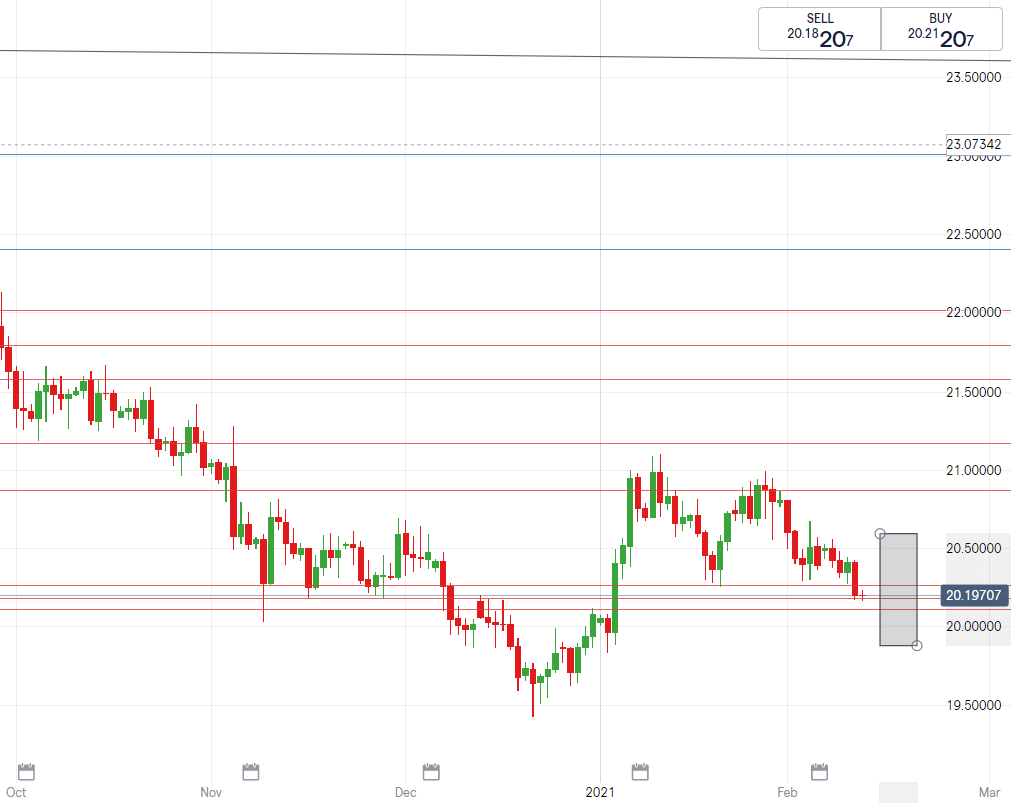

State of the Nation’s “effect” didn’t seep through to the rand, and major Central Banks stand together on keeping rates unchanged next month.

USD/ZAR News

“Lower for longer” was the theme in US Fed Powell’s talk on Wednesday, reminding us that as long as Powell is at the helm of the Federal Reserve we can expect policy to be unchanged with no rush to change course and intent remaining on keeping interest rates low.

US job data showed a slowing in the labor market however this data did not do much to damage sentiment as together with this grim news often comes the lurking promise of further stimulus.

Chair Powell did imply that the Fed does not wish to take its foot off of the stimulus gas pedal anytime soon and thus giving US markets some encouragement.

Despite these reassurances, the dollar remains soft without a catalyst in sight to reverse its current strong downward trend.

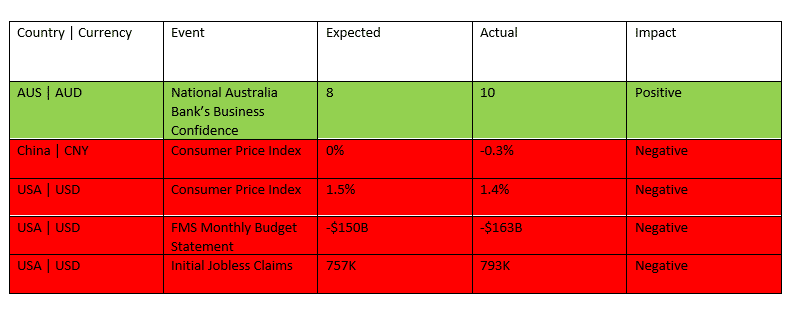

Technical direction forecast

USD is expected to remain consolidative with weaker bias as the outlook.

