OVERVIEW

The rand sets up for a weekly loss as dollar bulls triumph and investors launch a ZAR sell-off.

Investors shifted focus from the temporarily overbought rand and moved to this week’s safe haven being the dollar..

SA MARKETS

We saw a stark contrast to the rand’s performance this week as opposed to last week’s emerging market rally.

JP Morgan gives recommendations on stocks and currencies to buy and sell, on Tuesday the American multinational bank advised that the rand is vulnerable due to several factors and urged a sell of our ZAR – which market players took as gold.

The above counsel combined with SA retail sales shrinking 0.8% year on year (impact of riots and unrest affected the figures largely) negatively affected sentiment on the rand this week.

A sell-off ensued on the rand and commodities also suffered this week, gold normally provides a good support for us but with bullion dropping out of investor favor this left the ZAR in open water.

What to look out for : Across the board the dollar challenged all safe havens and produced solid data this week, holding 3 week highs against the majors as confidence improved around previously cautious views on the greenback.

We need to look out if the dollar’s bullish mood will be tested with US figures coming out later, progress on China Trade relations in regards to whether China grows it’s influence and the several noteworthy central bank meetings next week which will take the spotlight.

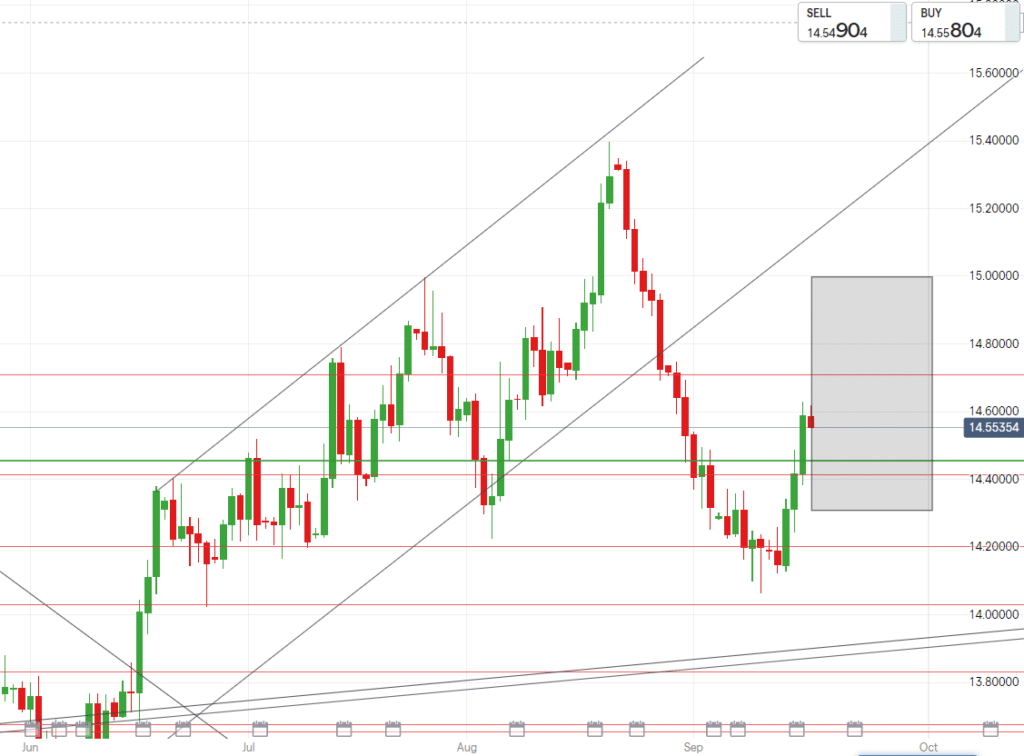

Technically – We are calling it wide for next week and on dollar-rand and this is no surprise given how outrageously volatile the pair shifts.

We saw over 60 cents of movement this week in the greenbacks favor and just 3 weeks ago we were well above R15.00/$.

