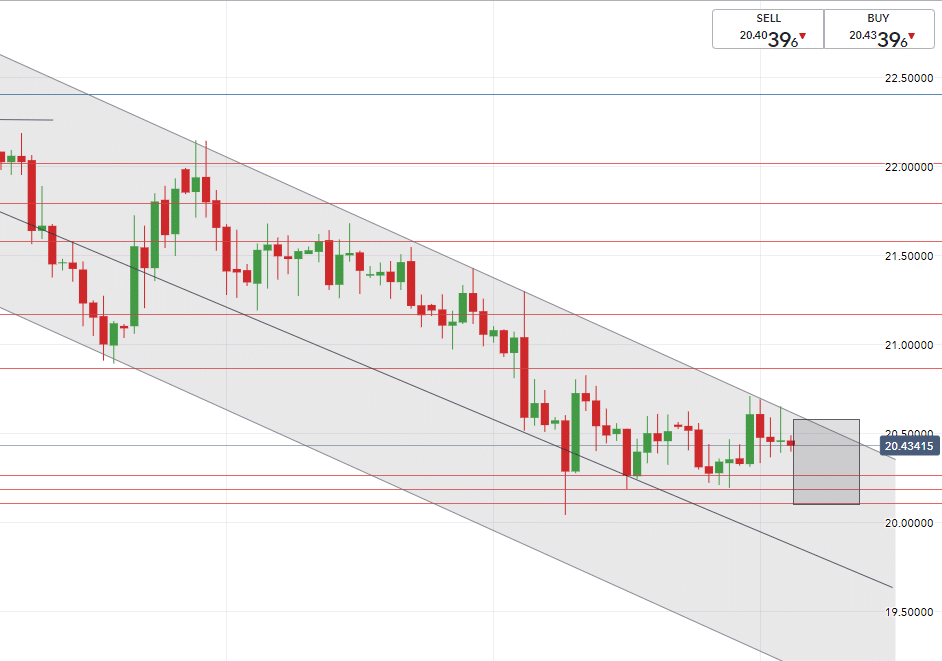

Rand News – The Rand experienced a cautious week with whispers of a mini lockdown creeping into the markets however progress made on vaccines this week continues to help boost risk appetite.

USD/ZAR News

Pressure prevailed this week on the dollar, keeping USDZAR in a minor sideways trend between R15.20/$ – R15.45/$.

Four large factors which weighed on the dollar’s potency this past week include:

– The vaccine rally sending bidders into risk-on currencies and away from the greenback.

– Rising coronavirus cases due to the Thanksgiving rage.

– US stimulus expectations which keep investors away from the dollar due to inflation.

– Weak manufacturing data, showing a slow recovery in the economy.

Technical direction forecast – The week has exhibited a sideways movement on USDZAR, this can be seen in the tight range of less than 30 cents that we remained in from Monday.

There is still a bearish impetus as we remain in a downward channel, leading us to believe that if we break R15.20/$ and R15.10/$ convincingly that we may see lower levels in the form of a R14.92/$.

EUR/ZAR News

The European Central Bank remains more of a supporter for fiscal stimulus as opposed to the US Fed, December is a month whereby investors will watch to see what kind of restructuring may arise.

Fears remain that a second dip may occur in Europe due to their troubles with a new wave of the pandemic and stricter restrictions being implemented.

Market players will remain cautious as growth is expected to slow in the EU as the pandemics effects increase.

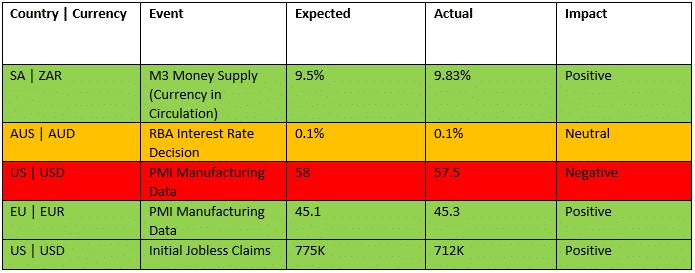

Technical direction forecast – the EUR/ZAR climbed from R18.25/€ to a high of R18.61/€ this week.

