OVERVIEW

Dollar fluctuates off of speculation this week and the Bank of England surprises with it’s first rate hike in 3 years.

The rand remains hostage to investor sentiment and pandemic progress.

sa markets

The dollar was boosted off of expectations and rumours until Wednesday, hitting a high of R16.27/$.

US Fed talk anticipation helped the dollar surge to said highs before the magic of rumours wore off and saw the dollar close with losses for 2 consecutive days.

The US Fed stated that it would taper it’s stimulus by $30 billion each month and will have 3 rate hikes of 0.25% next year.

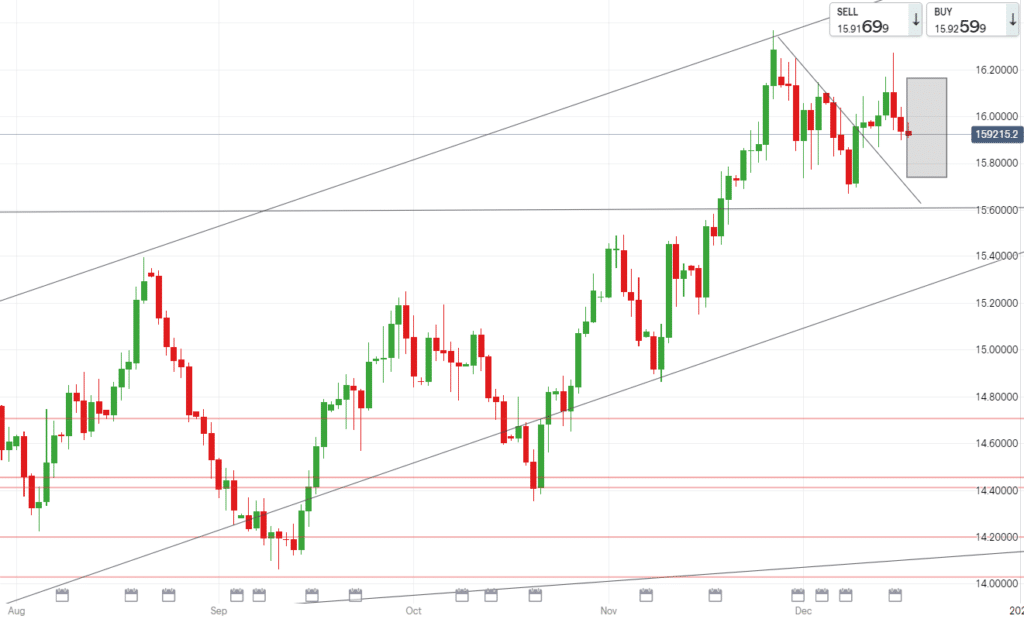

These comments steadied the dollar and should USDZAR lose another day of gains while remaining below R15.95/$ then R15.85/$ will be on the cards.

What to expect:

We are approaching the last few days of the year and traditionally stocks are expected to rise in the last 5 days of the year and the first 2 days of the new year – this period has been dubbed the Santa Rally by analysts.

Given that all major economic events are done for the year, price action will be driven by the progress of the pandemic and risk appetite.

Technically:

Breaching a low of R15.85/$ would be great for importers, opening the floodgates to R15.75/$ and R15.60/$, risk appetite would have to spike for this move to occur. Given the volatility of Omicron’s spread, the tides could turn quickly and see USDZAR pushing above R16.05/$ once more. We expect a high of R16.16/$ if the dollar regains its balance.

EUROPEAN MARKETS

After Wednesday’s US Fed rate decision, the EU markets shifted focus to their own central bank decision.

The European Central Bank advised they would begin slashing pandemic emergency funding, but promised to continue stimulus support for the economy into next year. President Lagarde noted that it’s unlikely rates will be hiked in the EU next year.

The cutting of emergency funding strengthened the euro slightly on Thursday, pushing EURZAR up to a high of R18.17/€ yesterday.

Markets seemed to have calmed off of the central bank talk, noting EU data saw a weakening in manufacturing and service activity.

Business confidence is also expected to weaken which may push the pair under R18.00/€ despite a bearish bias for the euro.

Technically:

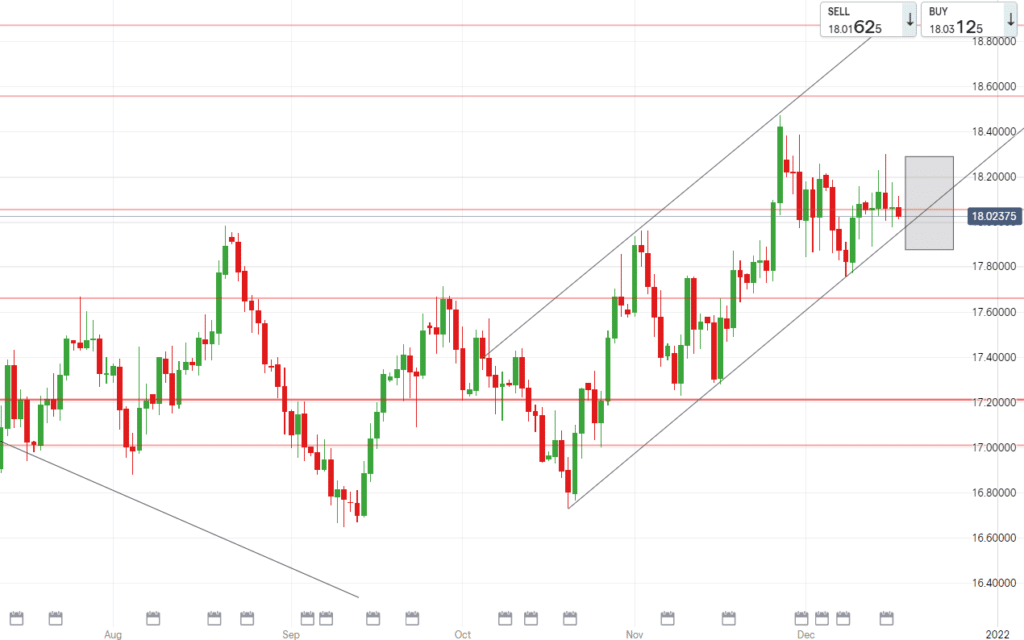

EURZAR fell spot on into our predicted range for this past week, ranging between R17.87/€ and R18.30/€. For next week we can expect price action to be centred around the R18/€ mark, while staying tethered within our channel on the below graph. Breaking out of the channel below R17.99/€ would lead the pair to see lows of R17.88/€, while a bounce off the bottom channels line will likely see the EURZAR retest R18.20’s. The euro remains trending upward but price action may dwindle next week due to holidays.

uk markets

The Sterling had the biggest surprise of the week, in the form of the Bank of England being the first of the major nations to hike rates.

The BoE stated they would action their first rate hike in 3 years from current record lows of 0.1% to 0.25%.

This unprecedented move is attributed to the high inflation which the BoE felt it had to take action against – UK Consumer Price Inflation rose to a 10-year high of 5.1% in November, increasing the risk of stagflation (a dreaded mix of weak growth and elevated prices).

The shock rate hike pushed the pound upward by 0.5% and saw GBPZAR test bear 21.40/£ yesterday before markets calmed down.

Hiking rates before the US puts the pound is a stronger position than the USD but this will be temporary with the rate hike being minor and investors will soon shift focus to digesting this mornings UK retail sales data.

Technically:

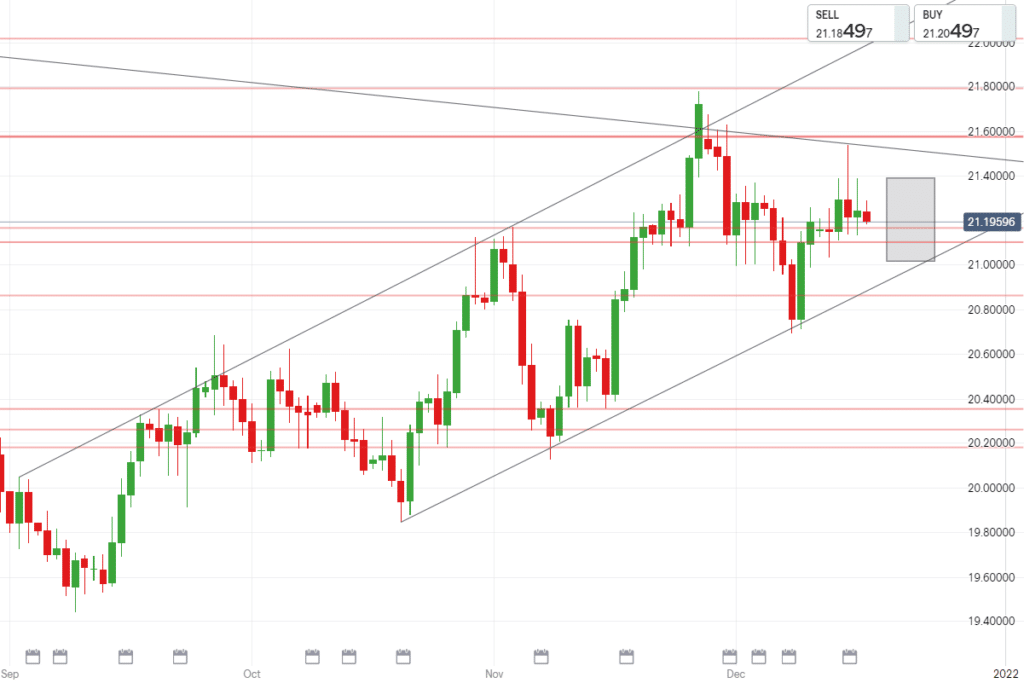

The GBPZAR remains strong supported above the levels of R21.10/£ and R21.16/£, both of these levels would have to be convincingly broken before we can expect to see pound-rand relax to rates around R21.01/£ – which would leave the pair touching the bottom of our channel on the below graph.

We don’t foresee the pound breaking R21.50/£ before year end but should remain strong until reversing below R21.10/£.

Technical levels we are watching for the upcoming week:

USD/ZAR

- High – R16.20/$

- Support – R15.92/$

- Low – R15.73/$

EUR/ZAR

- High – R18.25/€

- Support – R18.00/€

- Low – R17.85/€

GBP/ZAR

- High – R21.40/£

- Support – R21.20/£

- Low – R20.95/£