The USDZAR environment is a treacherous one and will be just as volatile next week as investors play around the US Fed meeting and our SARB meeting.

We feel R14.70/$ is a big level and expect it to be tested, if broken then R14.99/$ wont be far off.

EUROPEAN MARKETS

Inflation figures are to be released today in the EU and hints are that the numbers will have ticked up.

Consumer inflation has risen across the board of most nations as the impacts of the pandemic and lower rates start to ripple through globally.

Italy has introduced restrictions and will become the first EU country to approve mandatory vaccine passes for all workers, this would improve investor confidence in the bloc’s recovery due to stricter measures.

In contrast to the European Central Banks regular cautious approach, a recent turn to a hawkish (aggressive in policy) approach has given the euro a boost.

The prospect of today’s higher inflation, increases the possibility of a earlier than expected interest rate rise which would also lift the euro due to more attraction to foreign investment.

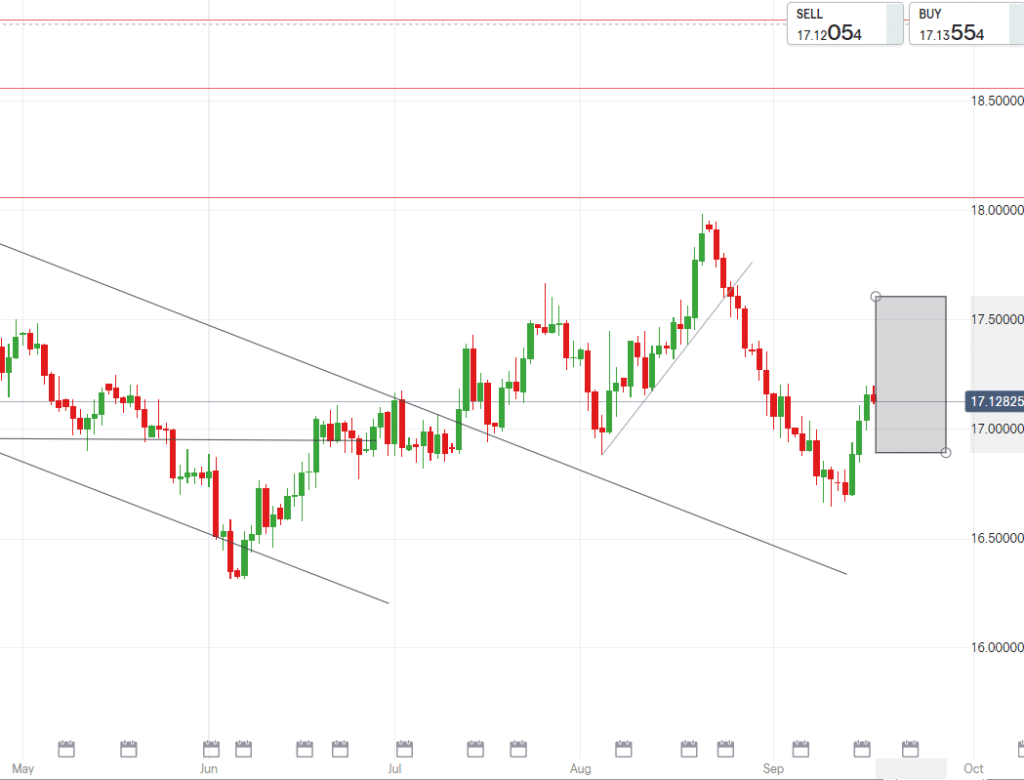

Technically – The EURZAR is moving in an upward trend, having bounced off of it’s support at R16.70/€ and forming a falling wedge pattern.

Our predicted spread is wide with bias being toward the upside, the pair may retrace slightly but movement will be up-ish and inclined to test near R17.70/€ at next weeks most volatile days.

UK MARKETS

The socio-economic event of the week in the UK thought to drive the Sterling’s price action was Wednesday’s news that Prime Minister Boris Johnson executed a cabinet reshuffle.

