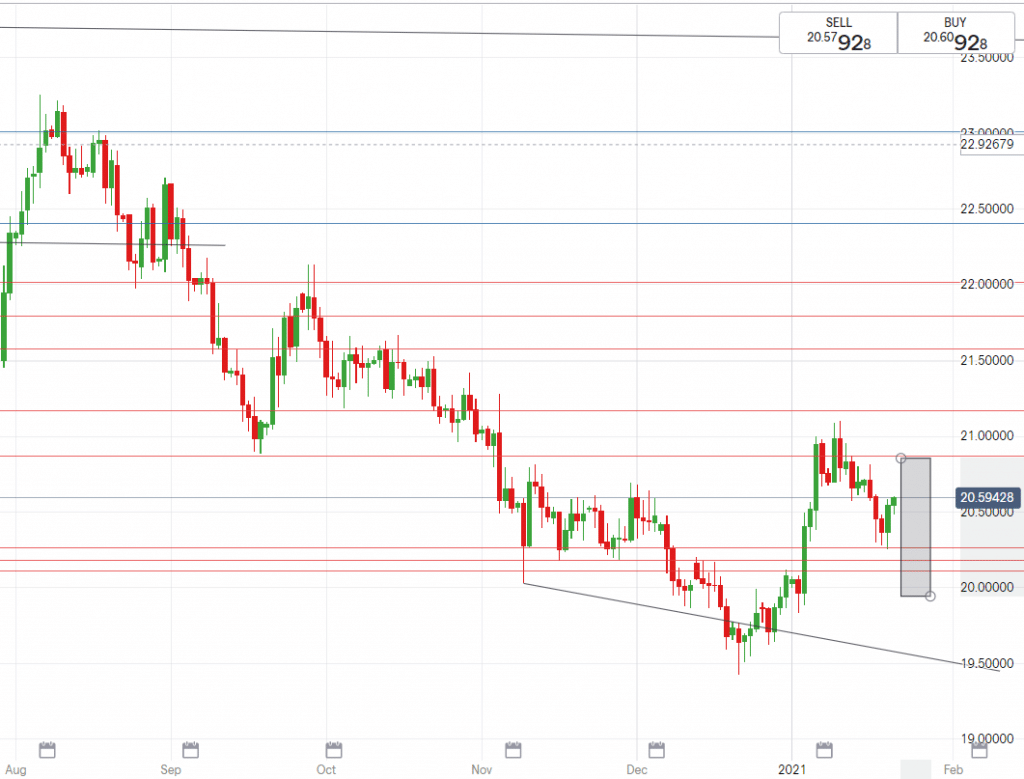

USD/ZAR News

Inauguration week was the talk of the week for the vulnerable dollar.

The arrival of President Joe Biden and Vice President Kamala Harris boosted the hopes for more stimulus and thus increased risk-on appetite.

This appetite kept the dollar weak for most of the week, with investors remaining speculative over the American currency.

Positivity remains around the newly inaugurated Biden administration, expectations are high that President Biden’s office will bring calmer international relations with less trade wars and radical bans.

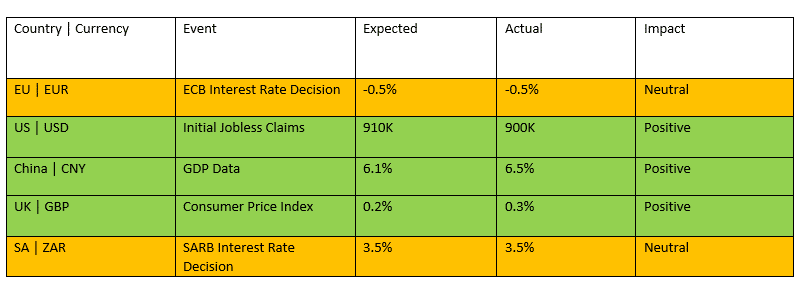

Technical direction forecast

After a four day losing streak on the USDZAR, yesterday night saw the risk on appetite and stimulus confidence overexert itself and lose oomph.

