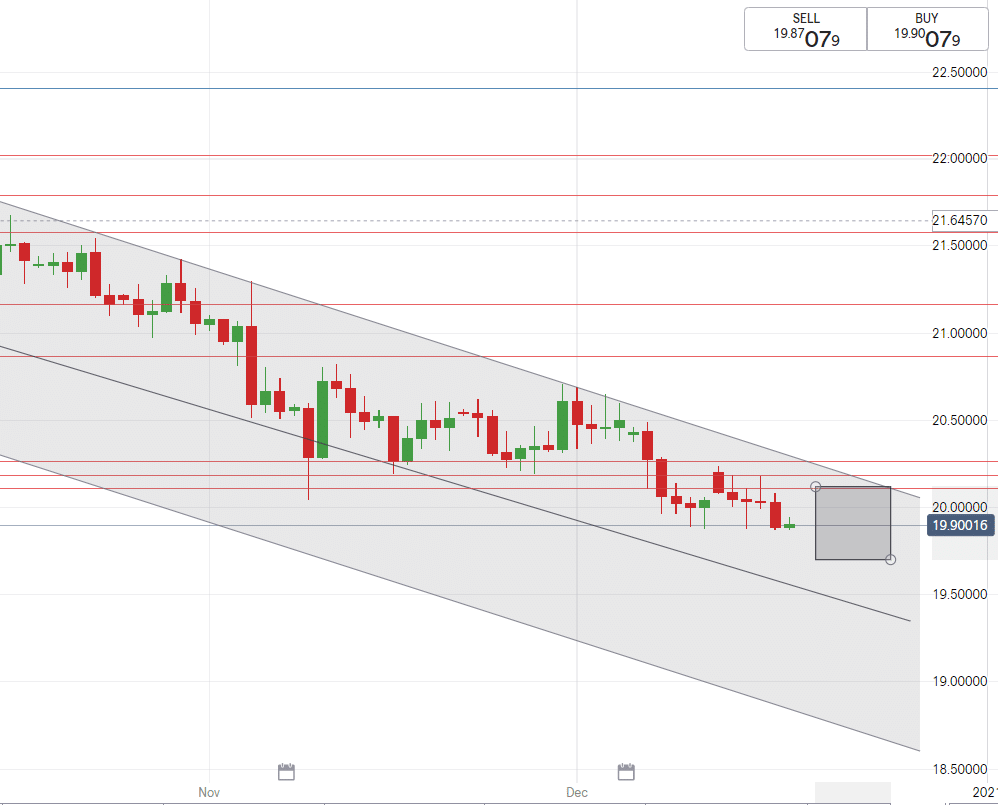

Rand News – South Africa is the hardest hit coronavirus country on the African continent however this didn’t stop the rand from being fuelled by the emerging market rally this week.

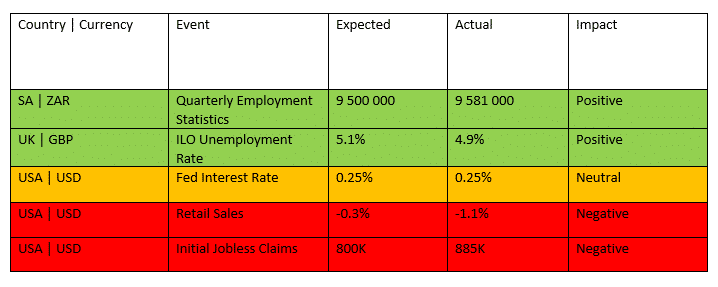

USD/ZAR News

Having starting the week at a high of R15.09/$, we saw the USDZAR drop almost 50 cents to a low of R14.63/$ yesterday.

Last week, we gave two options of how the USDZAR may behave and clearly option 2 of a technical drop to R14.70/$ and possibly lower played out solidly.

This downward jerk-reaction can be attributed to dollar weakness and an extreme surge in risk appetite due to confidence in a global recovery.

The US Fed kept interest rates unchanged and continued to roll out the Covid-19 vaccine this week, these factors are good for setting up a rehabilitation of the nations economy.

