Rates as at 10:37 USDZAR 14.70 | GBPZAR 20.17 | EURZAR 17.06 | AUDZAR 10.90

overview

The dollar nears its first weekly decline of the month as investors seek profit taking from the emerging markets.

Higher than expected US CPI data and healthy jobless claims played in the rand’s favour this week.

SA MARKETS

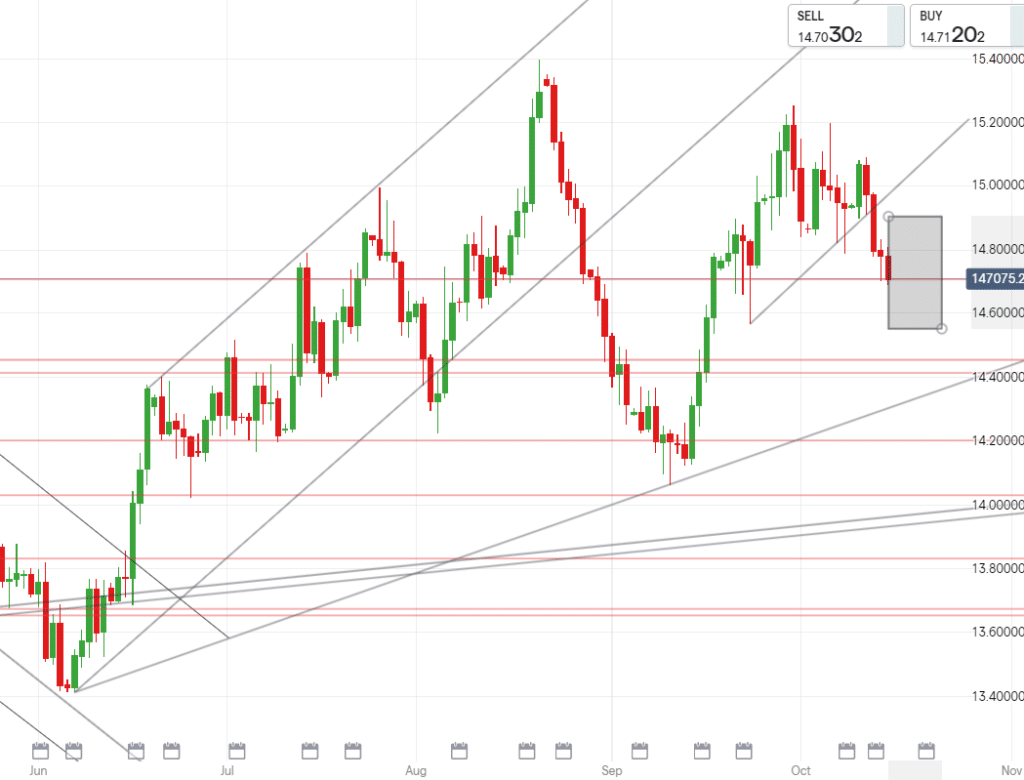

The South African rand benefited from a week of recovering risk appetite as we saw a decline on USDZAR from over R15.05/$ to our current levels of around R14.70/$.

Investors looked out for US CPI which saw a historical surge on the year-to-year comparison, rising by 5.4%. This increased investor belief that tapering will begin sooner than expected due to inflationary pressure and partly caused a temporary dollar sell-off.

US jobless claims numbers were released yesterday and showed the lowest figures since March 2020, dropping to 293K on the weekly claims end and 2.594million on the continuing claims stats.

These healthy economic figures added to the overall mood this week that global recovery is picking up, fears over the Chinese Evergrande debacle calmed and energy crisis in several nations began to see remedial action.

The International Monetary Fund released it’s growth forecasts and changed SA’s growth outlook by 1% up to 5%.

Hereon the spotlight will shift towards our next budget speech scheduled for the 28th of October.

Technically: This loss in dollar strength shouldn’t be considered a reversal as of yet, more so profit taking from market players as they try and play off of current market conditions. If we see a break below R14.70/$ then a 50% retracement to R14.55/$ becomes a closer reality for USDZAR.

Going below that would see the possibility of testing a R14.20/$ but that’s still some way off and would require a break of R14.50/$.

If the dollar becomes a safe haven again and the month end US Fed meeting begins to affect markets then we may rebound back up to near R15.00/$, currently importers should take advantage of these levels and the weak week for the dollar.

EUROPEAN MARKETS

ECB President Lagarde cited this week that the EU economy is increasingly entering a rebound phase, these comments supported the euro however risk appetite contained the euro’s movement.

It was noted however that the economic activity of the bloc remains in recovery and the challenge remains to climb out of the pandemic’s reaches.

Furthermore, inflation outlooks are back on track according to ECB policymaker Knot – this is a positive development but has had no visible impact on the euro as of yet.

Global finance officials came together this week in Washington for the G20 summit with hopes of finding ways to reduce pressure of supply-chain issues and inflation.

ECB President Lagarde stated she had a good discussion with US Fed Chair Jerome Powell and remains positive on improving the European currency as well as making moves towards combating climate change.

