OVERVIEW

Markets saw investors move into the dollar as China’s Evergrande was proven not too big too fall this week.

Volatility expected as the rand prices in the US FED meeting and braces for local SARB meeting later on.

SA MARKETS

The Rand is still seeing a decline and is trending on the weaker side for the 3rd consecutive week in a row after a two week High.

Markets all over the globe have taken a huge hit due to the Evergrande debt scare in China which has resulted in the dollar strengthening and becoming the current “safe haven” currency.

Evergrande has made their first payment but it’s uncertain if they will be able to pay the next, the volatility of the rand is also very much dependent on how yesterday’s Fed speech is digested by markets.

The Fed has kept their interest rates near zero but have indicated that the tapering of bond buying will likely come in November.

US FED Chair Powell also indicated that interest hikes would be coming soon in tandem with the approaching reduction of asset purchases.

What to look out for: Locally, the SARB will announce our interest rate decision later today and this will be a key factory for the Rand.

It has been speculated by analysts that the interest rates will most likely still remain unchanged.

With unemployment being one of the key factors that contribute to the economy, and our high unemployment due to Covid-19 together with the unrest that happened a few months ago will keep the repo rates unchanged at current historic lows for the time being.

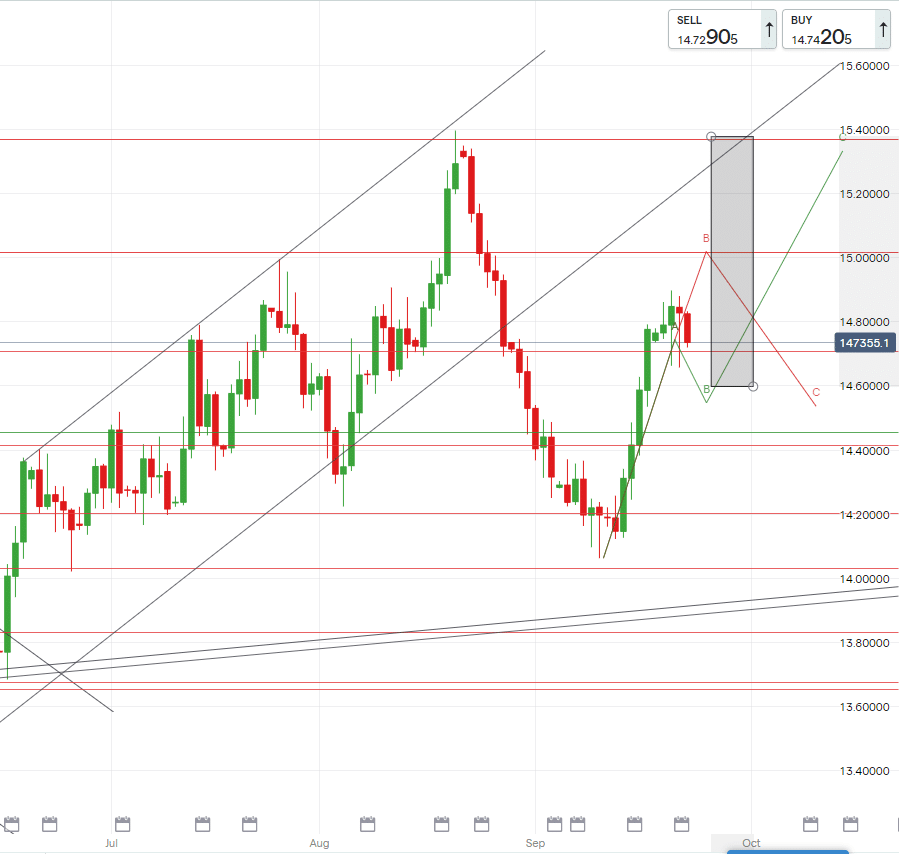

Technically – The dollar seems to have priced in the US Fed announcement given that USDZAR has stayed virtually unchanged. The pair remain ranging around the strong level of R14.70/$ as we await a breakout, if a calm comes to investors then risk appetite may boost the rand.

For the time being USDZAR would be set on testing R15.00/$ in the coming days given that the pair has been moving over resistance levels.

EUROPEAN MARKETS

With the emerging markets being heavily affected by China’s ongoing changes and surprises, the eurozone’s consumer prices have improved.

The euro is also trending on a downward channel against the dollar.

The ECB governor has stated that increasing the asset purchase programme might not be the best thing for the EU so there is definitely some uncertainty there. It as also been said that the EU wants to reach a conclusion on Brexit issues by the end of the year.

