OVERVIEW

This week saw 2 events impact the rand – US retail sales data and the SARB MPC meeting.

The dollar is on it’s way to a 2nd week in the green, keeping the rand on elevated levels.

sa markets

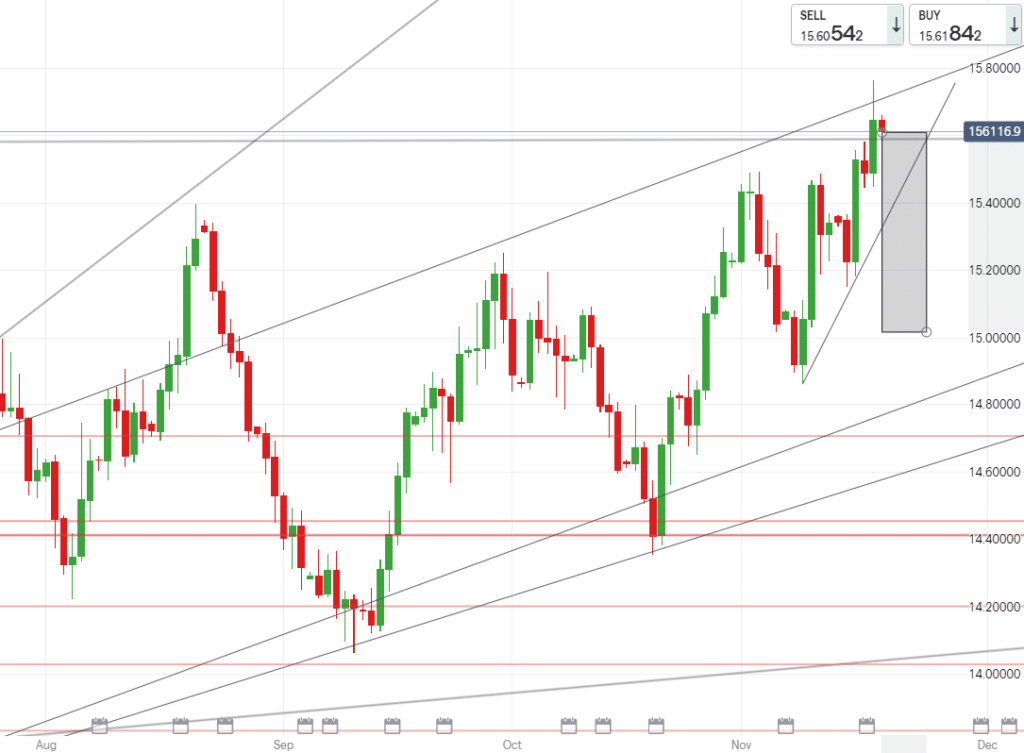

We posed the question in our Wednesday daily market report – ‘Dollar surges, is R15.75/$ next?’, and yesterday that question was answered with an impulsive yes.

The rand weakness we have been seeing was set up off of the inflation scare early in the week, dollar strength then piled on after positive US retail sales data and the latest push upward occurred after our SARB interest rate decision yesterday.

The SARB MPC meeting statement saw Reserve Bank Governor Lesetja Kganyago speak on projections for the economy which some would consider optimistic.

The meeting statement reflected minor revisions down in growth projections but “healthy” moves of growth are expected in the next 2 years.

Ultimately as a result of the local and global current and forthcoming conditions, the decision was to hike the interest rate by 25 basis points.

This hike is expected to have a negligible effect on consumers but further hikes are expected in the next 3 meetings scheduled for next year.

The USDZAR surged almost 20cents after the decision seeing a high of R15.75/$ then settling to a close of around R15.64/$.

Furthermore, emerging markets aren’t having a positive run with debt issues still plaguing China’s Evergrande and the Turkish Lira collapsing to an all time low with Turkey’s inflation near 20%. These events will not support the rand and add worry over emerging market currencies, pushing market players away from the rand.

What to expect next week :

Emerging markets are facing stronger waves as global economic financial policies tighten, investors may now move to the majors as expectations are building for rate hikes in the advanced nations due to inflation. Supply chain issues and higher oil costs are likely to keep emerging countries under pressure. While lockdowns and restrictions are also slowly creeping onto the global stage, which normally causes anxiety and forces investors into safe havens like the dollar.

EUROPEAN MARKETS

The euro fell against it’s major counterparts this week with pressure pushing the bloc currency down 0.7% while bidders ran to the dollar.

Economic data in the EU is not providing the confidence for investors that they are seeking.

Until better than expected figures and more aggressive policy surfaces, the euro will remain under pressure.

With the dollar making moves in policy and fundamental data, the euro has been unattractive for buyers but still remains strong against a emerging currency basket, including the rand, which is under turmoil.

Technically:

