overview

The rand was fuelled by the demand in risky currencies this week, until fear over credit giant Evergrande ravaged investors sentiment and pushing players back into the dollar.

SA MARKETS

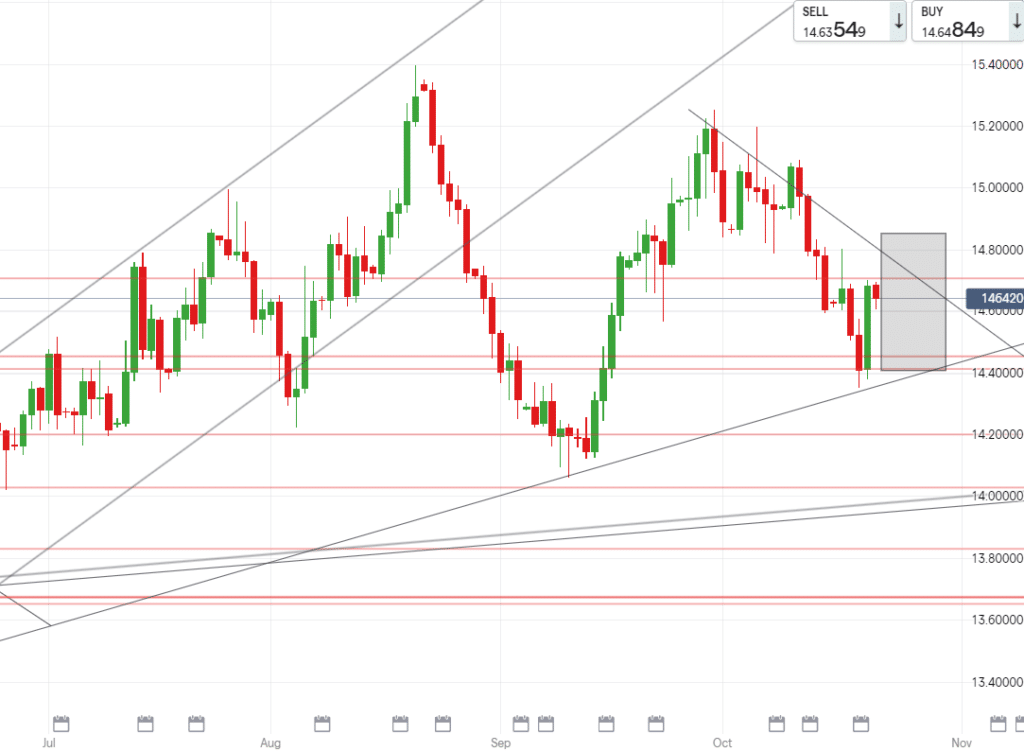

The dollar is close to ending it’s second week in a loss against the rand, this comes as we started the week on a high of R14.80/$ and proceeded to fall to a low of R14.35/$.

This rand momentum is attributed to emerging market demand, which slightly faded yesterday as a pullback in risk appetite helped the dollar back up to R14.60/$.

After the large drop and breaking of support levels, a move back up in the name of ‘consolidation’ is normal and expected for a currency like the rand which is largely held hostage by external global events.

Lets take a look at elements in the markets that may affect the rand in the coming days.

Possible positive factors:

– Demand for emerging currencies, if investors go profit searching and aren’t scared away by any adverse growth data on the global stage.

– Investors going for gold, when gold is sought after then the commodities rush will play in the rand’s favor.

– UK’s BoE raising rates before the US Fed, this would knock confidence in the Fed and give the pound a upper hand, causing a loss in the dollar in the majors pool.

Possible negative factors:

– Evergrande nearing default due as their 30 day grace period approaches an end, the Chinese powerhouses would cast a shadow over emerging economies like SA and send ripples into the markets.

– Lockdown and restrictions as the global 5th wave hits Europe, Russia has ordered a factory shutdown and the UK is looking to enforce restrictions. New lockdowns would offset the global confidence and push market players into the dollar for safety

Next week we have the US Fed meeting and our local budget speech which will be 2 of the spotlight events to look out for, investors will be cautious and playing in and out of positions.

