Rand News – A big reaction in the markets from investors has developed into a fourth day of Rand weakness

USD/ZAR News

After the Democrats won the election in Georgia, the US experienced violent protests at Capitol Hill. However before the election the Dollar had already started strengthening when market players came back from Holiday. We expected a dual win for the Democrats would strengthen the Dollar further which is exactly what has taken place. The Dollar moved forward against all major currencies even though jobless claims this week were elevated.

Technical direction forecast:

After a 47 cent jump yesterday, markets opened at R15.39/$ this morning. Sticking within a long-term channel which we have been trading in since April 2019, we could see the USD/ZAR pair topping at R15.60/$. A break of that level would see the pair moving up to the R16.00/$ mark once again, no doubt a possibility due to the rise and concern around infections in SA.

EUR/ZAR News

The publication of retail sales in the Eurozone showed that sales collapsed to -6.1% in November, its worst levels since the height of the first wave of the COVID back in April. Inflation has also remained negative reading -0.3%

Technical direction forecast: A 40 cent jump on the EUR/ZAR pair yesterday and markets seem to hold steady at this point. Its important to keep in the mind the Dollar has also strengthened against all currencies and this is not just Rand weakness. The pair could move over the R19.00 mark toward R19.30.

GBP/ZAR News

The UK entered a hard lockdown to begin the year. Prime Minister Boris Johnson declared a six week circuit breaker as cases being recorded surpass 40,000 a day. The UK’s economy is under strain as a second recession could be looming. The only hope is a rollout of vaccines to be done faster than the spread of the virus.

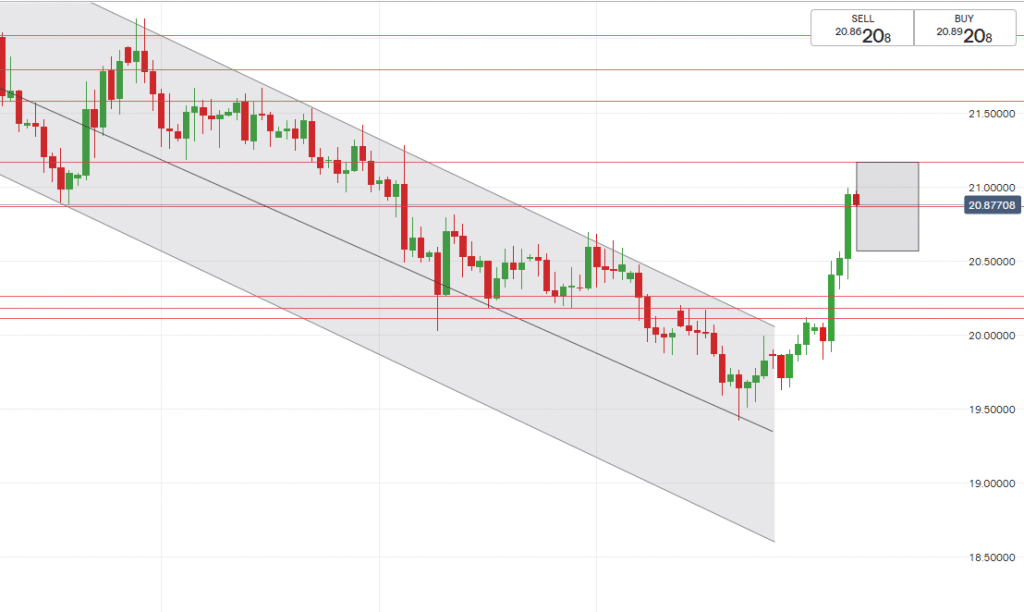

Technical direction forecast: The GBP is near R21.00 and possible headed over that soon based on USD strength coming through and the vaccine rollout in the UK.

South African Rand News

A big reaction in the markets from investors has developed into a fourth day of Rand weakness after SA’s COVID cases topped 20,000 for a 2nd day. A Level 3 lockdown causes concern for market players as the result from this will equate to economic contraction for SA.

This week healthcare workers called for stricter measures due to hospitals reaching capacity around the country, after much deliberation and meetings called, the NEC announced yesterday that the country cannot go back to a hard lockdown but what they can do is provide necessary support to avoid a total shutdown before any further measures are considered. Further this week, medical aid companies in SA pledged to purchase vaccines for uninsured individuals equal to their number of members which estimates around 14 million vaccines to be purchased, easing the government’s burden. Painting an even grimmer picture here is Eskom, reinforcing load shedding citing the grid is under severe pressure.

EUR/ZAR

- High – R19.32/€

- Support – R18.85/€

- Low – R18.51//€

GBP/ZAR

- High – R21.17/£

- Support – R20.87/£

- Low – R20.55/£

Our NEW free Demo to Live system allows you the freedom to explore our world class payment platform.

Register here for a free trial account today.

CLICK HERE FOR A FREE DEMO TO LIVE ACCOUNT