Bond tantrums set the tone of the week and US Fed Chair set a Firestarter to the dollar by downplaying fears of inflation and quick job market recovery.

USD/ZAR News

Overnight the dollar reached highs on USDZAR last seen in January.

This surge in the greenback is mainly attributed to the semi-dovish stance that US Fed Chair Jerome Powell took in his address on the economy.

A dovish approach indicates that the Fed is inclined to support lower interest rates and more fiscal stimulus to help the economy out of issues like worsening unemployment and inflation.

Powell strayed from details but maintained firm in his credence that recovery will take some time to occur and that the labor market will not regain its numbers fully in 2021 – obviously this type of cautionary talk sent the markets into the dollar and away from risk currencies like the rand.

At the back of investors mind is that President Joe Biden is doing well with the vaccine roll outs, the US stimulus package reaching finalization and expectations of inflation increasing.

These factors push market players to feel policy tightening will reach the US sooner than later and thus is keeping the market away from gold and invested in the dollar.

Technical direction forecast

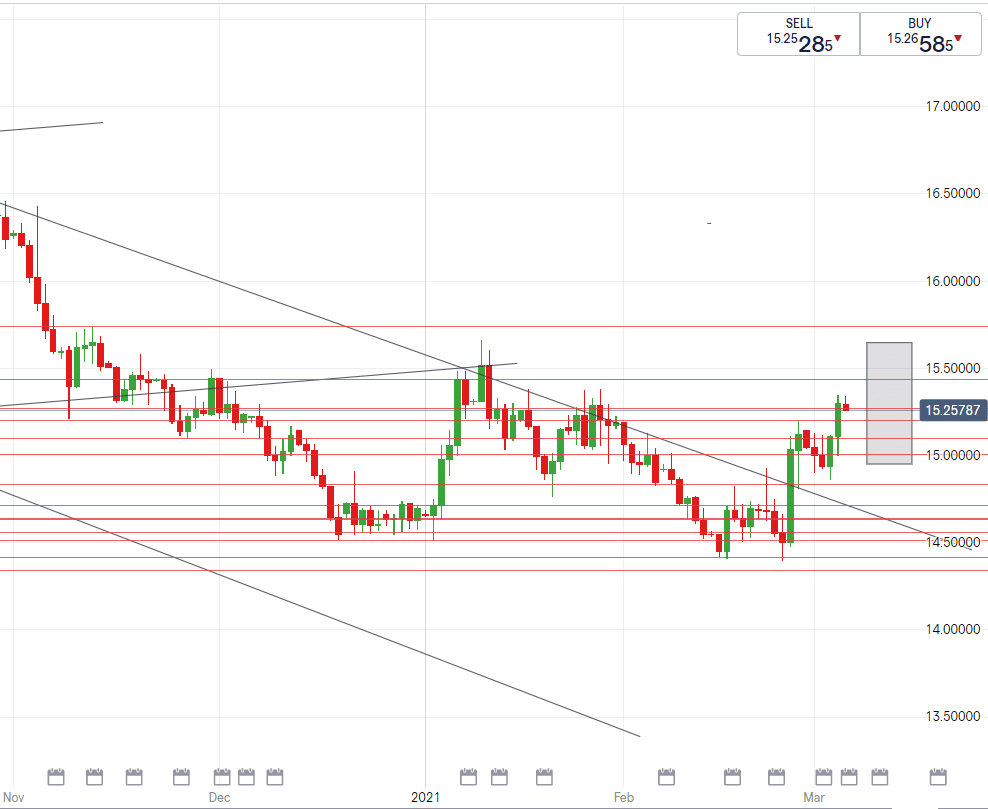

The recent surge pushed us over 3 resistance levels on USDZAR which have now become support. Having broken out of our long running downward channel indicates that now the road ahead is not a favorable one for the rand.

Support now rests at R15.27/$, R15.20/$, R15.10/$ and the strong R15.00/$ – meaning we have to rebreak these to see more “stable” levels for the rand.

