A faltering dollar lost strength off of tapering fears, while a global commodity boom played to the rand’s advantage this week.

USD/ZAR News

The dollar’s week began on a somber note with the Memorial Day holiday, range bound movement kept USDZAR hovering around R13.70/$ for two days.

This somber start didn’t last as the markets saw a surge against the dollar with fears of a thinning out in the US Fed’s contentious approach to monetary policy and expectations that their interest rates will stay lower for the foreseeable future.

A low interest rate is advantageous for the rand as investors benefit from the differential when borrowing at low interest rates and investing in assets that provide higher rates of return – this is called a carry trade.

This goes hand in hand with the growth in the commodity market which further plays in the rand’s favor and not to the dollar.

The greenback suffered multi-year lows this week but market players eagerly await the employment data which showed promise on the indication yesterday that saw initial jobless claims decrease by 20,000.

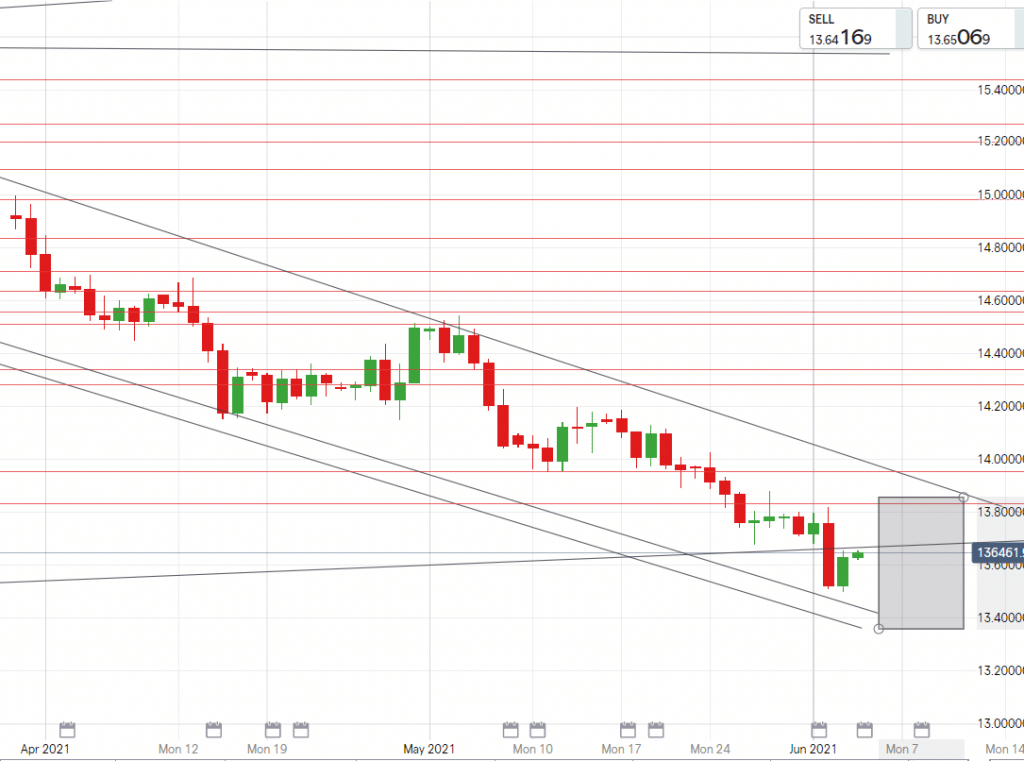

Technical direction forecast:

Breaking below R13.80/$ opened a path for USDZAR to play in lower ranges.

By testing the low of R13.50/$ in midweek gives the pair impetus to test R13.35/$ in the near future.

A retracement will certainly see the dollar tick upward given that there is now a shortage of dollar positions with traders awaiting todays data. Breaking above R13.80/$ convincingly would signal higher levels for the days ahead.

EUR/ZAR News

Despite economic damage caused by lockdown in Europe, surveys show that citizens believe the health benefits outweigh the damage done economically – including affects to personal income.

ECB President Lagarde has supported the feeling that strong stimulus and policy support will be needed to get through the pandemic and initiate a economic recovery.