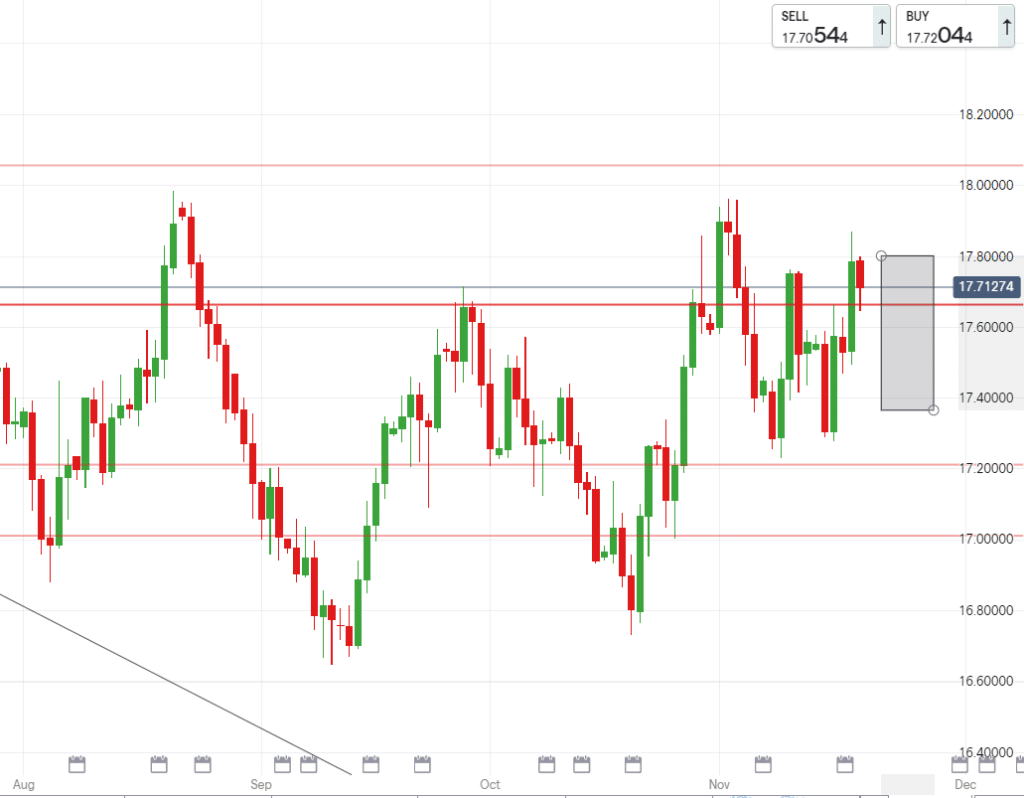

Movement on EURZAR fell well within our range for the last week, until yesterday’s surge rose above resistance lines.

Looking to next week we expect settling down with a low of R17.40/€ on the cards with a support of R17.55/€ needing to be broken before seeing a move downward.

UK MARKETS

Consumer confidence in the UK rose slightly for the first time since July, with holiday season approaching these figures are likely to maintain positivity. UK employment also rose by 160K in Oct and this pushes mood that rate hikes are on the horizon and thus this would support the pound.

Adversely, the UK administration was largely against reinforcing restrictions but at the last minute have seemed to reconsider that sentiment as numbers spike and the Kingdom experienced its highest daily infections rate in a month. Boris Johnson stated that he is seeing storm clouds gather over Europe.

The pound isn’t under as much pressure as the euro, with positive data on its side – but Brexit uncertainty and rising pandemic numbers will be the Sterling’s remaining challenge.

Technically:

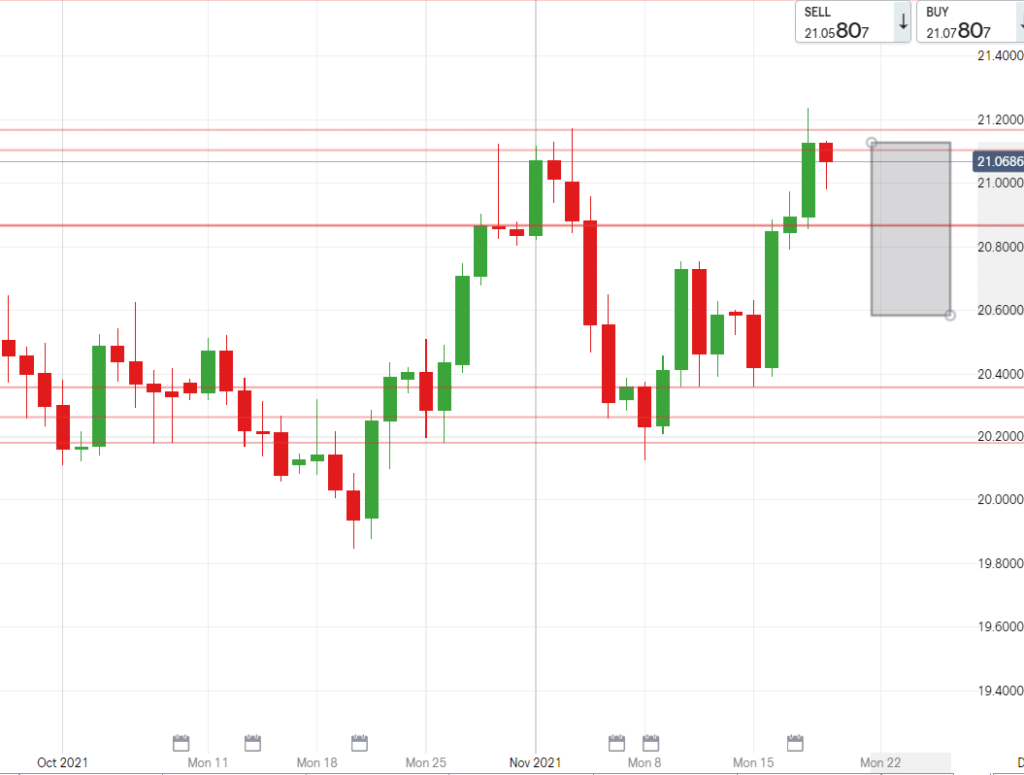

Rising above R21.00/£ means the GBPZAR pair needs to break R21.00/£ and R20.88/£ before we can see relaxed levels. The pound strength is losing momentum and although a large shift down isn’t on the cards yet, the pair may see a pullback before it’s next big move.

USD/ZAR

- High – R15.60/$

- Support – R15.35/$

- Low – R15.05/$

EUR/ZAR

- High – R17.80/€

- Support – R17.55/€

- Low – R17.30/€

GBP/ZAR

- High – R21.12/£

- Support – R20.85/£

- Low – R20.65/£