Looking ahead to next week next possible levels we can expect to test include R15.43/$ and a possible high of R15.65/$ is now in play.

EUR/ZAR News

Unchanged from the previous month, the euro zone January’s unemployment rate stood at 8.1%.

Eurostat estimates that 15.66 million people were unemployed in January 2021.

Furthermore, Eurostat confirmed that retails sales were down sharper than expected by 5.9% month on month in January. We can see the impact of these statistics playing against the Euro as it has lost ground against the Dollar but still shows visible weight against the rand.

Technical data forecast:

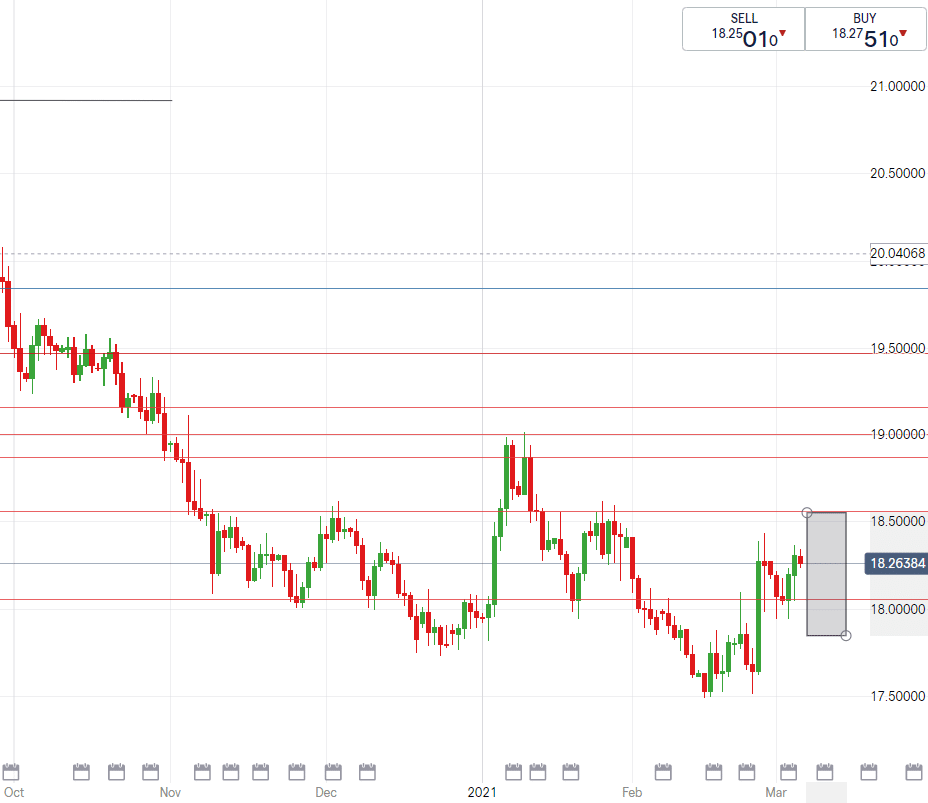

The EU seems to be handling Covid-19 well but there has been many delays with vaccines and distribution challenges along the way. The EUR/ZAR pair is riding on the coattails of a strong Dollar, testing previous highs along with most other currencies. Support is around R18.20/€, whilst should the Dollar’s ride prolong, the pair could get to a high of R18.61/€. A break of the R18.05/€ could see best buys around R17.95/€.

GBP/ZAR News

After a strong UK budget proposed on Wednesday this week, the Sterling is trading over R21/£, reaching the highest level since October 2020 at R21.32/£.

The UK Chancellor pledged in his budget statement to do “whatever it takes” to support economic recovery.

The measures declared were largely priced in even after shocking tax increases in corporation tax from 19% to 25%, projected to roll out in 2023.

The budget extends near term support to households however which brings great relief to investors of the solid currency. Focus now shifts to local Covid-19 stats in hopes of some easing on lockdown restrictions after PM Boris Johnson unveiled his guidelines to lifting all restrictions by the Summer.

