OVERVIEW

A risk rally boosted the rand this week until SA manufacturing data dropped by 8.9% and global restrictions caused investors to turn to the dollar safe haven.

52 year job market lows and upcoming Fed meeting is supporting the greenback, focus shifts to todays US inflation data.

sa markets

It has been a quiet week on the economic data front, leaving price action to investor sentiment around the Omicron variant and speculation over today’s US CPI data. The dollar-rand made up ground mid-week as risk appetite took centre stage and saw the pair reach near 3 week highs, until the tide turned in the dollar’s favour off the back of pandemic fears.

Market attitude is that the dollar has peaked at overbought levels and is now at the point of being labelled “expensive”.

The rand had negative manufacturing data, analysts thought we would see a 1.4% drop in the figures and a surprise fall of 8.9% helped erase the rand’s gain over the dollar. Further support to the dollar came in the form of a 52 year low in the US jobless claims numbers, reflecting a stronger job market and improving economy.

What to expect:

Today’s focus will be firmly fixed on the US inflation figures, expectations are that the monthly inflation will slow and the annualized figure will grow. Should CPI figures be in line with expectations then the dollar shouldn’t move much but if there is a better or worse result, the USDZAR will move accordingly.

Next week the US Fed will meet and likely remove stimulus and implement rate hikes, this will drive the dollar higher and investors are already cautiously buying in anticipation.

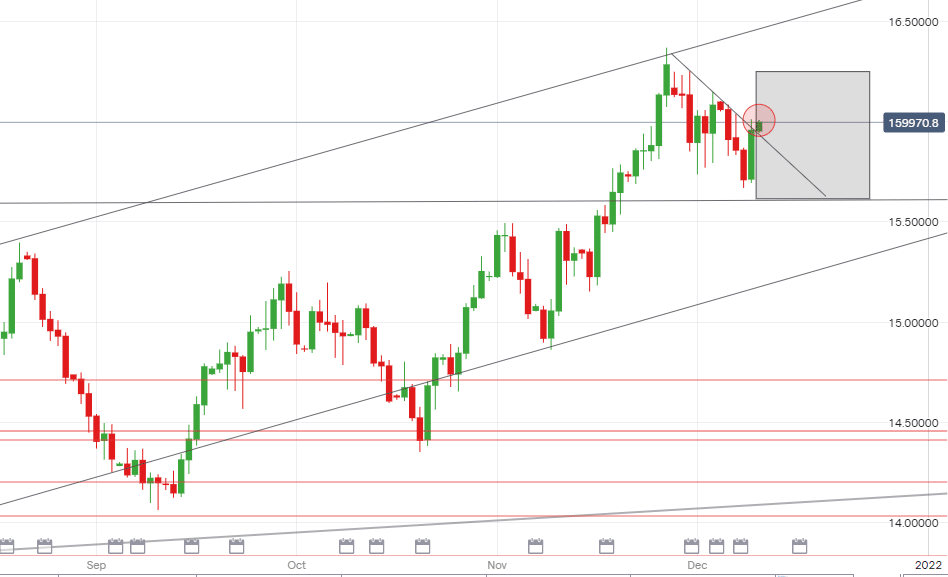

Technically:

The contrast is evident, improvement in the US and troubling issues in SA – without risk rally’s and technical retracements the dollar will remain dominant over our rand. Currently the pair is pushing towards R16.10/$ and R16.15/$, breaking higher than this would leave us at a high of R16.25/$. The bias is upward with the pair likely to remain supported by a strong dollar, if news or sentiment reverses then we can expect to find support around R15.83/$.

european markets

It’s been 20 years since the inception of the euro and it’s at this time that the EURZAR remains above R18.00/€.

The euro is currently outperforming the pound, but remains behind the dollar’s dominance. EU finance ministers cited this week that the eurozone economy is making a speedy recovery and that they intend to remain supportive of the growth.

Uncertainty remains as Covid-19 numbers rise and geopolitical pressures are mounting in Eastern Europe as Russian soldiers are gathering at the Ukrainian border, but this will only keep the ECB cradling the economy with supportive measures. ECB President Lagarde will speak today and give guidance on current views of the eurozone economy.

