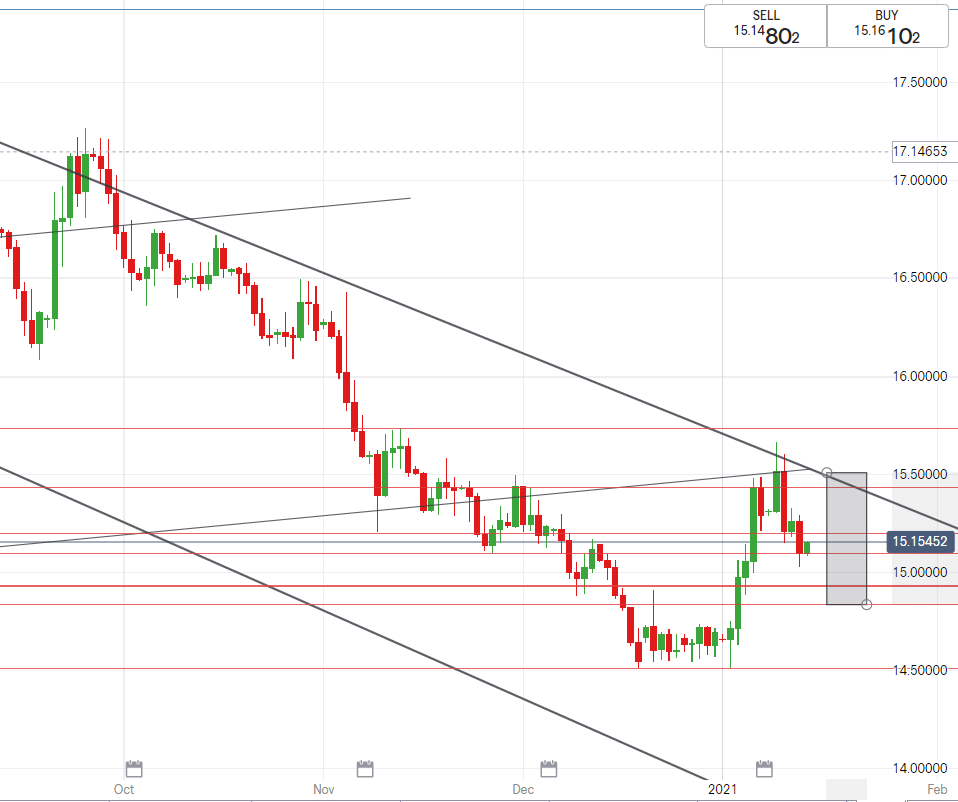

USD/ZAR

In this weeks Rand News. The US dollar started the week on the backfoot as pressure to impeach President Donald Trump increased.

On Wednesday, headlines concluded that President Donald Trump has become the only President in US history to be impeached twice, however is unlikely to be convicted as congress surely wont gather enough votes against him to convict.

Events of the week for the USD include the announcement of President-elect Joe Biden’s stimulus package and the guidance from the US Fed’s webinar yesterday.

Biden’s stimulus will boost relief for households and thereafter the US Fed remained dovish in saying that rates are to remain low.

Concerns now shift to a tax point of view under Biden’s administration, as strategists cite that markets may ignore political on-goings but they don’t often overlook taxes.

Technical direction forecast:

USD weakness had a major impact on USD/ZAR this week, breaking support levels of R15.44/$. The stronghold at R15.20/$ has seen the currency pair decline from a high of R15.65/$ to current levels of around R15.12/$ this morning.

We may be seeing a correction of the early January move, should the Rand continue gaining ground against the US Dollar and break R15.05/$ then we may see levels heading back to around R14.90/$ on the market.

