overview

The Dollar has suffered big losses after The Fed raised interest rates by an expected 75 basis points and the U.S economy contracted for the second quarter all while a recession looms.

U.S AND SA MARKETS

It has been quite an eventful week for the U.S as they had their interest rate decision on Wednesday as well as their GDP data released yesterday.

The Fed delivered its second 75 basis point interest rate hike which was most likely priced in to the markets. Fed Chair Jerome Powell indicated that the central bank could slow down the pace of its rate hikes if there is proof that the 225 basis points of hikes so far has had an impact on the sky high inflation in the country. The Fed was rather dovish and investors were not impressed with this seeing that the Dollar has lost more ground after The Fed announcement. It is expected that the Fed would deliver a 50 bps interest rate hike with next meeting in September and not a third 75bps interest rate hike. However, it is important to note that the Fed is very data dependent and we will wait to see how they react to the GDP that was released this week plus further jobs data.

The U.S saw a contraction in the second quarter and the annualized GDP fell by 0.9%. This is the second consecutive quarter where the economy has shrunk. Back-to-back quarterly growth contractions are signaling that an economic recession is around the corner. The White House is dismissing talks that the economy is already in recession and President Joe Biden has noted that the record job growth and foreign business investments are signs of strength and growth in the economy, he said that doesn’t sound like a recession to him.

The South African Rand has been doing extremely well in the markets since the SARB interest rate decision which has supported the Rand very well this week. Gold, which moves inversely to the Dollar has seen its strongest days after the Fed was rather dovish.

President Cyril Ramaphosa has announced that they are actively working towards a brighter future for the country in terms of our energy crises. South Africa’s Treasury is currently finalising to take over a portion of Eskom’s R396 billion debt as their part in helping the energy giant to get back to stability. He has also said that we will be getting more energy supply from Botswana.

Technical:

The ZAR has been dominant in the markets this week taking full advantage of a weaker USD. The Dollar is confirmed to be in overbought territory and there is a correction forming on the USD/ZAR pair. The USD/ZAR has traded within the range of R16.40’s to R16.90’s this week. We expect the technical correction to lead us back to the R16.20 levels soon as we see the Rand continue to strengthen.

Low – R16.20/$

Support – R16.50/$

Possible High – R16.70/$

EUROPEAN MARKETS

The Eurozone remains under dire strain and the war between Russia and Ukraine continues. Russia launched missiles on northern Ukraine from Belarus. According to Ukrainian armed forces, six Russian Missiles hit a military base in the north of Kyiv. There has also been reports about missiles in Kharkiv, the second largest city of Ukraine.

Inflation in the Eurozone remains at a record high and is at 8.6% in the Country. The ECB delivered their first interest rate hike of 50 basis points in over a decade last week to try and bring some stability to the economy but it seems that this was not enough. It is anticipated that the ECB will most likely deliver another 50 basis point interest rate hike in September. The ECB will have to act strategically in their next meeting in order to avoid a recession. We are also expected to see the EU’s GDP data today and this will give the ECB more direction with their next interest rate decision.

The Gas crises in the Eurozone continues as Russia has minimized its supply to Europe through the Nord Stream Pipeline and has cut supply by 60% for 10 days. Putin is most likely gaming the Eurozone into a recession. Russia’s Sakhalin Energy Investment Co has requested that its liquified natural gas (LNG) customers pay via Moscow and are negotiating to move away from the US Dollar for payments.

Technical:

The Euro has been on a bearish streak this week and has lost ground against the Rand significantly, currently trading in a downward channel. Even though the EUR has been struggling, the fall of the USD hasn’t helped in the EUR’s price against the ZAR. These are very good buying levels for importers. We anticipate that the EUR/ZAR pair will be trading within the range of R16.62 – R17.00. It will be interesting to see how the pair reacts to the EU GDP data.

Low – R16.62/€

Support – R16.81/€

Possible High – R17.00/€

uk markets

Much like other countries, the UK has been battling with sky high inflation which is currently at 9.1%, a 40-year high in the country. British households are facing severe pressures and this has since resulted in strikes around the U.K. Homelessness in the country is on the rise and UK business reported a fall in confidence over this month. With inflation woes and the high cost of living, a recession is closely looming around the British economy.

Technical:

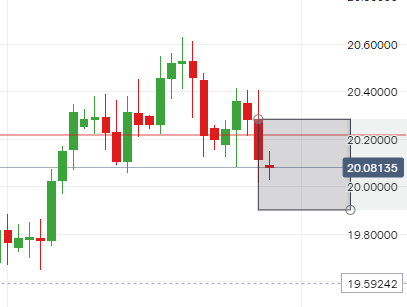

The GBP/ZAR has been trading within the range of R20.03 – R20.41 and like other currencies has lost ground against the Rand. We can anticipate that the pair will trade within the range of R19.90 – R20.20 over the next week.

Low – R19.90/£

Support – R20.07/£

High – R20.20/£