Technical direction forecast

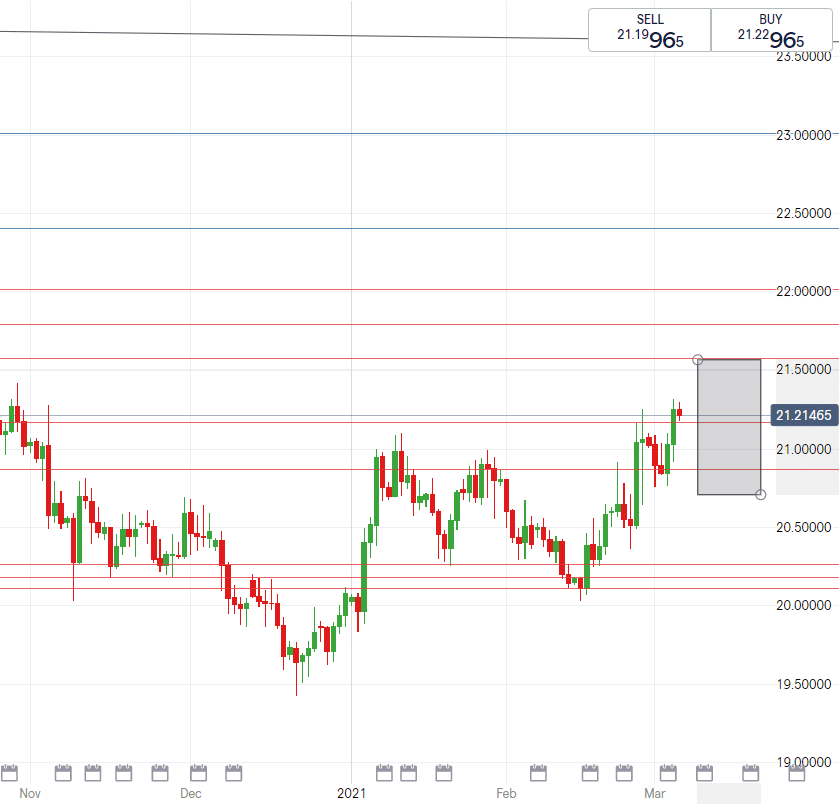

A clear break above R21/£ has taken the GBP/ZAR currency pair to test highs we all hoped to not see again but truth be hold, quite inevitable.

With markets digesting the proposed budget and a strong Dollar, we can only expect to see this pair soar.

There is clear support at R21.10/£. If that support line breaks, we see best buying levels around R20.90/£ (this is if the Rand gets to come up for air). A foreseeable high and on the back of the USD, we could see the pair test R21.52/£.

South African Rand News

The rand kicked off the week with an easing down in restrictions from coronavirus alert level 3 to 1.

This shift kept us steady and consistent, opening around R14.98/$ each morning until a bullish trend began yesterday and was set alight overnight.

This week the country marks one full year since the first case of the covid-19 strain was reported on our soil.

After two waves and an approaching third wave, we now await a tidal wave of another downgrade in the nation.

Rating agencies were not convinced by our national budget and have little faith in the country’s ability to reduce spending and increase growth.

Debt is expected to rise to 100% of our GDP in the next 2 years and possibly force upon us an unwanted issue of defaulting to many of our lenders.

Given the current turmoil and volatility which has put the rand under pressure, the likelihood of a downgrade may pull the carpet under the feet of our rand.

At this point we can only hope that negative downgrades are already being priced in and that a rapid vaccination drive may restore stability in our nations ability to economically recover.

USD/ZAR

High – R15.65/$

Mid – R15.25/$

Low – R14.88/$

GBP/ZAR

High – R21.52/£

Mid – R21.10/£

Low – R20.80/£

EUR/ZAR

High – R18.62/€

Mid – R18.20/€

Low – R17.90/€

FX Paymaster is the smart, easy way to transfer money abroad.

Register here for a free demo to live account today for access to our world class online payment platform.

CLICK HERE FOR A FREE DEMO TO LIVE ACCOUNT