETS

The European Central Bank held a conference on Wednesday and the Euro plummeted thereafter. However, the Euro has since been trying to make a comeback in the markets. ECB President Lagarde has warned that the economy could be beyond the point of saving. The risk to financial stability has increased massively in the Eurozone. Lagarde has also warned that the ECB will go as far as necessary to bring inflation back down to its target of 2%

Consumer price data from the Eurozone will be released later today and investors will be watching closely to see if inflation has indeed peaked. Annual CPI for the Eurozone is expected to climb by 8.4% in June and it is assumed that this will be a new record after inflation reached 8.1% in May

Investors remain concerned that the Eurozone is on the verge of an economic meltdown and a recession, resulting in them pulling out of shares and stocks plummeting. Euro stocks are expected to decline as investors are uncertain that the ECB will hike rates strategically enough to avoid a recession and combat soaring inflation.

The Eurozone continues to suffer from the effects of the Russia and Ukraine war and ECB has asked banks to calculate a possible recession with risks. The ECB has stressed that lenders in the Eurozone factor a possible recession into their business plans, this has since put more fear into investors.

Technically:

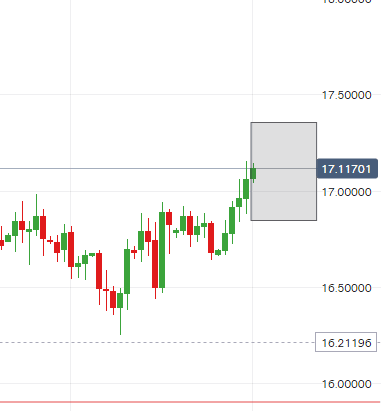

The Euro made a strong comeback against the Rand yesterday and has topped over R17.00/€. We are curious to see how investors react to the consumer price data today. We anticipate that the EUR/ZAR pair will continue to trade in an upward trend, similar to USD/ZAR and we can expect the pair to trade within the range of R16.85 -R17.35. Spreads remain wide as stocks continue to fall in the Eurozone.

uk markets

The Bank of England’s governor Andrew Bailey has warned that the U.K economy is at a turning point and is cooling down quicker as red hot inflation remains at a 40-year high. The UK economy’s inflation rate of 9.1% is the highest among its G7 peers. Investors are highly concerned and are trimming demand forecasts for the British Pound.

Manufacturing PMI data is expected to remain stable at 53.4% in the country. However, households could be facing extreme penalties of reduced paycheck value in the U.K .

UK trade performance has also seen its worst level on record in the first quarter. It is assumed that the displeasing trade levels come from the economic effects of Brexit. The economy has a long road to recovery to take.

Technically:

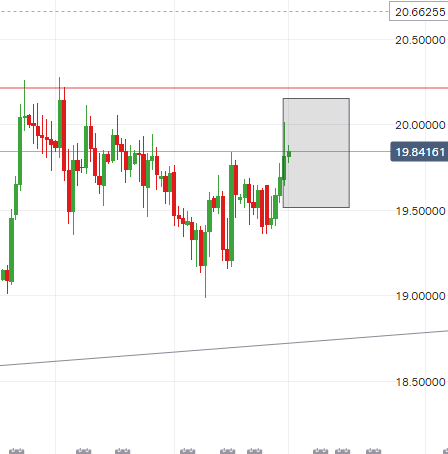

The Pound sterling continues to suffer from the effects of the Russia and Ukraine war. The Pound lost ground and saw its biggest six month loss against developed currencies. The Pound has however gained its losses against the Rand and the GBP/ZAR pair can be seen trading in an upward channel with other developed currencies. Just like the EUR and the USD, the pound has taken full advantage of the Eskom woes in South Africa and has rallied against the Rand. We can expect the GBP/ZAR pair to trade within the range of R19.50/£- 20.15/£

Technical levels we are watching for next week:

USD/ZAR

High – R16.60/$

Support – R16.39/$

Low – R16.20/$

EUR/ZAR

High – R17.35/€

Support – R17.12/€

Low – R16.85/€

GBP/ZAR

High – R20.15/£

Support – R19.85/£

Low – R19.51/£