We closed business yesterday at R14.85/$ however find the pair over R15.02/$ this morning.

Seeing this spur pushes us to now consider levels like R15.08/$, should this be tested and broken we may see a R15.15/$ again. We expected a wide range in the week to come between R14.51/$ and R15.20/$.

EUR/ZAR News

In an effort to contain the impact of the pandemic, the eurozone finance officials stated that fiscal support will be implemented with a budget conscious approach.

This approach raises worries that countries struggling with debt will now be expected to accept further debt.

With a new variant of covid-19 seeping into Europe, the French health minister has cited that a further extended lockdown may be necessary in France should the cases increase drastically.

During a virtual meeting yesterday, eurozone members are in alliance to improve the co-operation between states in order to combat the pandemic across Europe.

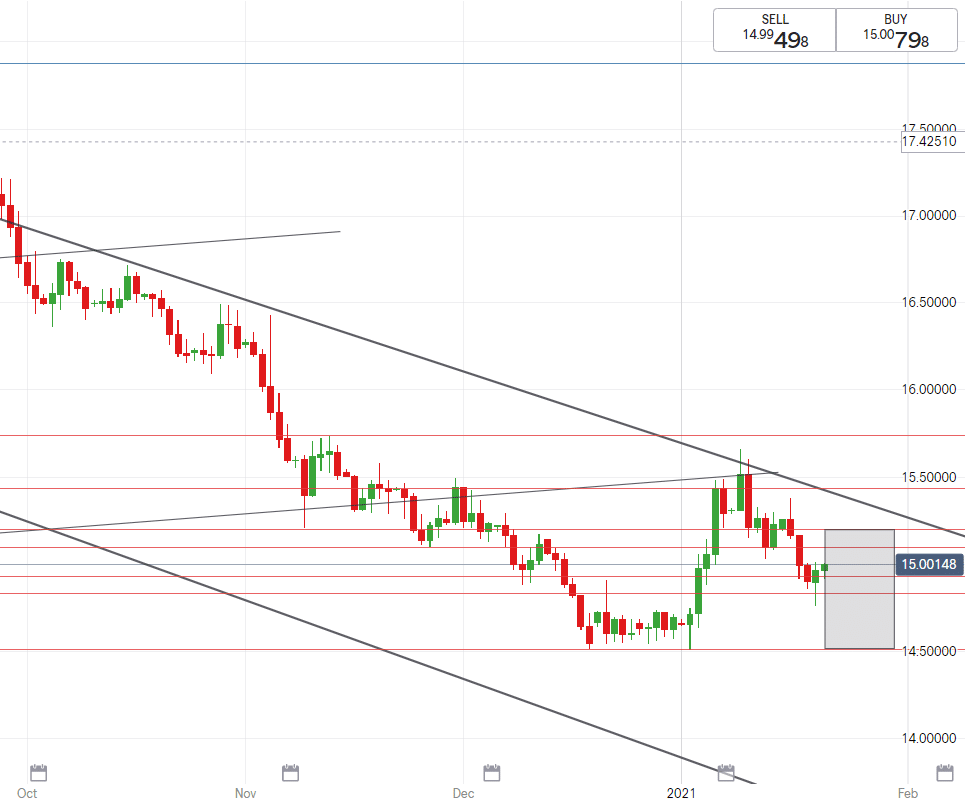

Technical direction forecast

EURZAR travelled across around 60 cents this week seeing a downward move translate into a correction this morning.

The week ahead is expected to see the pair testing our channel on the below graph. Support may be found at R18.30/€, with a high towards the resistance of R18.50’s as the risk appetite in emerging markets steams out.

GBP/ZAR News

Lockdown is playing the Brit’s favour as it disguises the effects of Brexit on the economy.

Prime Minister Boris Johnson stated yesterday that it is “too early” to say whether the restrictions will end this season.

Britain’s economy is expected to see gradual recovery as the infection rates declines and lockdown restrictions are loosened across the board.