We may be forming a double bottom with a possible break out expected.

Given the sturdy downward channel that USDZAR remains in, it’s anticipated that the breakout would be towards the lower levels of R14.55/$ and R14.50/$.

These past few weeks have shown technical guidance can be thrown out the window so lets not forget the possibility of a upside towards R14.80/$ and back up to R15.00/$ should the greenback find it’s grip.

EUR/ZAR News

Covid-19 continues to wreak havoc on the eurozone with Germany reinstating border controls and Portugal urged to extend restrictions until April.

Furthermore due to the pandemic, a struggle to solve energy problems has worsened and left 30 million Europeans unable to heat their homes.

The European Central Bank recently also gave indication that they wish to keep rates unchanged with no inclination to dive deeper into negative rate territory.

A concern for the ECB is that the euro is around 5% further than its year-end target and thus the governing council intends to launch an exchange rate study to determine why the euro is stronger than the dollar.

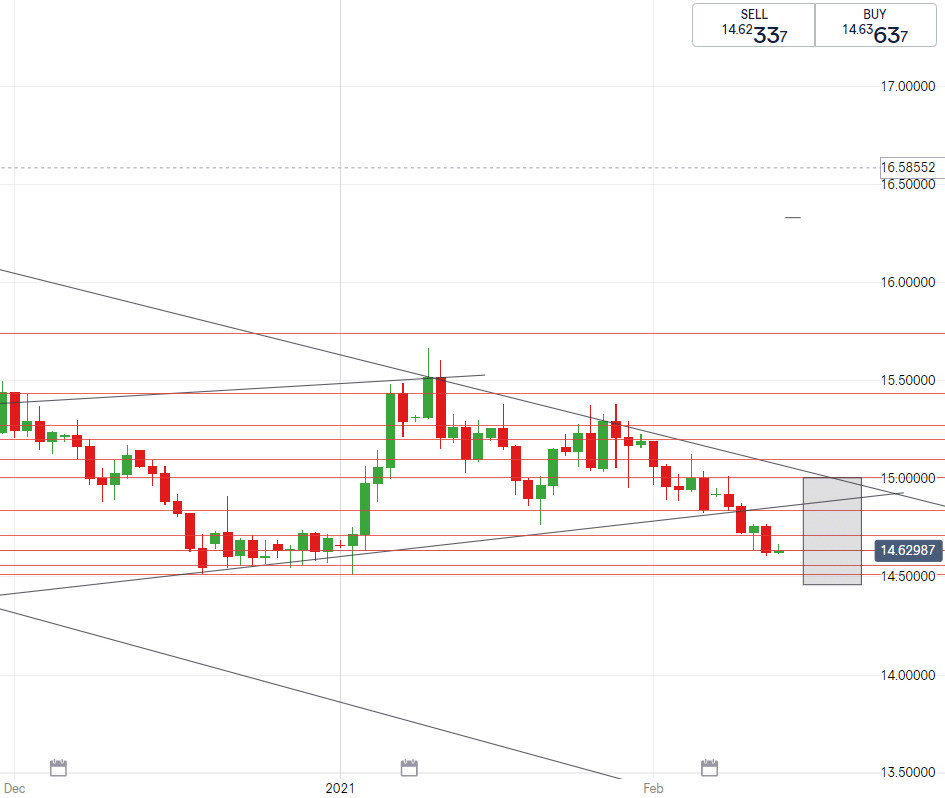

Technical direction forecast

EURZAR steamed through the bottom end of our forecasted range this week, staying well below R18.00/€ and reaching two month lows.