The slightest change in sentiment will rock the rand and it will surely be a volatile week with wide ranges and large price action.

Technically:

USDZAR remains true to a downward trend and having broken R14.50/$ keeps the path open to retest R14.30/$.

A rebound upward may be on the cards but the pair continues to create higher lows and this further gives rise to the belief that we may range at current levels near the support of R14.50/$.

We opened this morning at R14.68/$, and may look to touch a R14.78/$ before coming back down to calmer levels, if China’s Evergrande situation worsens then we will continue to see these elevated levels and lose ground on USDZAR.

EUROPEAN MARKETS

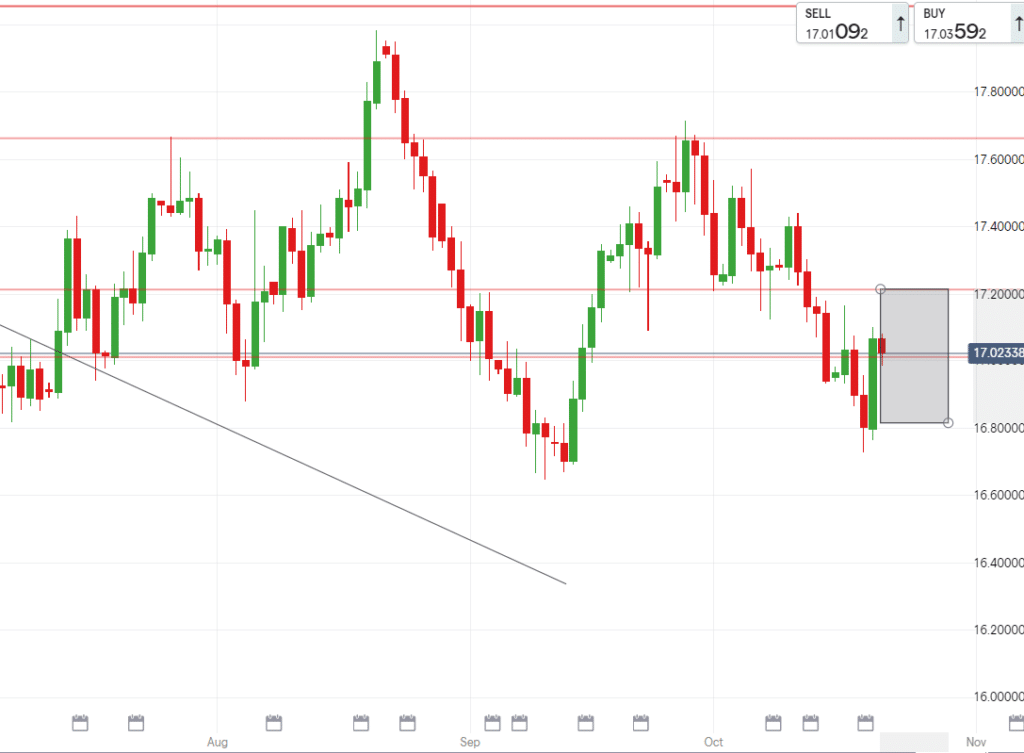

The euro had soft data yesterday in the form of consumer confidence data falling to -4.8%, which was better than expected but still not a figure of sunshine.

ECB officials sited that the pandemic revealed the EU needs to come to more uniform budgetary across the bloc.

An EU summit is underway but is falling in the shadows of a dispute between Poland and Brussels, challenging the supremacy of the EU law.

Several nations in the EU see this as a big crisis for the bloc after Poland’s constitutional tribunal ruled that some of the EU law isn’t compatible with their constitution.

Technically:

The euro rose against higher yielding currencies like the Polish zloty and Hungarian forint yesterday, and is back over R17.00 against the rand. Staying above this level may see a retracement up to R17.21/€. If we close today under R16.93/€ then we can expect to remain under R17/€ and see lower levels next week.

