Risk-On Appetite Spurred The Rand To Year Best Levels This Week.

Will This ZAR Strength Last As Our Countries Negative Realities May Be Exposed In Next Week’s Budget Speech.

USD/ZAR News

The dollar’s negative storyline continued this week as the traditional safe haven currency lost major ground.

The week began with markets closed for Presidents Day in the US, this saw thinner liquidity and lower appetite play against the greenback.

Possible factors behind current dollar weakness includes prolonged pressure from former President Trump’s impeachment trial, consistent worry of the US job market and blemished confidence in a global recovery.

Soft data and indicators are showing market players that the recovery in the US is and will remain unsteady, pushing them away from this buckling power currency and into risk-on emerging currencies.

A tender dollar is anticipated to persist as long as questions remain over a recovery worldwide and thus monetary policy changes follow with associated inflationary constraints.

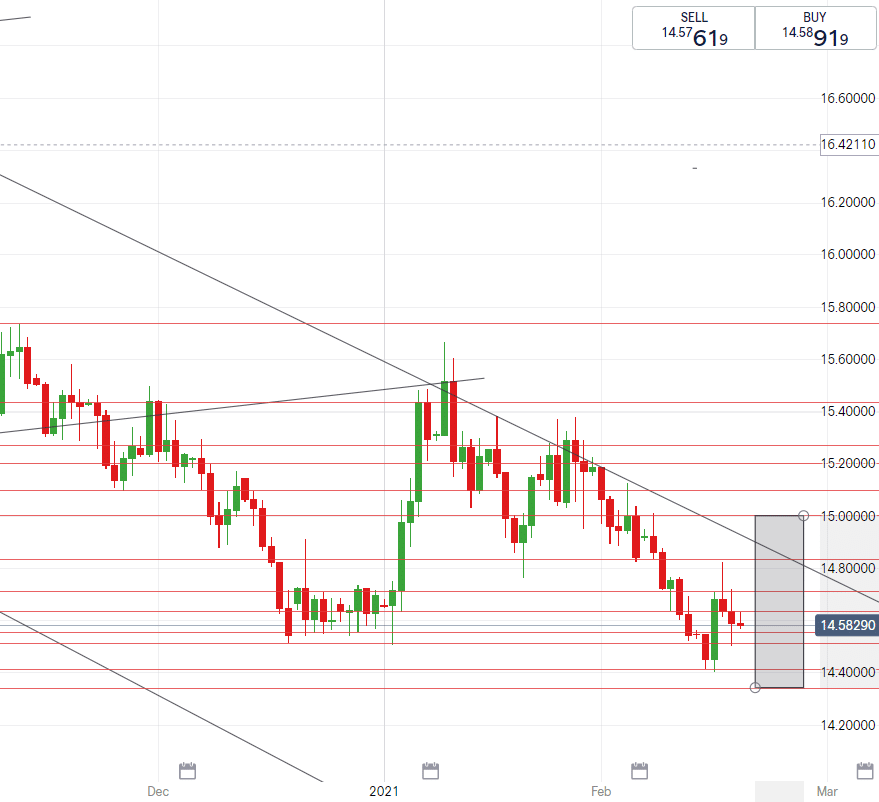

Technical direction forecast

Expectations remain for the dollar to remain weak in the long term, as it has done in the past during times of global economic recovery.

We failed to break below R14.40/$ this week however expect that this line may be retested as we remain under R14.65/$.

A key event linked to the movement of USDZAR will be Wednesday’s budget speech, as a result of this we are keeping the forecasted highs at R15.00/$ – an unlikely break beyond this may see a 100% retracement back up to R15.40’s.

EUR/ZAR News

Increased vaccinations and decreased coronavirus infections continues in the eurozone.

The economy still requires stimulus and market participants expect injections of support to arise from next month onward.

The G7 partners meet today and 3 EU countries will be involved, the partners are set to pledge aid and plans to tackle the current global health and economic crisis.

Much attention lies on Italy’s new Prime Minister Mario Draghi who is expected to have a ‘whatever it takes’ approach, hopes lies upon Draghi to take Italy out of disaster.