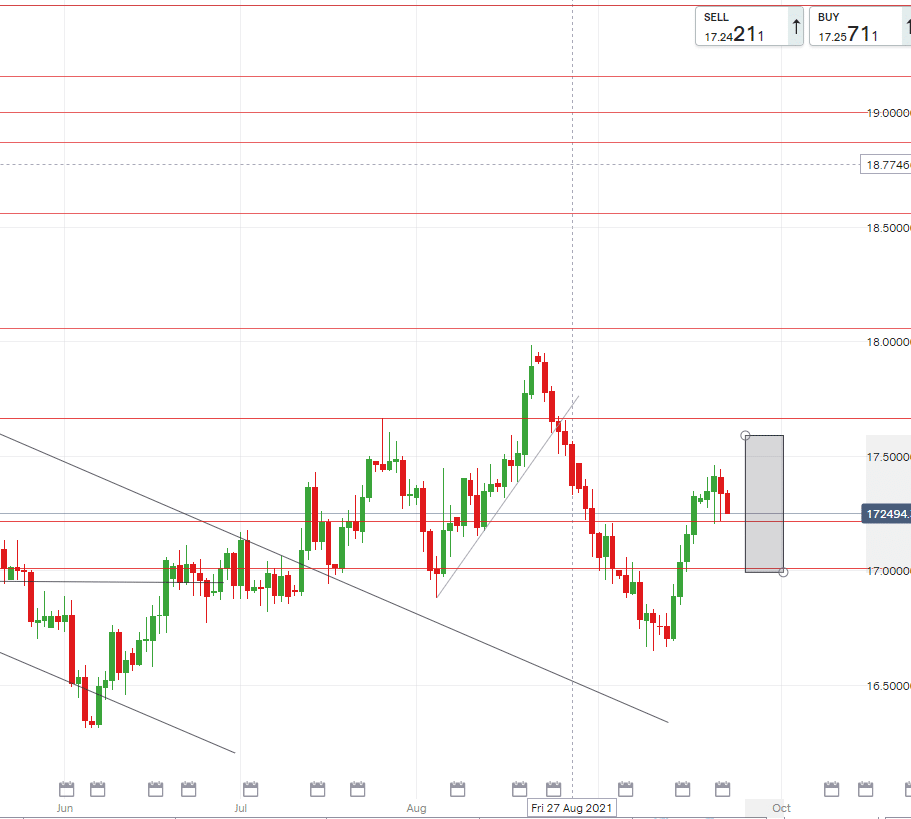

Technically – EURZAR is still in a downward move when we look at the weekly time frame, however current movement is more ambiguous on the pair. Bias seems to be tracking towards a high of R17.60/€, EURZAR will likely remain above R17.20/$ unless rand strength occurs from global events.

UK MARKETS

The UK interest rate decision has become much of a debate, as there is speculation on whether the kingdom’s interest rates will increase.

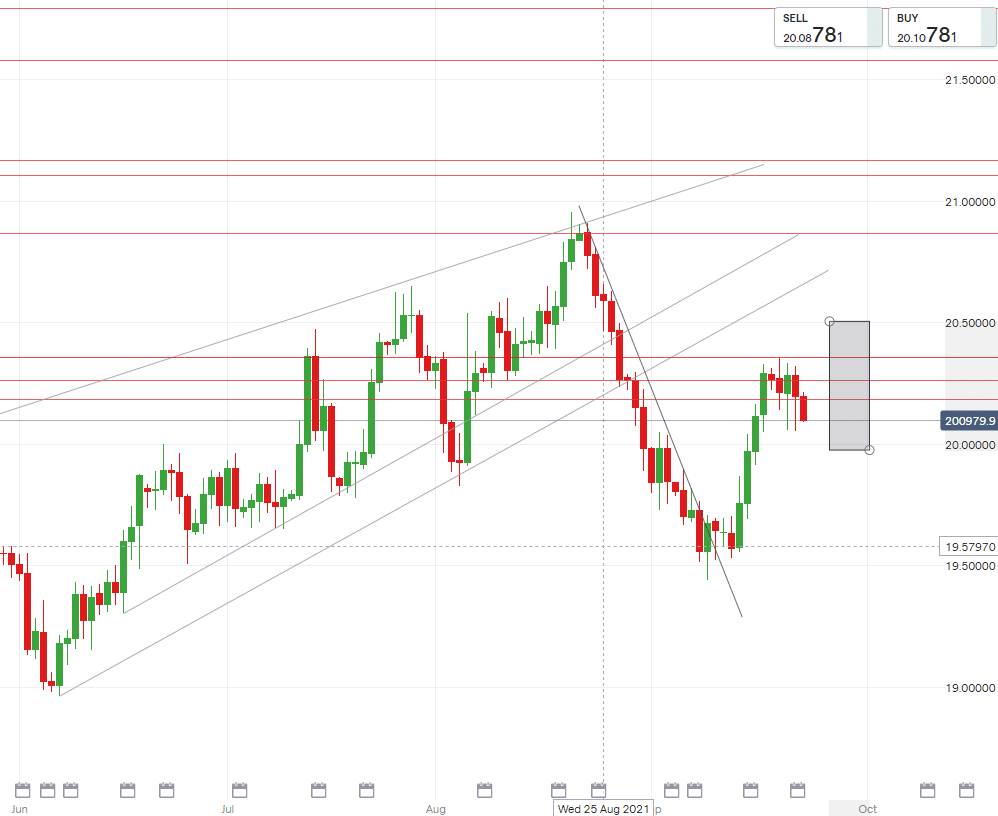

We could be seeing an extension of a downward trend for GBP/ZAR early next month. Short term however, if the dollar and rand keep trading as it is, we might see an increase in the pound.

The Pound is currently stronger than the rand and gained 2.69% against the rand last week.

We are assuming that the GBP/ZAR will reach R20.50/£ in coming weeks, this will also be dependent on the markets reaction to Boris Johnson’s latest speech to the United Nations.

The UK PM stated that “it’s time for humanity to grow up”. He is concerned about the climate changes in the globe and urged UN leaders to take charge and commit to major changes that might deter or delay the global warming crisis.

Technically – GBPZAR remains over R20.00/£ which means that the possibility to see sustained higher levels is still on the cards.

Should the pair possibly break R20.35/£, then we should expect to see R20.60/£ in coming weeks.

Technical levels we are watching for the upcoming week:

USD/ZAR

- High – R15.37/$

- Support – R15.00/$

- Low – R14.58/$

EUR/ZAR

- High – R17.65/€

- Support – R17.21/€

- Low – R17.00/€

GBP/ZAR

- High – R20.52/£

- Support – R20.30/£

- Low – R19.99/£