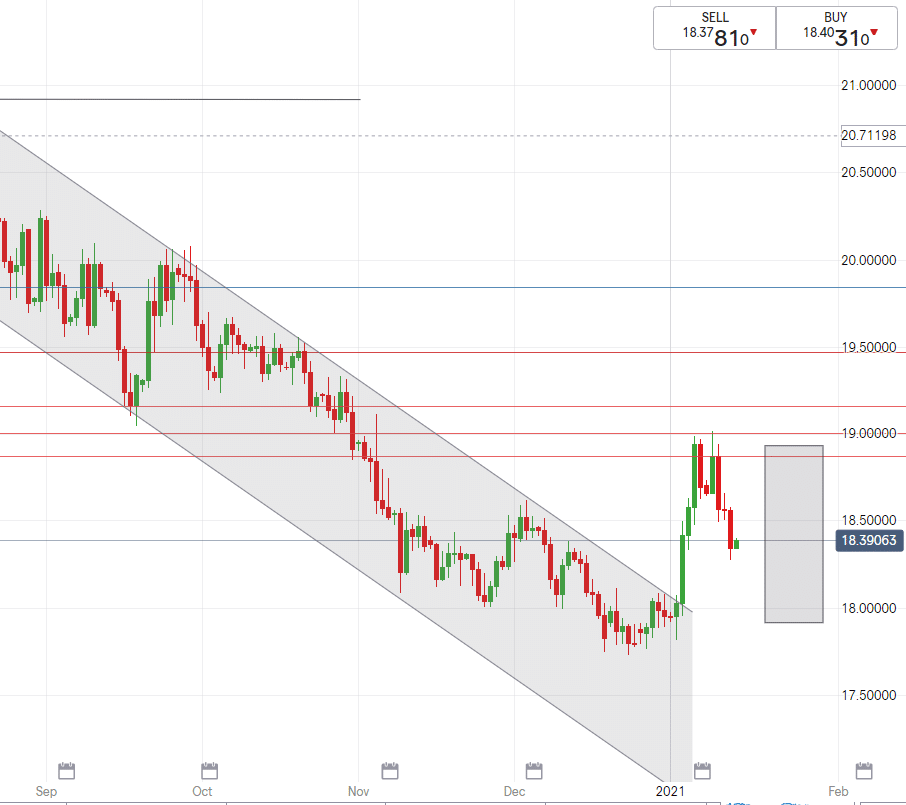

EUR/ZAR

The Eurozone remains volatile as new lockdown measures are introduced. However the roll out of the Corona vaccine across Europe, may calm market players in the interim.

Eurozone industrial production has risen to strong levels despite hard restrictions.

Investor sentiment is seen to be rising and is expected to strengthen after vaccines are distributed.

Looking ahead, the European Central Bank will announce its interest rate decision next week Thursday, which will be a focus for the EUR, however the rate is expected to stay the same.

Technical direction forecast:

Taking a look at the technical data, the EUR/ZAR fell in the bottom half of our predicted range this week, with a break below support to trade at R18.50/€.

Should the ZAR rally and emerging market appetite continue, the EUR/ZAR may test a range closer to levels such as R18.08/€.

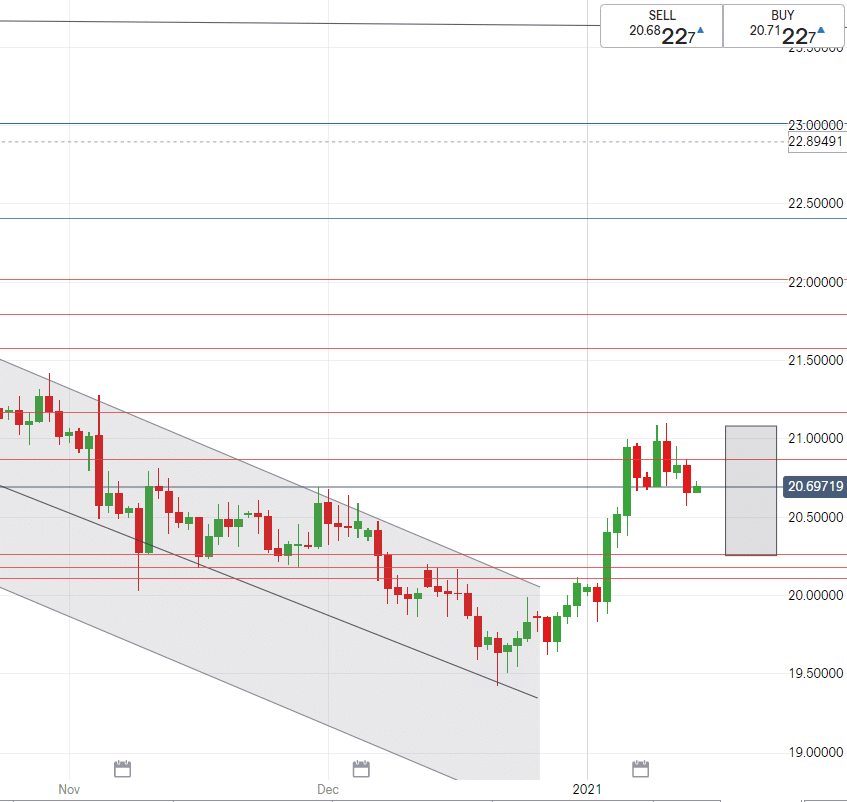

GBP/ZAR

The UK entering a hard lockdown seems to be paying off as the UK reports a drop in covid-19 cases.

An accelerated vaccine rollout plan in the UK has given the market some much needed reassurance.

With covid-19 cases beginning to simmer down, vaccine provision creating confidence and Brexit failure not expected – the Pound is expected to perform well as a result in the short term.

Technical direction forecast:

GBP/ZAR fell smack bang in our predicted range this week between R21.12/£ and R20.70/£. Looking ahead, things look good so we expect a similar spread for the week but with a downward bias.

If R20.60/£ is broken then we can look forward to levels below R20.50/£.

South African Rand News

South Africa braced itself this week for news that we may soon return to a higher level of lockdown. This would have a catastrophic impact on our already fragile economy and exchange rate. Fortunately, we didn’t head that way in the end leaving the Rand with some room to rally.

Expert officials are still calling for harder lockdown measures to be introduced in hotspot regions. This is likely to continue putting pressure on the Rand. For now, we wait for the infection rates to hopefully stabilise and for the vaccine to arrive. Only then, will things really start to go back to normal.

For more Rand News, sign up to our daily market report, where we bring you the latest currency news from around the world.

|

EUR/ZAR · High – R18.95/€

· Support – R18.30/€

· Low – R17.92/€ |

|

· High – R21.08/£

· Support – R20.61/£

· Low – R20.25/£ |