overview

The dollar retreated this week as investors took to the side-lines while awaiting tapering confirmation from the US Fed Chair.

The SA job market fell to record turmoil but emerging market demand kept the rand afloat.

sa markets

The rand lost ground last week and saw major currencies jump to 9-month highs, however this week painted a different picture as the Jackson Hole Symposium kept investors weary of dollar bids.

Caution over the possible changes in monetary approach from the US Fed officials kept the rand in a steady downward move against the dollar.

Local data showed that SA’s unemployment rate surged to the highest in the world off a list of 82 countries in a comparison done by Bloomberg. With the unemployment rate rising to 34.4% officially and 44.4% in the expanded definition of unemployment.

This negative data kept the rand range bound for a day until risk appetite had investors overlooking the adverse figures and selling off the dollar once more.

Over the past few months, the US Fed hinted about the need to reduce asset purchases, and yesterday 3 officials took a war-like approach to backing the early tapering of asset purchases and stimulus. The closing talks are due later today and tomorrow at Jackson Hole but US Fed Chair Jerome Powell is expected to take a more dovish and cautious comments with no definite say on when tapering will begin.

A cautious statement is likely to strengthen emerging markets and may see the rand make more gains below R15.00/$.

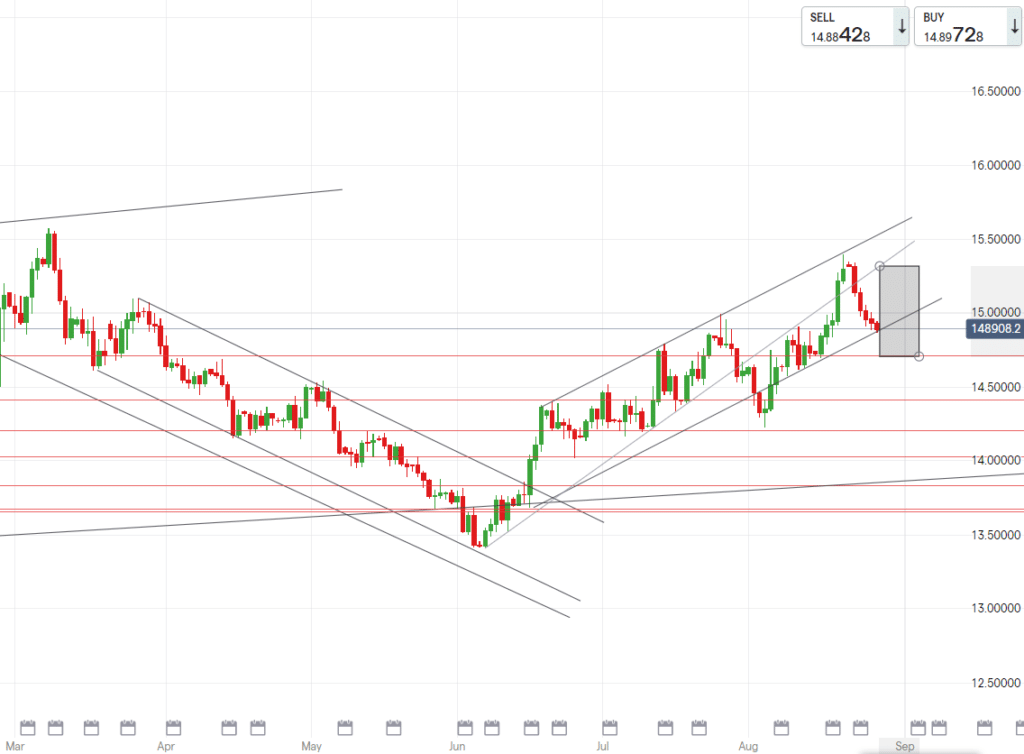

Technically – last week we broke above the psychological level of R15.00/$ on USDZAR, this morning we see a confirmed move below the R15/$ mark. The next move which will guide us to lower levels is if USDZAR breaks convincingly below our current channels bottom line of R14.88/$, shattering this would mean a path towards R14.70/$ is open.

Remain cautious on your costing and don’t be too ravenous for more gains as the pair may remain in a steady range should todays Fed comments be in the dollars favor.

european markets

The European markets represent the largest economic region with a combined GDP of more than $13 trillion, when economic activity is strong in this region then the euro strengthens.

Data released earlier in the week saw eurozone business activity recovering firmly in August. The EU has been deemed the in the best position out of major nations to fight the pandemic with vaccination rollouts reducing hotspots and improving infection numbers.

The bloc’s currency remains affected as well by the Jackson Hole talk as the growth rate and state of the US economy impacts the ‘anti-dollar’ euro. Slight pressure remains from the possibility of more variants, however the high vaccination rate is keeping the impact of the pandemic at bay in the EU.

