OVERVIEW

1 order of interest rate hikes all round coming up – From Central Banks Everywhere

The SARB and ECB delivered huge rate hikes at 75 basis points and 50 basis points respectively, owing to their fight against the red-hot inflation that continues to grow on the economic thermometer.

The U.S Fed will have their turn to deliver next week.

U.S AND SA MARKETS

It has been quiet for the U.S markets with little to no economic data being released this week. After some serious inflation figures from the U.S last week, investors are anticipating the Federal Reserve’s interest rate decision next week Wednesday.

Markets expect The Fed will deliver another 75 basis point interest rate hike after expectations of a 1% interest rate hike was cut short by two Fed officials who said that it was unlikely. With slowing growth and the economy potentially moving into a mild recession, The Fed will most likely announce a cut back on large rate hikes in their future meetings, with a possible 50 bps hike in September and 25 bps hike in November this year.

In South Africa, inflation hit a 13 year high, being recorded at 7.4% in June 2022, this is the highest inflation the country has seen in 13 years. The effect on consumers is that prices of food and non-alcoholic beverages have increased by roughly 8.6% (YoY), fuel up by 45.3% (YoY), Electricity up by 14.5% (YoY), Public Transport (14.3%).

Yesterday, The South African Reserve Bank released their monetary policy decision and raised the interest rate by 75 bps to 5.50%, the biggest hike in nearly 20 years. The Governor mentioned that “the aim of policy is to stabilize inflation expectations more firmly around the mid-point of the target band and to increase confidence of hitting the inflation target in 2024.” What this means for consumers is that they will have to fork out more on the interest paid for short term debt with a variable rate. Consumers shopping for new houses and cars will pay more now on loans.

Technical:

This week, the USD/ZAR pair has had little volatility with the weekly low being R16.95/$ (seen earlier in the week) and the weekly high seen at R17.26/$. This could be short lived as investors await the Fed interest rate decision next week which could help break the range bound activity on USD/ZAR. The SARB interest rate decision was basically a non-event as the pair closed at R17.07/$ yesterday. We can see from the little movement in the markets the interest rate hikes have been widely priced in however, should The Fed exceed expectations, we could finally see some volatility.

Low – R16.90/$

Support – R17.05/$

Possible High – R17.30/$

EUROPEAN MARKETS

The Eurozone’s economy is tumbling as their CPI rose to 8.6% (YoY), which was a big jump from 8.1% (YoY). This has since resulted in the ECB having to take drastic measures to tame their ever so hungry inflation in the country.

The European Central Bank released their monetary policy statement and delivered their biggest interest rate hike in 11 years. The ECB raised their interest rates by 50 basis points, which was higher than the forecasted 25 bps. This hike boosted the Euro against the greenback moving away from parity between these currencies.

The ECB President Christine Lagarde touched on the economic activity of Europe reiterating that Russia’s war against Ukraine continues to drag and slow growth significantly and that uncertainty has increased as purchasing power has reduced due to high inflation. The ECB expects inflation to remain undesirable for a while as long as supply shortages remain tight.

Technical:

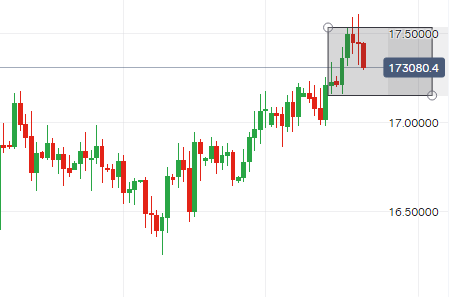

The Euro has been on a bullish streak against the Rand for 4 consecutive weeks, with the Euro having a weekly low of R17.16/ € and a weekly high of R17.60/€ . The Rand has since strengthened against the Euro after the rate decision yesterday. It is likely that the pair may retest the R17.20/ € level again next week and depending on the outcome of the FED rate decision, it will give a clearer picture of how the Euro will perform for the rest of next week.

Low – R17.20/€

Support – R17.35/€

Possible High – R17.50/€

uk markets

The UK is currently living in crisis as the cost of living in the country continues to spike, with the year-on-year Core CPI jumping up from 9.1% to 9.4% ,which is a whooping 40 year high.

The Bank Of England Governor Andrew Bailey suggested in a speech on Tuesday that monetary policy needs to be tightened even further, with that being said, it is likely that the BoE will hike their rates by 50 basis points at their next meeting in August. Should this occur, it will be the U.K’s largest rate hike in almost 30 years

Technical:

Much like the Euro, the Sterling had a bullish start to the week, but after the rate decision of the ECB, the Sterling lost steam against the Rand as well. The GBP has posted a weekly high of R20.63/£ and a weekly low of R20.22. Looking at the graph, The Pound stand to lose a little ground in the coming week, and the pair may post a low of R20.29/£ but should it not hold, a low of R20.22/£ may be tested again.

Low – R20.22/£

Support – R20.40/£

High – R20.65/£