The Pound remains uplifted by hopes that vaccinations can usher the UK nation and currency into a stronger place with a more stable economy.

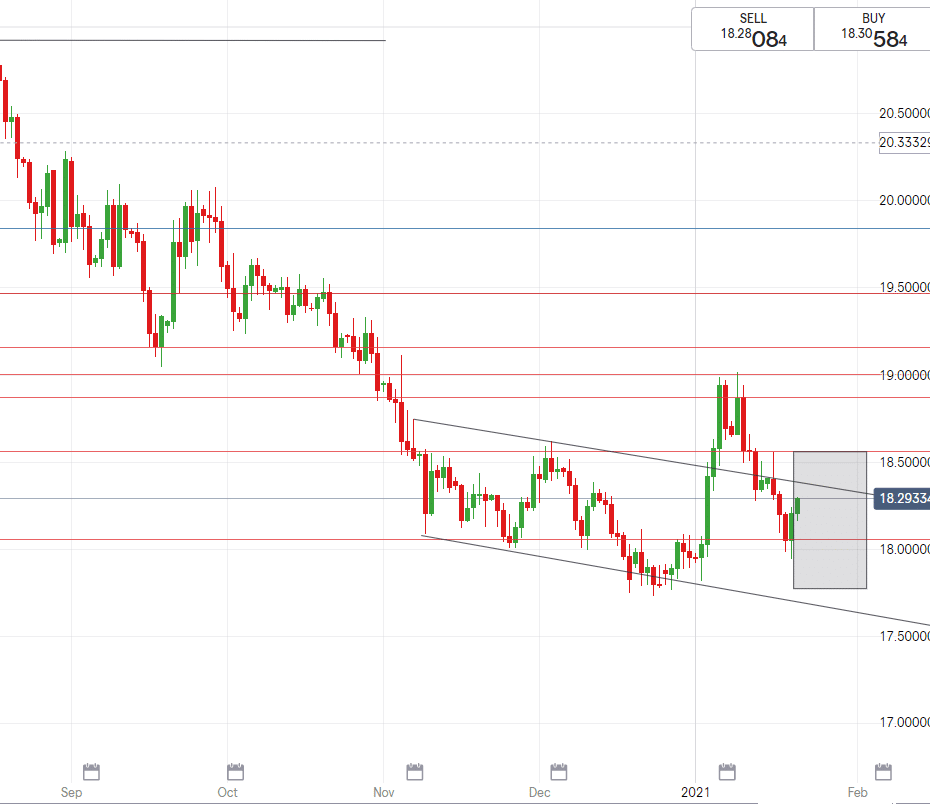

Technical direction forecast

GBPZAR finds itself ranging sideways with gradual downward momentum, where we open on Monday may set the tone for a clearer weeks picture.

Currently we expect that the pair will remain above R20.20/£ until that line is broken.

Look out for a break below R20.40/£ to signal lower levels and R20.70/£ to imply higher moves

South African Rand News

Investors were remaining on the side-line until after the SARB interest rate decision this week, this uncertainty played out in the rand’s favour.

As expected the SARB announced that rates would remain unchanged as 3 MPC members voted to hold rates and 2 MPC members voted to cut by 25 basis points.

The alcohol ban and load shedding continue to cause ripples in the nation.

Power cuts ae expected to be far worse in 2021 as the power stations performance continue to decline.

Hospitals are calling for further aid as doctors and staff are buckling under pressure – when health systems fall under pressure then it sets up parameters for further waves of the virus.

Emerging market appetite boosted the ZAR to contest against the majors this week, however today sees gains being lost and may be setting up a different picture for next week.

EUR/ZAR

- High – R18.54/€

- Support – R18.30/€

- Low – R17.76/€

GBP/ZAR

- High – R20.78/£

- Support – R20.40/£

- Low – R19.94/£

FX Paymaster offers a cheaper, faster way to send money internationally.

Register here for a free trial account today.

CLICK HERE FOR A FREE DEMO TO LIVE ACCOUNT