However with things getting “back to normal”, investors are persuaded to pull out of the dollar and seek assets/currencies with high yielding profits – leaving the dollar weaker and sensitive to bad data like this weeks gloomy job data showing job losses have been added to the US.

Technical direction forecast

USDZAR broke R15.00/$ for the first time in 10 months, two possible options for next weeks price action include :

1 – with next week being filled with holidays, the USDZAR may react strangely and retrace back towards a high of R15.03/$.

2 – our favoured possibility – due to risk appetite and a soft dollar, USDZAR remaining below R14.70/$ then breaking towards R14.50/$.

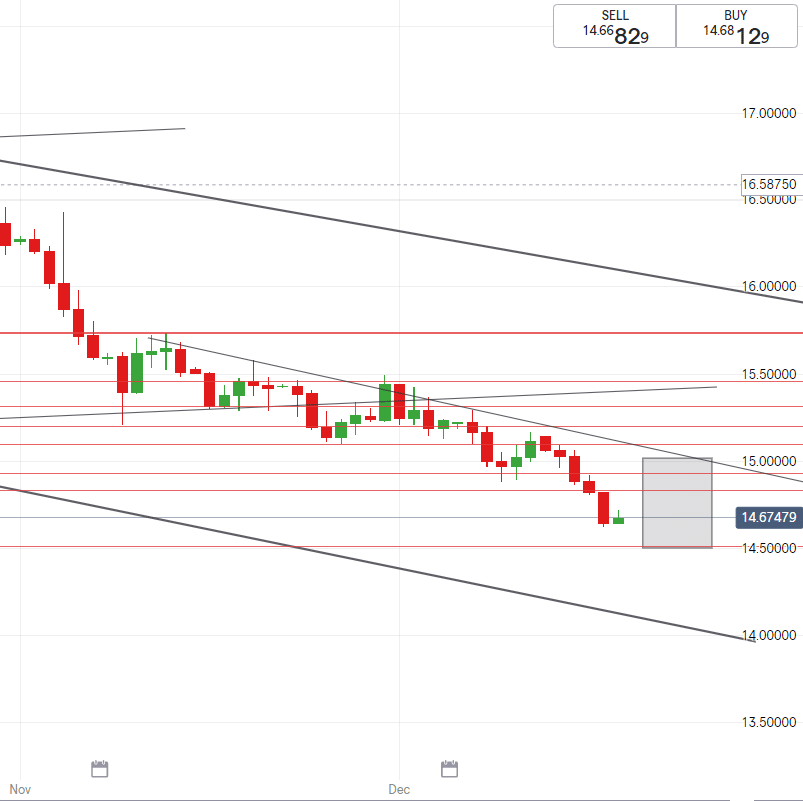

EUR/ZAR News

This past week saw the Eurozone find footing in some positive industrial production data.

Despite good data, the second most popular currency never climbed higher than R18.34/€ on EURZAR since Monday.

The European Union’s regulator of medicines brought forward the date to assess and authorize the covid-19 vaccine to January 6th.

EC President Ursula von der Leyen noted that progress is being made in Brexit negotiations however challenges remain due to “big differences”.

French President Emmanuel Macron has tested positive for Covid-19 and will now self-isolate for the next week.

Technical direction forecast

The Euro found itself smack-bang in the middle of our channel last week.

This week we foresee a bit of ranging as the EURZAR may move up and down between R18.21/€ and a low of R17.84/€.