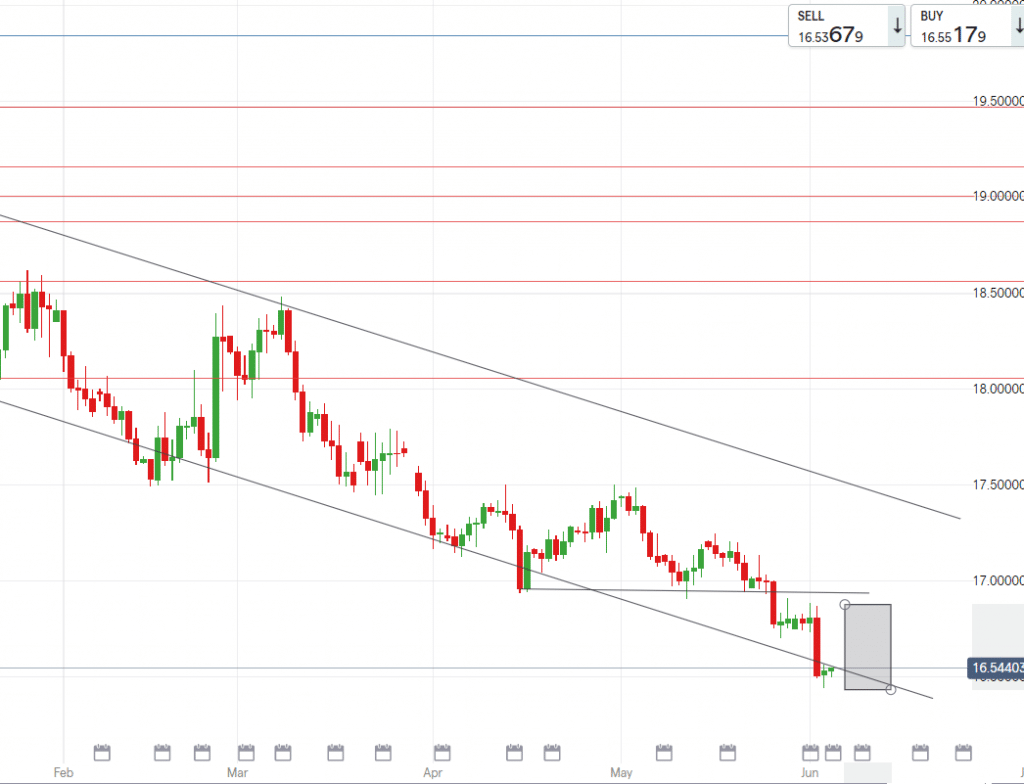

Technical data forecast:

EURZAR is testing outside of our 6-month downward channel but is likely to see an upward retracement up to R16.65/€. With an expected weekly range between R16.43/€ and R16.80/€.

GBP/ZAR News

Global tourism advisors have cited that the United Kingdom risks being overly isolated as it keeps international travel closed to many banned nations. Restrictions are seeing flight plans from selected tourists to the UK either cancelled or delayed, thus reducing the UK’s competitive edge in tourism yields.

Fears are that restrictions may only increase due to worries over the so-called Indian variant.

Technical direction forecast:

The GBPZAR pair remains above R19.10/£, breaking this level will signal a path towards R19.06/£ and then possibly R18.91/£. The GBPZAR is ticking up this morning as it corrects the large loss of ground suffered in recent days.

South African Rand News

The rand rallied this week to gain over 2% against the majors, strength was sustained from several factors including : dollar weakness due to Fed expectations and inflation worries, signs of a global recovery thus pushing investors into riskier currencies, spurring of the commodities markets which favored SA due to our rich possession of such materials and emerging market strength off the back of US interest rates.

Despite SA releasing data of record breaking unemployment levels this week, a faltering economy and continuing issues in the power sector – the rand remains gaining ground and seeing beneficial rates for importers. Current threats to this rallying is a turn in dollar data and investor sentiment as well as a slow local vaccination campaign causing a rebound in coronavirus waves.

USD/ZAR

High – R13.85/$

Mid – R13.60/$

Low – R13.36/$

EUR/ZAR

High – R16.88/€

Mid – R16.60/€

Low – R16.40/€

GBP/ZAR

High – R19.70/£

Mid – R19.45/£

Low – R19.05/£