Next support levels to look out for are R17.70/€ and R17.62/€, testing these previous lows and breaking or rebounding will give indication of next weeks moves.

GBP/ZAR News

Vaccination progress in the United Kingdom continues to positively effect the growth expectations in Britain.

Bank of England decision makers told banks to prepare for a move into the negative rate arena, however contrastingly mentioned that the ECB has no intention of making such a rate move as of yet.

With the health crisis seemingly under control and vaccination roll outs in the UK succeeding at a pace to rival all other major nations, it is unlikely that their central bank will make any large actions in terms of policy at the next rates meeting.

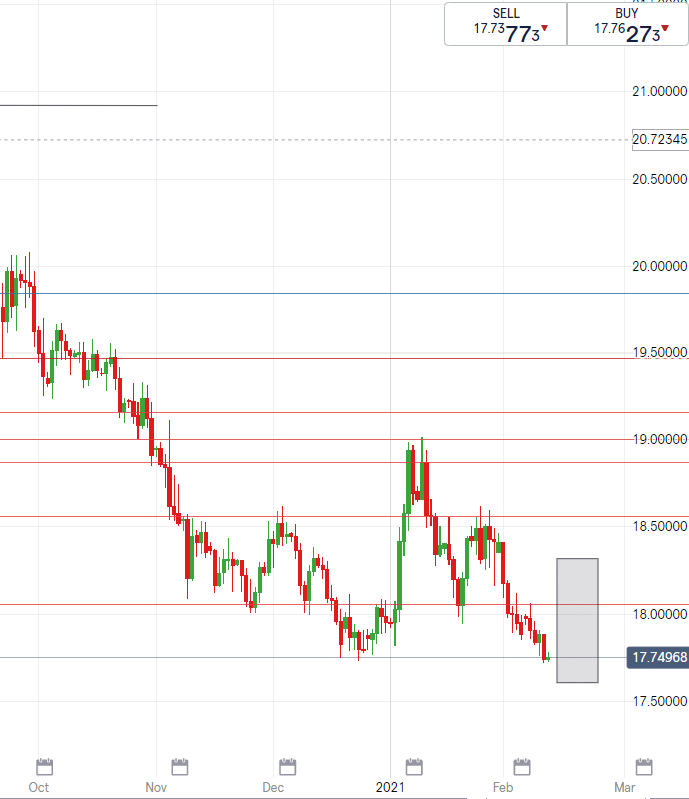

Technical direction forecast

Good progress in the UK is keeping the pound afloat however the sterling lacks momentum and has found itself at new lows this week.

Next levels to look out for a break are R20.17/£, R20.11/£ and then R20.05/£.

Could the rand’s rally push GBPZAR below R20/£, or will the pound rebound and correct upward?

South African Rand News

The nation was dealt a huge blow early in the week as it came to light that the saving grace of the AstraZeneca vaccine is not effective against the local mutations of the coronavirus.

Despite this spanner in our rollout plan, the rand remained well afloat and saw a reduction of close to 30cents on USDZAR since last week Friday.

This weeks rand strength can be attributed to a rally in risk sentiment, emerging market interest from market players and an overall weak dollar.

Focus of this week was fixated on last night’s State of the Nation address by President Ramaphosa which affected the rand in no way whatsoever.

Our President touched on many of the same plans we have heard of in the past such as splitting up Eskom, redistributing land, tackling corruption and reducing spending.

Reactions to the address were mixed as many of the opposition feeling the promises heard were nothing new. Next focus will be shifted towards the years first budget speech later in the month.

EUR/ZAR

- High – R18.30/€

- Support – R18.00/€

- Low – R17.62/€

GBP/ZAR

- High – R20.60/£

- Support – R20.33/£

- Low – R19.87/£

FX Paymaster is the smart, easy way to transfer money abroad.

Register here for a free demo to live account today for access to our world class online payment platform.

CLICK HERE FOR A FREE DEMO TO LIVE ACCOUNT