In our weekly round up this week, we look at some important data released and the affect this has had on the currency market.

USD/ZAR

The dollar saw a revival from last week’s vulnerability, firming progressively in a surge to closely near it’s largest gains in almost 6 months.

Renewed hopes of a economic stimulus package and risk appetite dampening due to second wave worries aided this recovery.

Despite the dollar’s rise, negative sentiment lurks closely with covid-19 cases topping 7 million and deaths reaching the 200,000 mark.

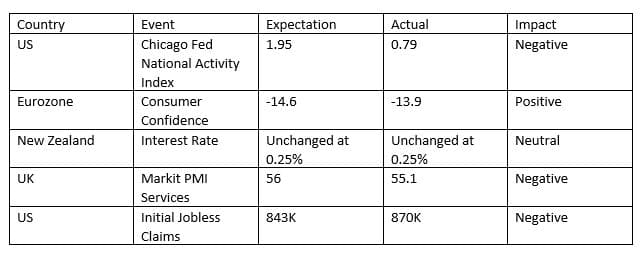

Furthermore, the US economy perceived to be decelerating as unemployment surprisingly increased yesterday.

EUR/ZAR

Europe is facing heightened fears over a second wave of coronavirus, as well as ripple effects of Brexit uncertainty.

The Euro has maintained our projected downward expectation this week with minor sideways movement seeing it correct back to a R19.77/€ this morning.

A possible state-of-health emergency loiters as France have taken the initiative to reinstate restrictions, however not all is dim and gloomy with Germany seeing slow signs of recovery – sparking the outlook that the economy will improve, in a gradual fashion.

GBP/ZAR.

The pound sterling rose from R21.10/£ to a high of R21.89/£ this week, however the British currency remains under pressure with Brexit turmoil vexing global sentiment, uncertain trading relationships shaking the nations stability and rising infection numbers causing expectation of a second wave.

Activity has been stifled as seen in data such as prospective investment intensions having dropped by 6% and the manufacturing sector seeing a three month low in orders.

With a ‘mini-lockdown’ being implemented to shelter citizens from a costly winter season, the pound may have a fluish next few weeks ahead.

South African Rand

Our rand lost last week’s gains in an unfortunate combination of events which saw the USD firm and a risk off surge impact emerging markets.

These events which weighed on our currency include the untimely announcement of our President being on bed rest due to an alleged cold, deteriorating confidence in state ability to handle the corruption in SEO’s and the leaking of information revealing that government will be funding SAA’s restructuring of R10.5 billion.

Emerging markets may carry on suffering as global risk appetite diminishes with US-China tensions highlighting a divide between the two power-houses.

The USDZAR is expected to remain extremely volatile with daily ranges seeing wide spreads, likely continuing to remain tracking upward in the short term and possibly seeing a shaky correction towards year end if the US elections don’t cause too much wobbles.

Our range on USDZAR for next week : R16.56/$ – R17.53/$.

|

EUR/ZAR

|

|

GBP/ZAR

|

Our clients enjoy a daily market report for free when opening a business account with us. If you feel like this is adding value to your business, sign up below.

CLICK HERE TO SIGN UP FOR FREE