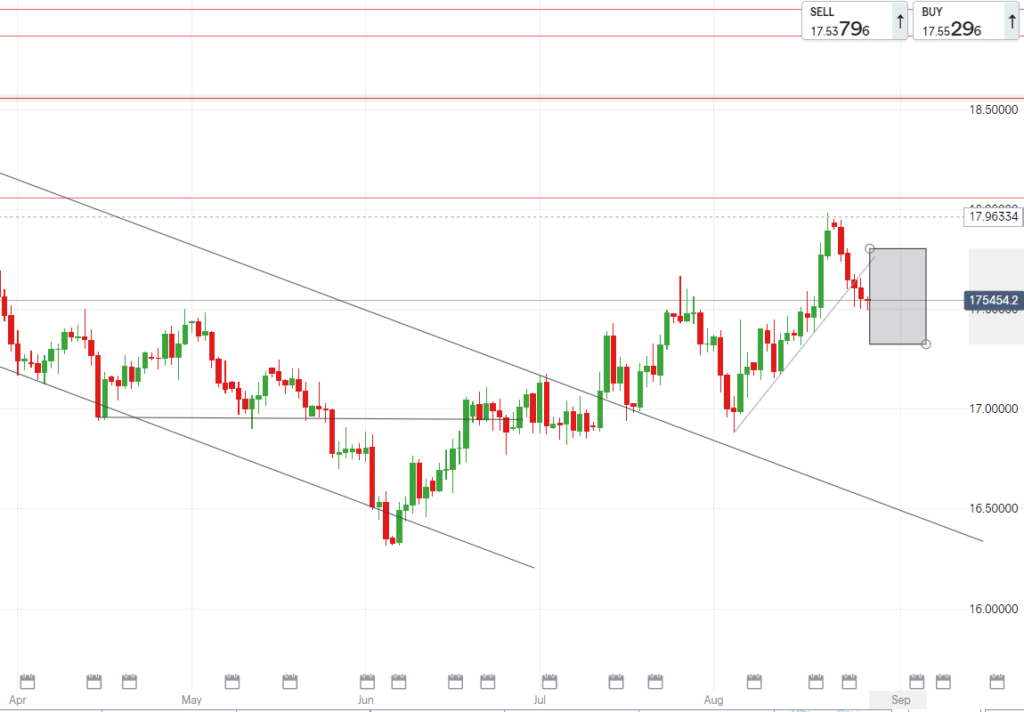

The EURZAR tested near R18.00/€ but failed to break and the pair is now geared to attempt a move under R17.50/€.

Should this occur then further lows of R17.40/€ and R17.32/€ may be possible. A rebound if the rand falls will likely see a range around R17.68/€.

uk markets

Escalating geopolitical tension and Brexit concerns weigh on international equities, while the global semi-conductor chip shortage was shown to have had a huge impact on the UK motor vehicle industry.

Such a hit to the vehicle output is expected to impact the Kingdom’s GDP. Despite slow downs in freight and certain logistics restrictions, retail sales in the UK showed that demand and sales increased to a 7 year high in August.

The rise is attributed to citizens saving up money during lockdown and building up a shop-till-they-drop desire once lockdowns were removed.

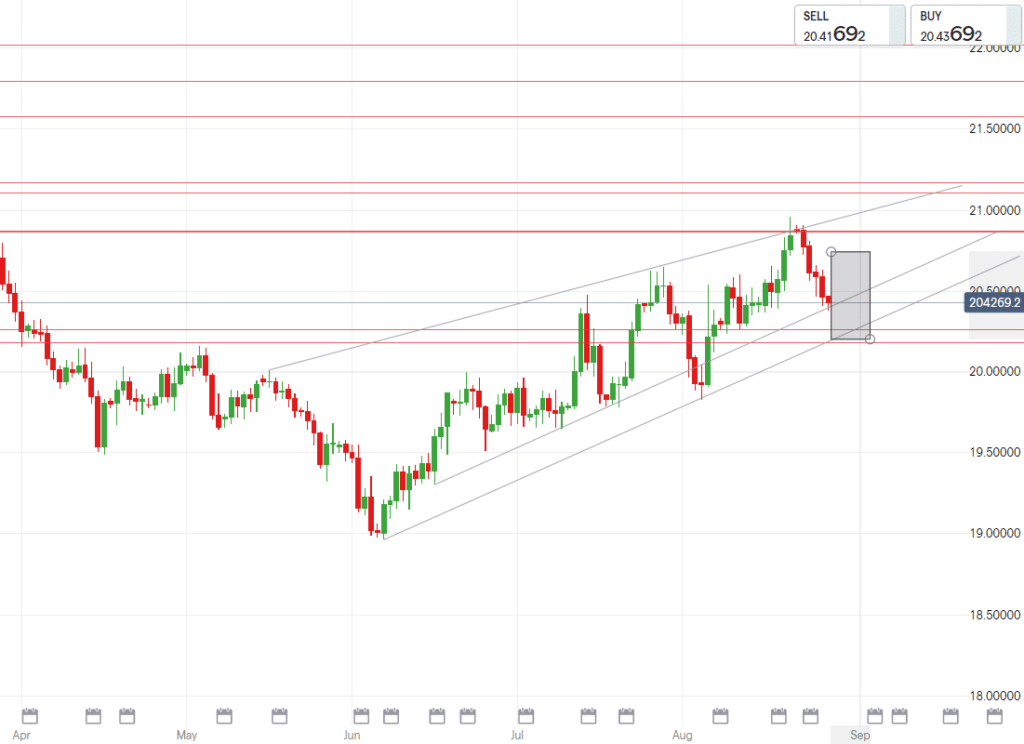

Technically, GBPZAR favor’s downward movement as the pair hovers around a support of R20.40/£. Levels to look out for are R20.30/£ and possibly R20.20/£ if those are broken.

Technical levels we are watching for the upcoming week:

USD/ZAR

- High – R15.30/$

- Support – R15.05/$

- Low – R14.70/$

EUR/ZAR

- High – R17.75/€

- Support – R17.55/€

- Low – R17.32/€

GBP/ZAR

- High – R20.75/£

- Support – R20.45/£

- Low – R20.20/£