OVERVIEW

US Job Data release held markets hostage this week, as the importance of this data indication will decide next steps for the US economy and interest rates. Analysts feel any outcome of the labour data may ultimately play into the dollars favour, we await 12:30pm to see the result.

SA MARKETS

August has started off with a shuffle of volatility as USDZAR saw a spread of 50c due to market conditions changing on the daily.

We saw the dollar being sold off in the beginning of the week with comments from the Fed and uncertainty over the looming job data and global recovery dominating – pushing investors into the safe haven Japanese Yen and the gold commodity.

The tide turned mid-week as influential US Fed member Richard Clarida cited that interest rates might be raised as soon as early 2023.

An indicator of how the US job report may pan out can be found in payrolls processor ADP which showed that US companies added far fewer jobs than anticipated, yesterday’s initial jobless claims showed a higher number of citizens applying for unemployment benefits – both these indicators are tilted towards a weaker job report for July, however if the result is that over a million jobs were added then the dollar is expected to spike.

We mentioned in yesterday’s market report that we were still awaiting a cabinet reshuffle and just in time President Ramaphosa addressed the nation last night with the changes we were waiting for.

The biggest change being the replacement of Finance Minister after Tito Mboweni resigned, bringing on a new FM in Enoch Godongwana.

At 8pm the USDZAR spiked from R14.38/$ all the way to R14.74/$ as a result of this shock announcement.

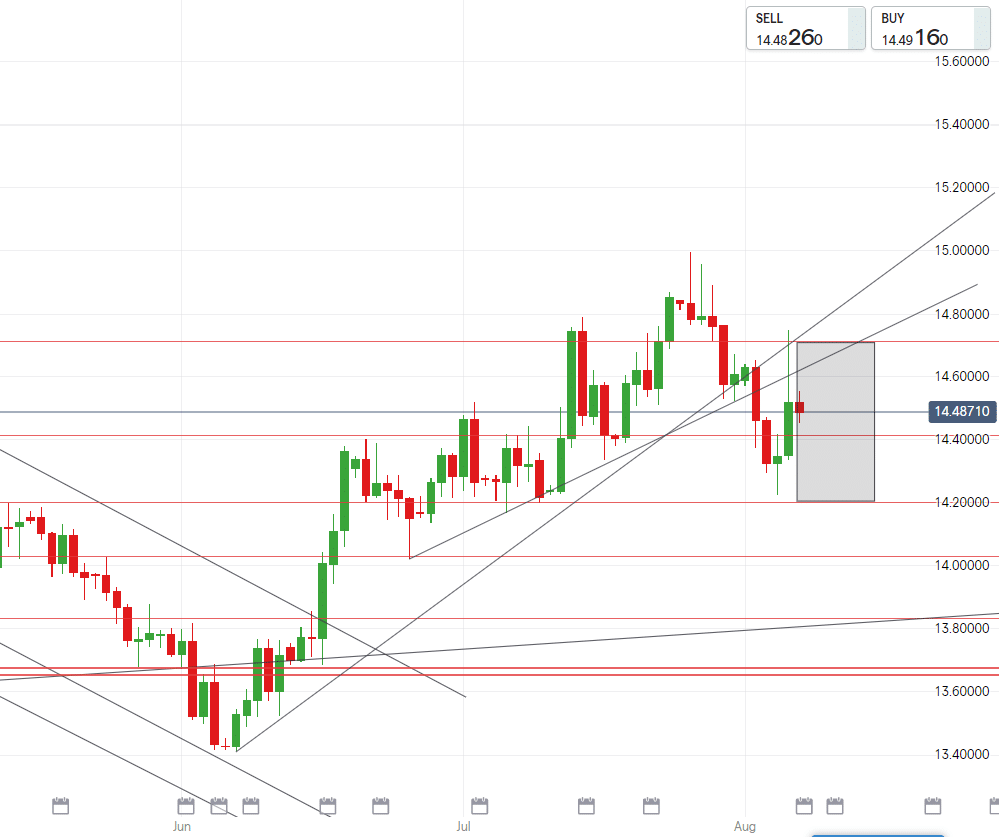

Technically, volatility is rife as USDZAR attempted to test R14.20/$ but failed and is currently settling from yesterday’s spike.

The pair remains in an upward trend with impetus to touch R14.70/$ – if the US labor market shows strong data then we may see these levels sooner, and should global recovery nerves turn against the dollar then we may retrace August’s moves and range back to R14.20/$

EUROPEAN MARKETS

The end of July saw Europe’s economy come back from a double-dip recession.

August has seen a bit more pressure off the back of the positive showings. Disappointing retail sales data in the Eurozone dragged the euro down in the start of this week.

Concerns over the spreading Delta-variant weighs on the euro and the currency is following the dollar’s climbs and dips as it looks for direction from the powerhouse currency. The eurozone is seeing elevated growth conditions, but at a slower pace than estimated.