Cabinet reshuffles are traditionally market moving events, especially with several Secretaries of State losing their jobs, however this reorganization had little impact on the pound.

Talks are already arising about the British Finance Minister presenting the UK budget next month, the possibility of raised taxes for businesses are feared to have a negative effect on the countries foreign investment and overall consumer sentiment.

The UK’s inflation rose to the quickest surge since the BoE gained independence, illustrating that consumers will pay more for food and have less for savings.

Next week focus in Britain will be the Bank of England’s Monetary Policy meeting and interest rate decision on Thursday.

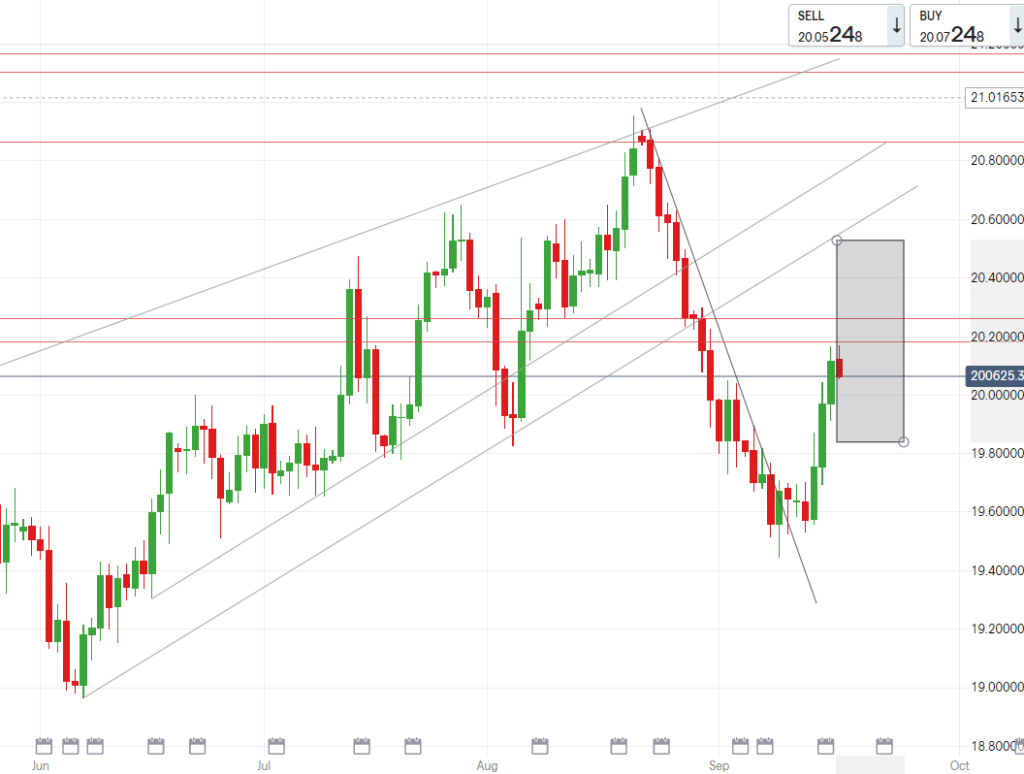

Technically – this week GBPZAR fluctuated across the upper end of our predicted channel, only breaking out yesterday as the pair breached the psychological mark of R20.00/£. The next level which seems set for testing today is R20.20/£, breaking past this will give rise to the pair aiming for R20.35/£ and R20.53/£ should markets continue to sell the rand.

Technical levels we are watching for the upcoming week:

USD/ZAR

- High – R14.99/$

- Support – R14.50/$

- Low – R14.30/$

EUR/ZAR

- High – R17.60/€

- Support – R17.15/€

- Low – R16.89/€

GBP/ZAR

- High – R20.53/£

- Support – R20.03/£

- Low – R19.85/£