Dollar weakness and positive local data allowed the rand to push near 30 month lows, but is it oversold and setting up for a bounce up?

USD/ZAR News

In the week past the dollar saw significant losses as the Fed’s unaggressive policy remained in tact as officials reiterated that policy will not change until growth is evident in the economy.

Furthermore by easing investor worries over inflation, this gave markets breathing space to approach risky high-yielding currencies such as the emerging markets.

Gold benefited from becoming the safe haven of choice this week over the dollar, however bullion is slowly dropping back to around the $1900 mark as the dollar begins to rebound slightly.

Factors that may see the dollar regrouping include President Biden tabling a $6 trillion budget, US-China trade talks and better than expected jobless claims data. Should today’s inflation data be positive then the dollar will strengthen.

Technical direction forecast:

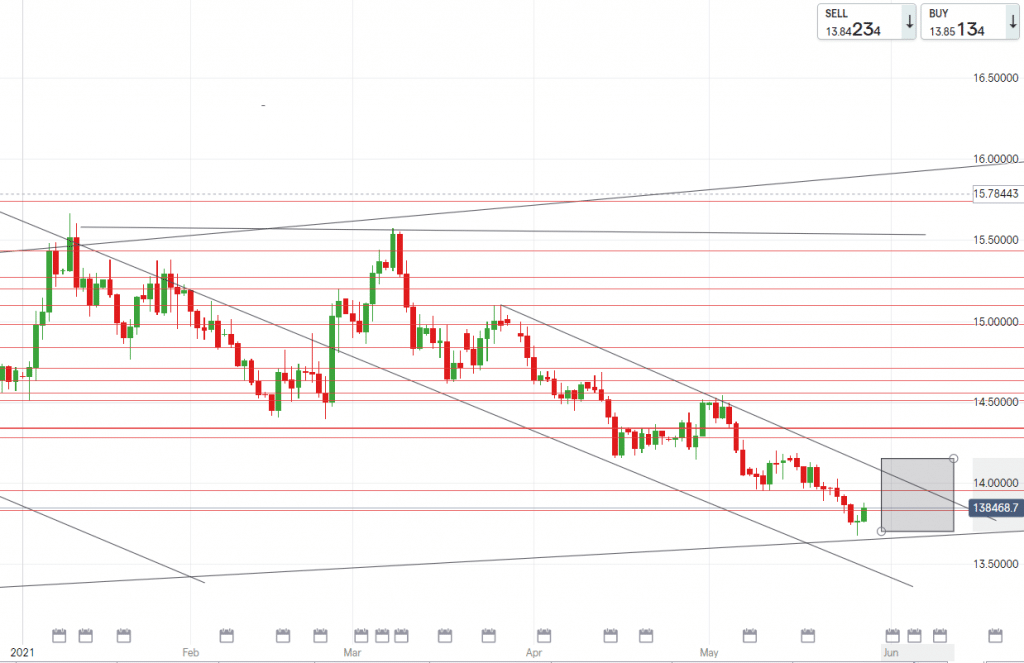

An unexpected break below R13.85/$ on USD/ZAR saw the pair reach 28 month lows of R13.67/$.

As much as this places the pair in a position to retest lows and possibly break supports, the pair is vividly oversold and we feel will see a retracement back up near R13.90/$ – especially if the dollar continues posting good data.

EUR/ZAR News

The Eurozone is expected to see an improvement in business confidence as trade data improves.

The ECB officials have noted that halting support at this stage would be too premature and that the short term outlook of the economy is showing promise.

The pandemics effect still remain over the eurozone as the bloc now needs to channel efforts into debt-reduction.

Technical data forecast:

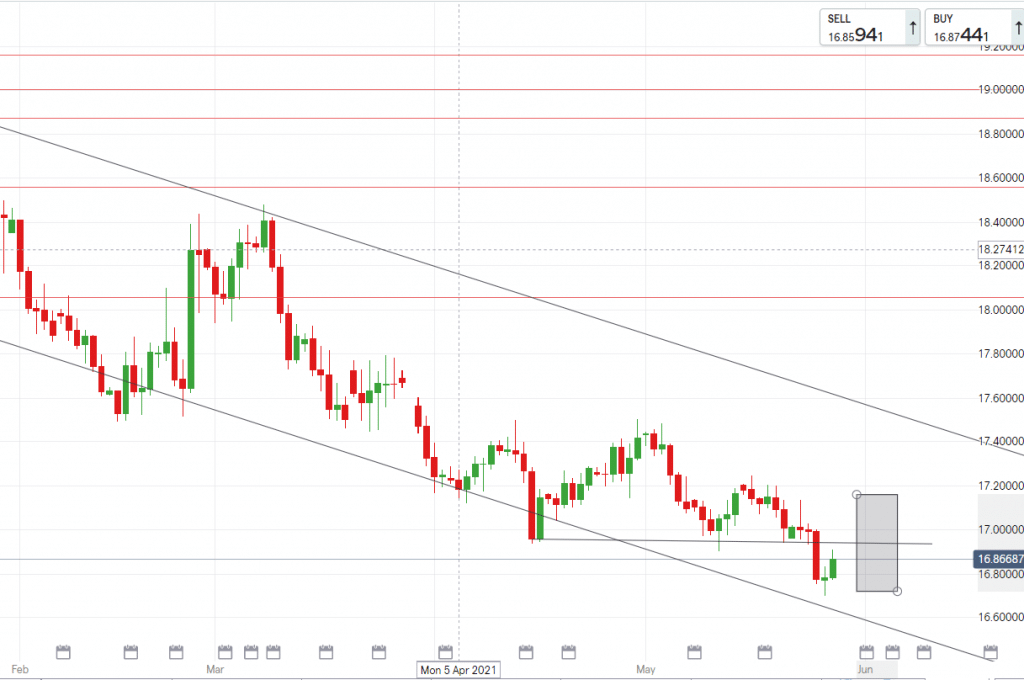

EURZAR dropped almost 50cents to see a low of R16.69/€ yesterday.

However the pair is on its way to retest R16.90/€ today and possibly find support around R17/€ in the coming week.

GBP/ZAR News

Bank of England officials have said they recognize the price pressure as a result of supply chain forces.

Due to this the officials will monitor the inflation in their economy but expect no rise linked to the above pressure. Consumer confidence in the UK reached a 3 year high and current expectations of future rate hikes from the Bank of England is supporting the pound after an official mentioned that increases may occur sooner than anticipated.

Technical direction forecast:

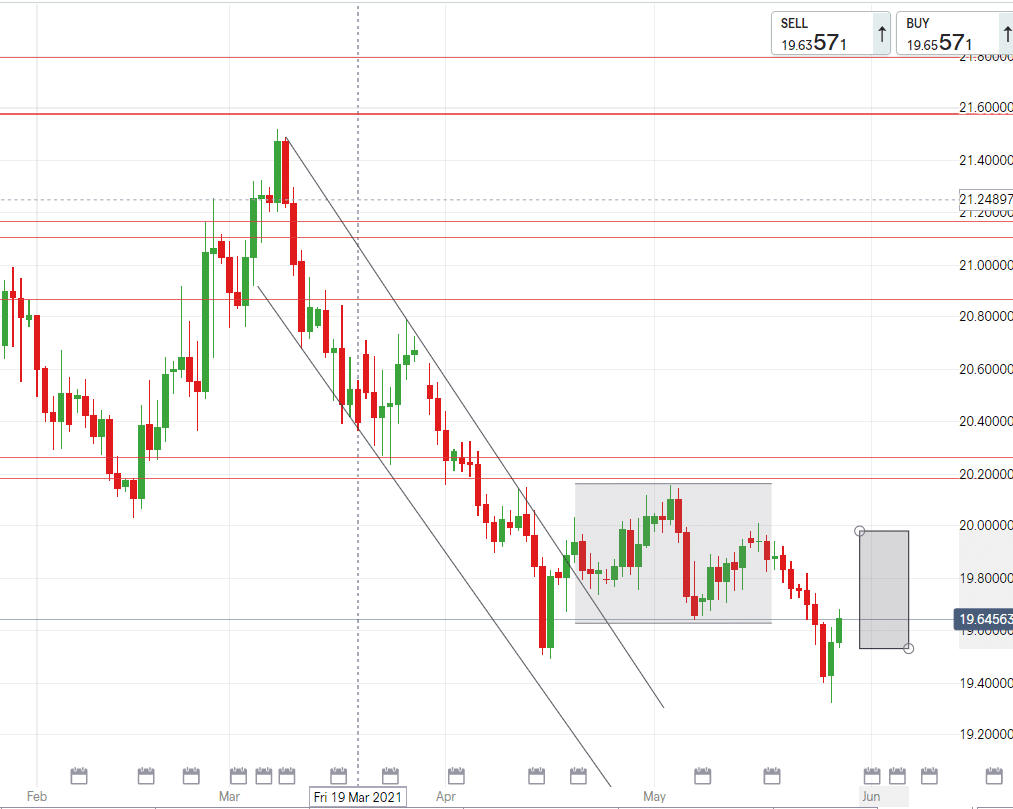

The GBPZAR pair is headed towards R19.70/£ after recovering from this weeks lows. We expect GBPZAR to test a support around R19.86/£.

South African Rand News

Importers benefited this week from the rand’s rally as it outperformed and tested lows last seen in 2019.

Risk appetite and a weak dollar gave our currency impetus, however this is likely to be short lived as the currency is deep in oversold territory and the dollar is setting up to see a stronger run next week after their Monday holiday.

Yesterday the SARB Financial Stability Review highlighted the issue of record breaking high debt in our economy. in the short term we are seeing minor recoveries however the long term is deteriorating with damage to our tourism industry and no clear path to bridging the gap in debt-to-growth ratio.

USD/ZAR

High – R14.15/$

Mid – R13.85/$

Low – R13.70/$

EUR/ZAR

High – R17.16/€

Mid – R16.99/€

Low – R16.70/€

GBP/ZAR

High – R19.98/£

Mid – R19.80/£

Low – R19.53/£