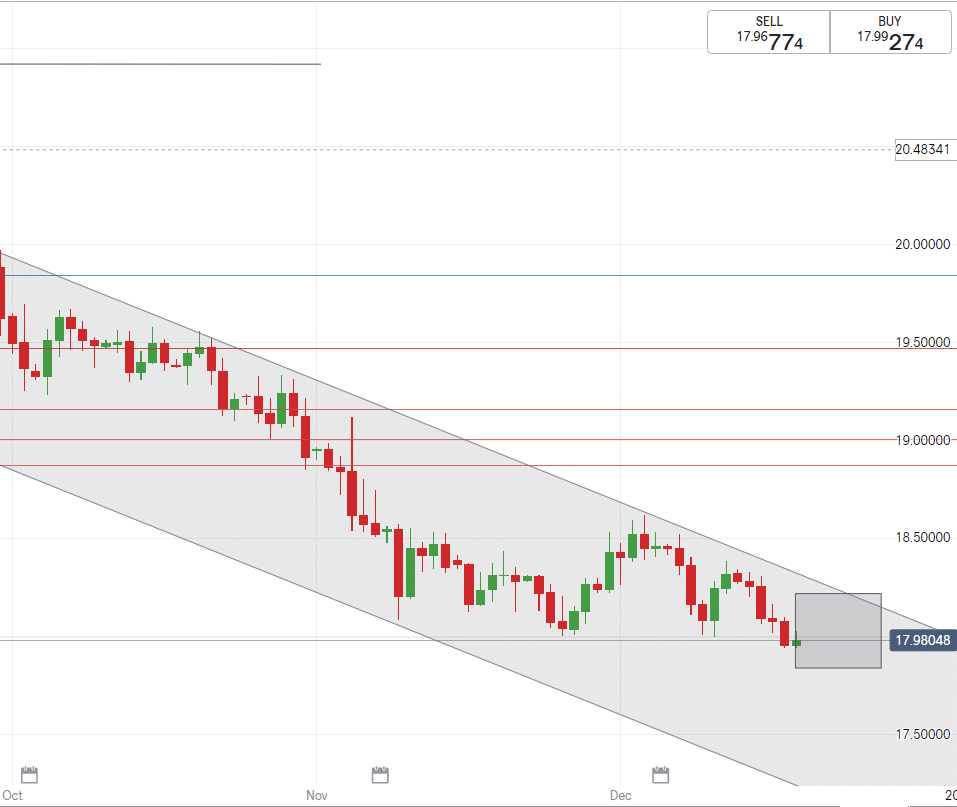

GBP/ZAR News

Brexit negotiations are now in “a serious place”, after a phone call between the EU and Prime Minister Boris Johnson yesterday saw confidence climb for a positive trade deal outcome – however solving differences is still the biggest challenge.

Next week has UK GDP data set to be released on Tuesday, this will be used as an indicator towards how the UK economy is faring in its current turmoil.

A mutated version of the covid-19 virus is said to have emerged in the UK, but this is not expected to harm the vaccines effectiveness.

Technical direction forecast

GBPZAR also fitted perfectly within our range block this past week, seeing a high of R20.23/£ on Sunday before embarking on a zig zag downward trend to where the pair eventually broke R20.00/£.

The pound remains centred in our downward channel and we expect the sterling to find support around R19.95/£ with a possible low of R19.71/£.

South African Rand News

SA is the hardest hit coronavirus country on the African continent however this didn’t stop the rand from being fuelled by the emerging market rally this week.

Remaining in the top 10 best performing emerging market currencies this week saw the rand break through R15/$, R20/£ and R18/€.

We saw updated restrictions this week as we are confirmed to be within a second wave of the pandemic here at home.

This December is to be filled with gathering, curfew and alcohol restrictions – with further restrictions assumed to be possible as cases continue to rise and some citizens ignoring the lockdown rules.

Positive local job data showed that 75,000 new jobs were added to the non-agricultural industries.

Vaccine worries are boiling in the nation as SA missed the deadline to make a deposit for securing vaccines to fight the virus, this is expected to be settled “soon” while cases continue to worsen with the country approaching it’s busiest time of the year.

EUR/ZAR

- High – R18.23/€

- Support – R18.08/€

- Low – R17.84/€

GBP/ZAR

- High – R20.11/£

- Support – R19.95/£

- Low – R19.71/£

Our NEW free Demo to Live system allows you the freedom to explore our world class payment platform.

Register here for a free trial account today.

CLICK HERE FOR A FREE DEMO TO LIVE ACCOUNT