Being unable to break over R18.60/€ has now seen EURZAR drop lower.

We anticipate better levels next week, breaking R18.30/€ and R18.20/€ may see us test our forecasted low of R18.12/€

GBP/ZAR News

Mood in the UK shown through a recent poll has indicated that many believe the UK’s economy will not see normal activity until 2023.

To no surprise, the largest contributor to this grim sentiment is the highly possible risk of a no-deal Brexit.

Decisions have been made on a Brexit course between EU and the UK, however, focus now remains on the finalization of the finer details which is the latest bump in the road.

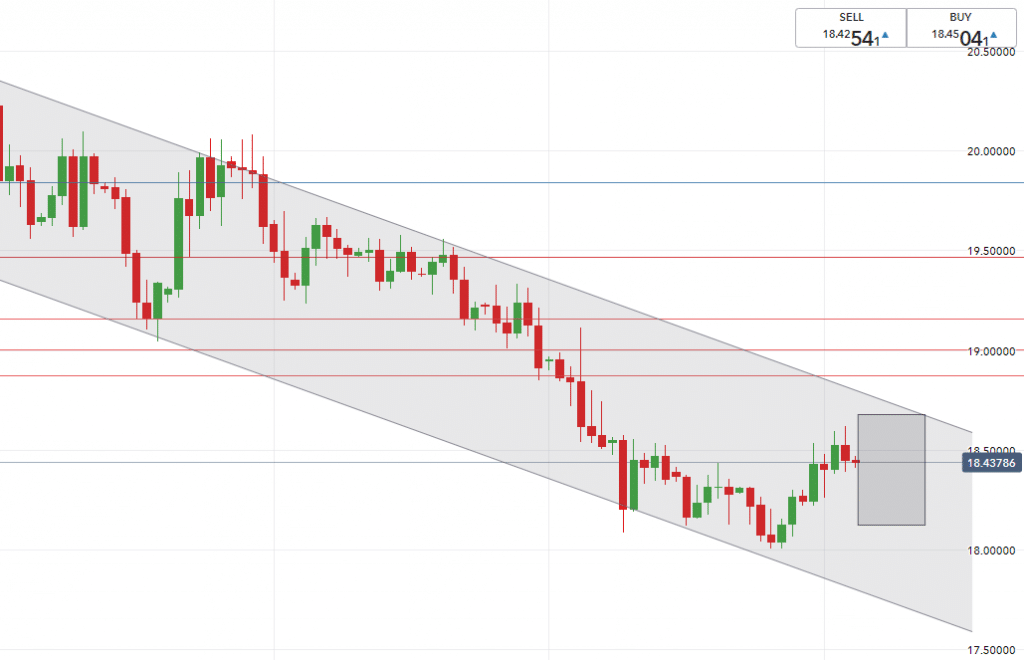

Technical direction forecast – Downside is favored on GBPZAR as we move into next week.

We are currently on a notable level around R20.43/£, a move under R20.33/£ will indicate that we may expect GBPZAR to touch levels in the lower R20.20’s.

South African Rand News

The Rand experienced a cautious week with whispers of a mini-lockdown creeping into the markets.

Our local economy was back in the spotlight this week along with focuses shifting to the public wage bill, debt gap solutions and the President’s competency as Ramaphosa was supposed to face a vote of no confidence.

Last night, President Ramaphosa reinstated restrictions in hotspots – this has not negatively impacted the rand as the economy remains open and moving.

The rand’s saving grace remained the fragile dollar this week, as talks of a huge relief-package urge market players to bid against the dollar.

Importantly the progress made on vaccines this week continues to help boost the rand as risk appetite increases at the idea of a return to normalcy.

EUR/ZAR

- High – R18.67/€

- Support level – R18.44/€

- Low (best buy) – R18.12/€

GBP/ZAR

- High – R20.57/£

- Support level – R20.33/£

- Low (best buy) – R20.10/£

If your business makes or receives foreign payments then you could save time and money using FX Paymaster Online. Have you tried our free demo system? Our registered clients also get the latest Rand News every morning to their mailbox.

CLICK HERE FOR A FREE DEMO ACCOUNT