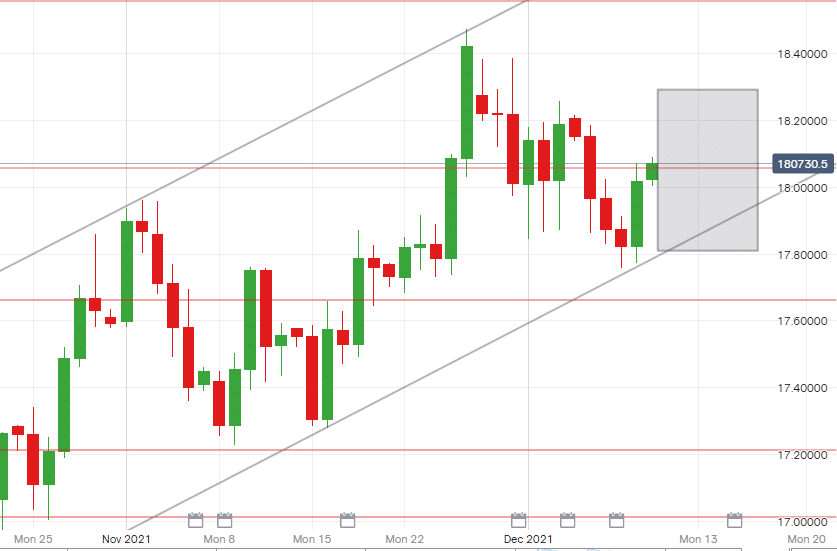

Technically:

EURZAR failed to break a low of R17.82/€ on EURZAR, indicating the probability of the pair remaining in it’s current upward channel without strength to break the bottom end. There is still impetus to creep below the R18/€ mark but given the lack of rand positive news and data, the EURZAR is poised to retest it’s early week highs of around R18.20/€.

UK markets

The pound began the week seeing a high of R21.30/£ on Monday before losing ground due to soft economic forecasts and concerns over lack of investment in the UK.

After reassessment by the CBI, the UK’s economic growth for 2022 was slashed to 5.1% from previous thoughts of the numbers being closer to 6.1%. Supply chain which are a global issue are some of the main contributing factors behind the hinderance in economic widening.

UK daily cases breached the 50,000 mark as the biggest wave yet is expected to wash over Britain.

As a result PM Boris Johnson revealed restrictions ranging from face masks, Covid passes and working from home guidelines.

The prospect of restrictions weakened the pound on Wednesday but yesterday’s news of ‘Plan B’ actually caused investors to run away from emerging markets and into the advanced currencies, pushing the pound back over R21.00/£.

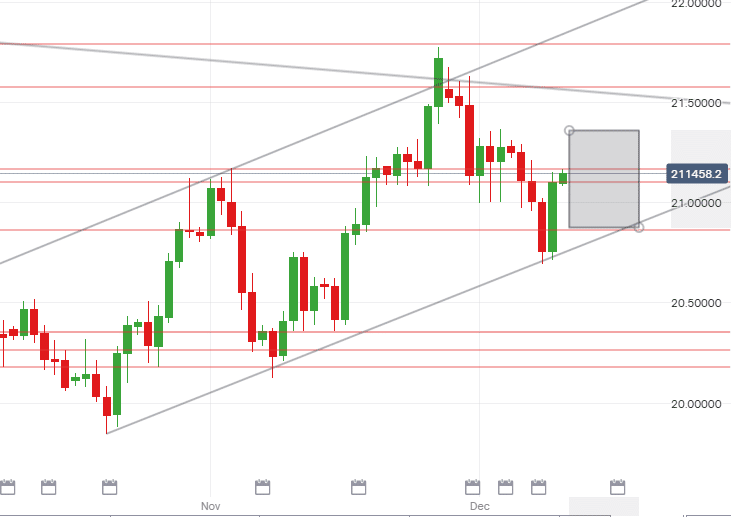

Technically:

The GBPZAR seems to be making a move back to it’s Monday high with risk appetite falling away.

Even though the pound is weak against it’s major counterparts, the bias remains toppish against the rand with movement around R21.05/£ and a high of R21.35/£ is within reach. Should a rand rally return we may drop to the bottom of our channel R20.88/£, breaching this would see a move to R20.70/£.

Technical levels we are watching for the upcoming week:

USD/ZAR

- High – R16.25/$

- Support – R15.85/$

- Low – R15.61/$

EUR/ZAR

- High – R18.29/€

- Support – R17.96/€

- Low – R17.88/€

GBP/ZAR

- High – R21.35/£

- Support – R21.01/£

- Low – R20.88/£