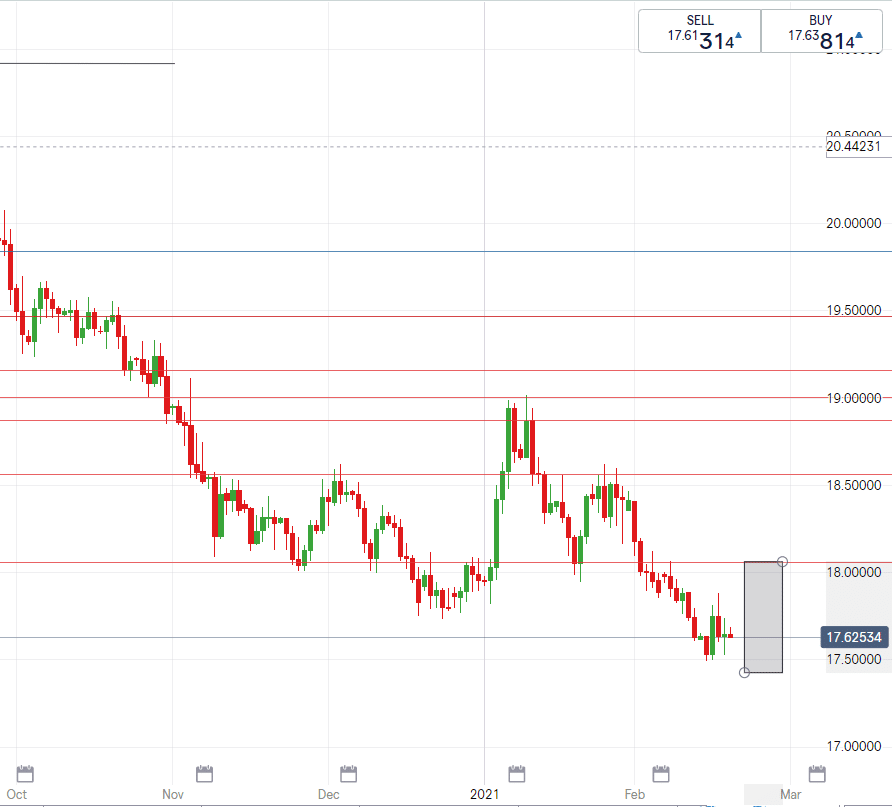

Technical direction forecast

The euro saw year long lows on EURZAR as we touched R17.49/€ on Tuesday.

Looking ahead, we remain in arms length of this support level, we might range within a tight spread until a break higher or lower occurs.

Support will likely be found around R17.70/€ and possible lows of R17.45/€ before Wednesday afternoon.

GBP/ZAR News

Despite the UK economy contracting almost 10%, the most in more than 300 years, the British pound surged the most in a month.

The pound remains resilient finding support in progress from Brexit and the aggressive vaccination roll outs in the UK.

Taxes may have to be raised soon in order to find more funds and implement fiscal reforms.

There remains little to cheer on for UK data as many British families and businesses experience hardship and focus will loom to see if the UK can build off of the growth that was seen in the last quarter of 2020.

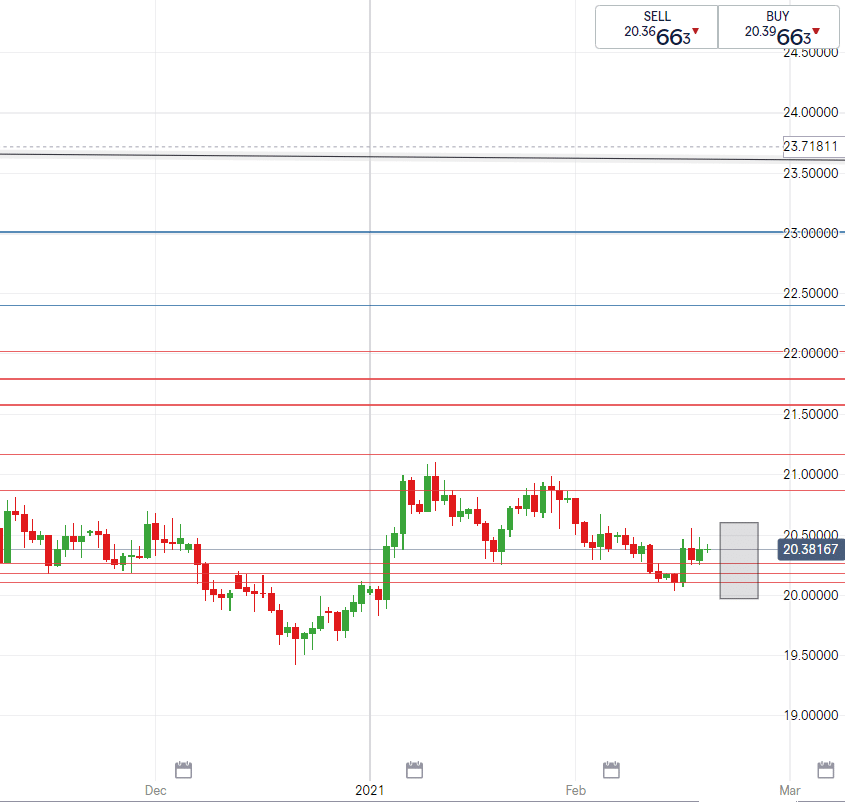

Technical direction forecast

For the week ahead we forecast roughly a possible 65cent range on GBPZAR.

With ranging around R20.30/£ probable, we await to see if we can break R20.00/£ on the stable pound.

In the opposite scenario, should we break upward, a R20.60/£ may be on the cards in the event the rand weakens after the budget talk.

South African Rand News

The rand turned 60 years old this past weekend, this turning of the age came hand in hand with a turning of the tides for emerging markets.

We kicked off our Monday having broken below a strong support level of R14.50/$ as the rand continued its rally this week – these said levels were the best we have seen since pre-lockdown.

We saw a stumble in the rand’s surge once strong data was released in regards to US treasury yields and US retails sales, pushing the USDZAR to R14.8250/$.

Our downward move was worried to be a bubble waiting to burst once market players locked in their profits and withdraw from the rand.

Beyond the events of past days, we focus ahead to Wednesday – will the budget speech reap better than expected fruit or contain the brittle plans and little action of past.

A good budget speech should maintain the ZAR at our current levels, however a negative talk may see a shift up to higher rates.

USD/ZAR

High – R15.05/$

Mid – R14.70/$

Low – R14.34/$

EUR/ZAR

High – R18.06/€

Mid – R17.70/€

Low – R17.43/€

GBP/ZAR

High – R20.61/£

Mid – R20.30/£

Low – R19.96/£

FX Paymaster is the smart, easy way to transfer money abroad.

Register here for a free demo to live account today for access to our world class online payment platform.

CLICK HERE FOR A FREE DEMO TO LIVE ACCOUNT