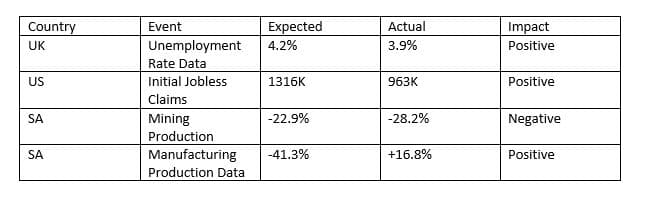

In our weekly round up this week, we look at some important data released and the affect this has had on the currency market.

USD/ZAR

The Dollar has had an active week – having seen highs of almost R17.80/$ and lows of R17.33/$.

Initial Jobless Claims fell under 1 million of the first time in 6 months, indicating momentum returning in the job market however stimulus in the economy is still being called for with unemployment still staggering at worrying levels.

Congress has been in a stalemate on an additional stimulus package, seeing a consensus being reached would be dollar positive for the week ahead.

EUR/ZAR

Economic sentiment on the EUR increased – gauging in at 64 this week, eluding to a positive view from analysts and investors.

Industrial production in the Eurozone fell on a yearly and monthly basis, however the drop was not as much as expected.

GDP data for the EUR is to be released this morning with expectations being that a -15% contraction was to be seen.

GBP/ZAR

The Pound Sterling has shown off gains this week, boasting strength despite UK GDP shrinking 20.4% on a quarterly basis.

As shocking as this figure was to market players, the forecasted figure was -20.5% and thus GBP was relatively unmoved by the horrid data.

On a monthly basis, for June the UK economy expanded positively by 8.7%.

South African Rand

August stayed true to its reputation again this week with volatility being profuse.

Women’s day began the week with USDZAR seeing 3-month high of R17.78/$.

Gold broke $2,000 last week but this week saw a retracement down from $2,076.00 all the way to $1,862.90 per ounce.

SA gold production fell by -17%, better than the expected -35.2%.

Furthermore, local retail sales were down on a month-to-month basis by 68.7%.

The cherry on top being Eskom restarting load shedding this Thursday.

Much anticipation rests on President Cyril Ramaphosa to announce an easing in lock-down restrictions, industries are expecting alcohol and tobacco bans to be lifted however hopes are being contained before an actual confirmation is given.

We have put out some levels to watch for the week on the currency pairs listed below.

We have moved into a sideways range for the USD/ZAR pair, this kind of lateral trend can precede a breakout. We are watching a top range between R17.39-17.80/$ and a possible lower range between R17.20/$ – R17.40/$.

|

EUR/ZAR – Easing Expected After Impulsive Move Upward.

· Support – 20.20 · High – Around 20.65 |

|

GBP/ZAR – Sideways Range Expected To Form Before Gradual Move Down. · Support – 22.45 · High – Around 22.85 |

Feel like getting this on a daily basis? Why not sign up for your free business account and enjoy low transaction fees and awesome service!

Click here to register for free