UK MARKETS

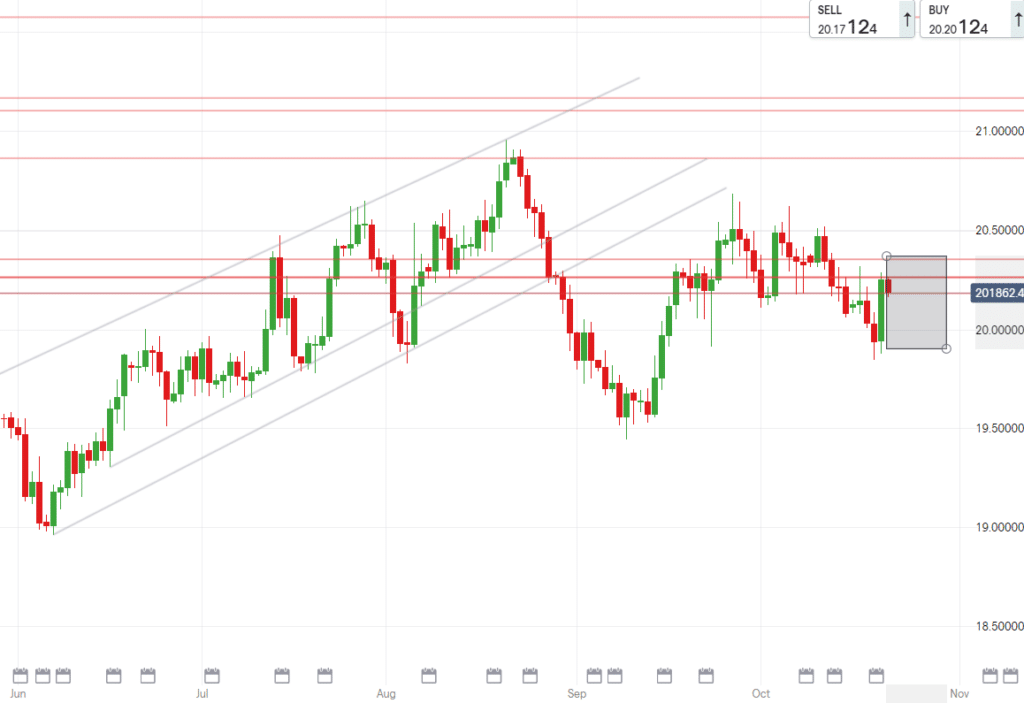

The British pound underwent selling pressure this week thanks to softer than expected inflation data mid-week.

The pound managed to wiggle it’s way out of this loss of ground as mood remains above a 70% chance that the Bank of England will raise rates in November and possibly again in December.

This aggressive policy is putting the pound on the front foot against it’s major peer the dollar, with whom the possibility of a rates increase isn’t as certain as the UK.

The pound remains vulnerable to adverse news from Brexit-related events which can always unsettle the Sterling.

However in absence of such news, the only conflict in pound strength is the looming restrictions in the kingdom due to high daily averages of over 40,000 cases.

Technically:

GBPZAR gained 40cents yesterday as optimism over raising rates in the UK pushed the pair from a low of R19.87/£ up to today’s levels of R20.20/£.

If the pair maintains it’s current support then it may test R20.35/£ – R20.45/£, should the GBP manufacturing data later today be positive along with any comments about raising rates by BoE officials come about then we can expect this Pound strength to endure. If risk appetite improves then we can possibly revisit R20/£.

Technical levels we are watching for the upcoming week:

USD/ZAR

- High – R14.90/$

- Support – R14.58/$

- Low – R14.40/$

EUR/ZAR

- High – R17.25/€

- Support – R17.00/€

- Low – R16.82/€

GBP/ZAR

- High – R20.25/£

- Support – R20.08/£

- Low – R19.90/£