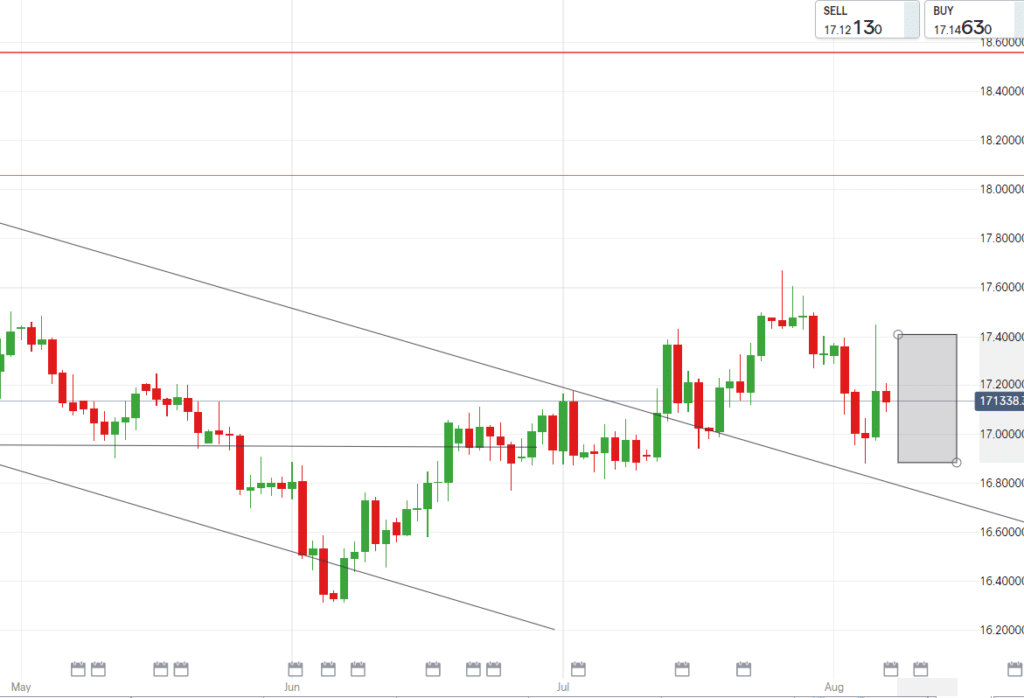

Technically, our forecasted range on EURZAR in last weeks round up was perfectly accurate with both sides of the range being tested and a good amount of movement across the predicted spread.

Looking forward there will definitely be more volatility ahead with the pair likely to continue moving between R16.90/€ and R17.35/€.

UK MARKETS

The UK continues to parade actions and plans toward economic and socio-political normalcy.

This show of recovery started with restrictions being almost completely lifted, travel bans being lightened and now culminates in the Bank of England citing the desire to begin planning on tapering stimulus.

As expected the Bank of England (BoE) voted to hold the UK’s historically low interest rate of 0.1% as well as voting to reduce the size of it’s bond buying. These moves are indicative of the country’s road to recovery with 10% recuperation from losses made in the start of the global pandemic.

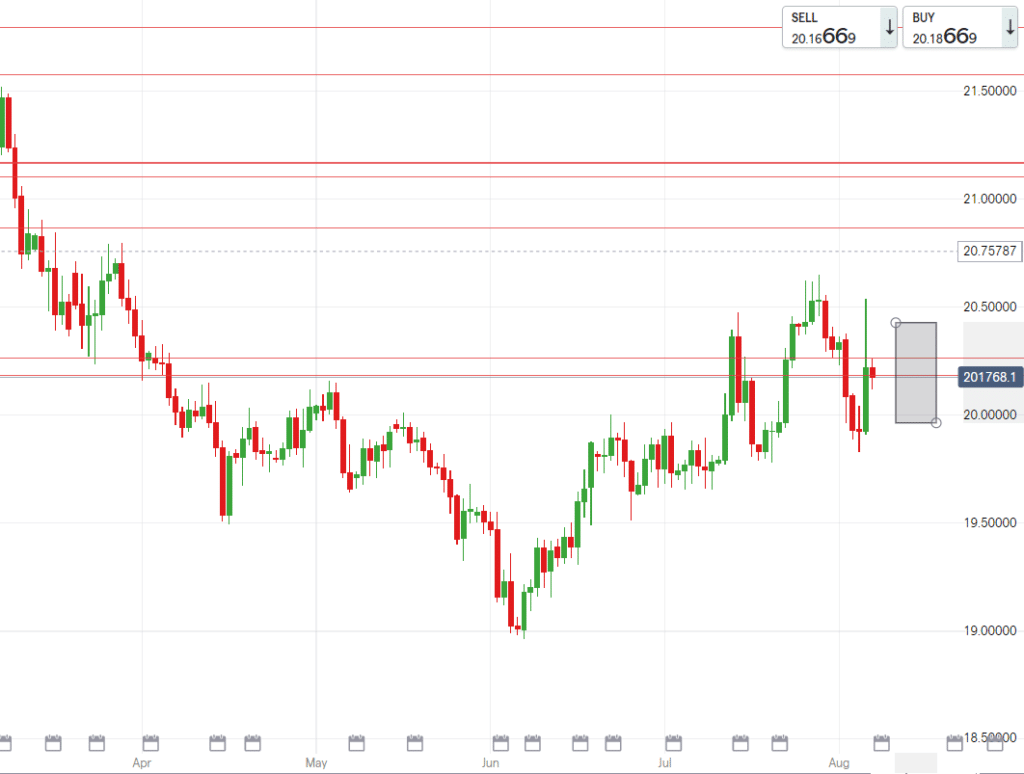

Technically, GBPZAR broke under R19.90/£ before returning to range back above the R20 mark. We expect the pair to hover and range between R20.05/£ and R20.40/£. Should the rand find some push in the dollar being sold off or risk appetite turning back on lower levels will be achievable.

Technical levels we are watching for the upcoming week:

USD/ZAR

- High – R14.80/$

- Support – R14.45/$

- Low – R14.18/$

EUR/ZAR

- High – R17.40/€

- Support – R17.20/€

- Low – R16.88/€

GBP/ZAR

- High – R20.40/£

- Support – R20.20/£

- Low – R19.94/£