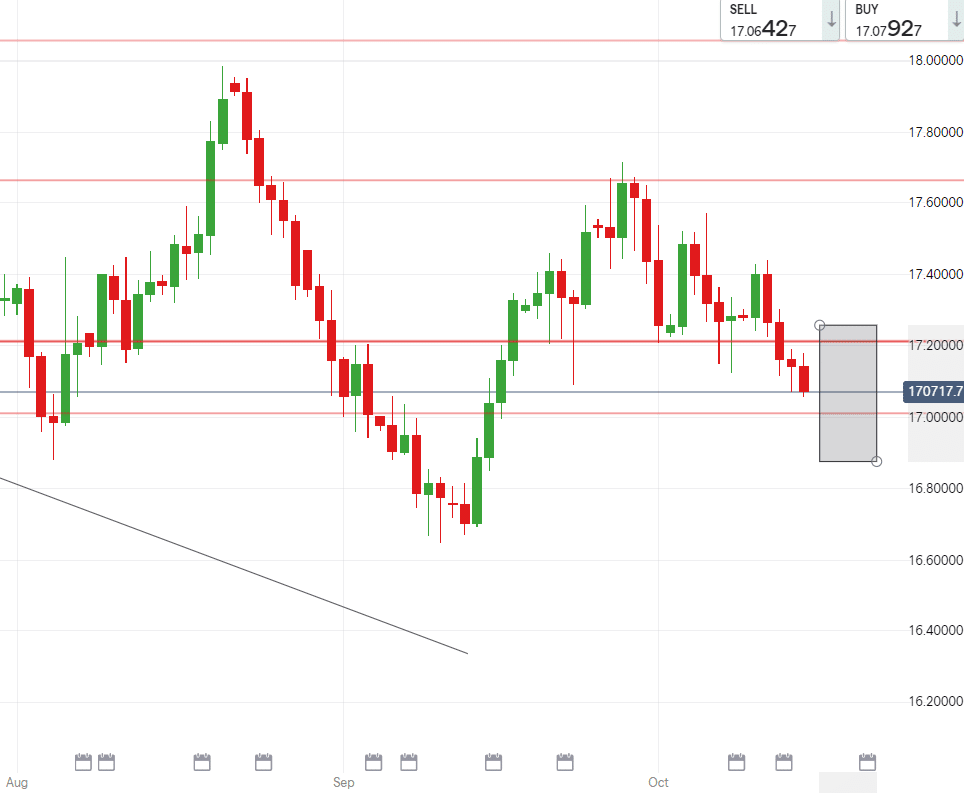

Technically: EUR/ZAR movement has been capped by a weaker dollar and fell well within our predicted range in last weeks report. The pair having broken R17.15/€ gives way to test R17.00/ in coming days which is a strong and important level on the EURZAR.

If the current path remains on track then good buys of R16.90’s can be taken advantage of next week.

UK MARKETS

Brexit jitters hindered the pound’s movement as the UK called out the EU on needing to give up more in the Brexit divorce.

Fresh arguments over the all important Northern Ireland Protocol are back on center stage, the 2 nations are yet to agree on the type of border and custom checks in place for the island.

Recovery is picking up in the UK in a faster fashion than expected, focus now shifts towards October 27th for when the UK finance minister will present the budget. The challenge facing the finance minister is to relax overspending and restore balanced fiscal structure.

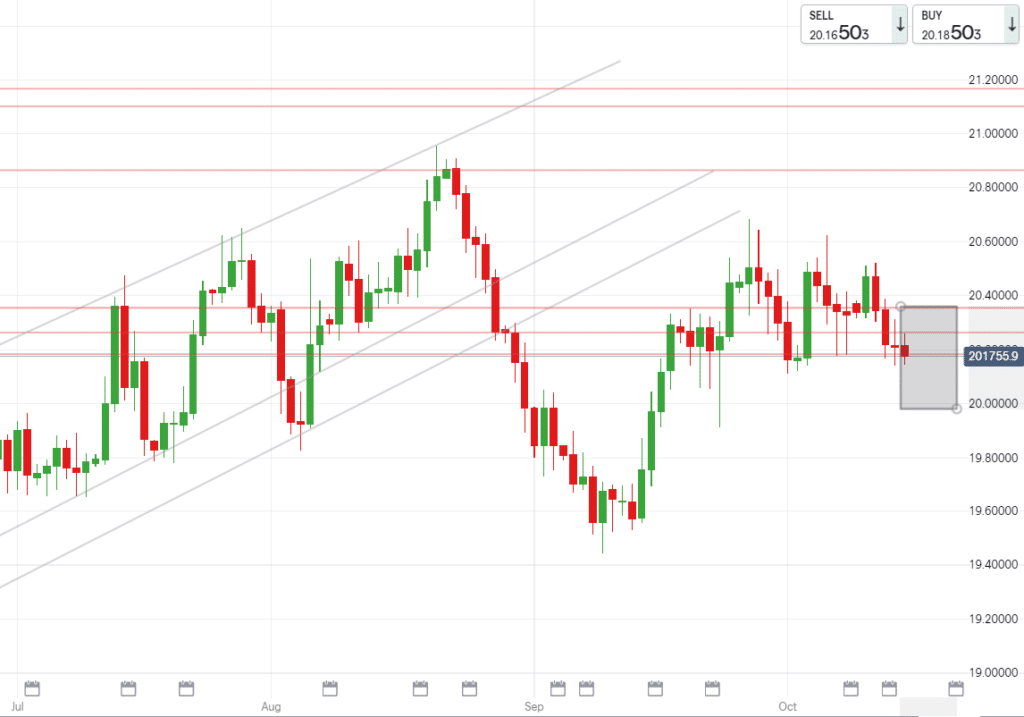

Technically: The GBP has remained steadier than it’s other counterparts and fell smack bang in the range given in our last weekly round up between R20.52/£ and R20.14/£.

The GBPZAR pair is now ranging around the support of R20.18/£, moving below this opens the route to a R20.10/£ and R20.05/£. Should the dollars decline continue then expect the pound to also fall against the rand and possible lower levels become a possibility.

Technical levels we are watching for the upcoming week:

USD/ZAR

- High – R14.90/$

- Support – R14.70/$

- Low – R14.55/$

EUR/ZAR

- High – R17.25/€

- Support – R17.05/€

- Low – R16.88/€

GBP/ZAR

- High – R20.35/£

- Support – R20.14/£

- Low – R19.97/£