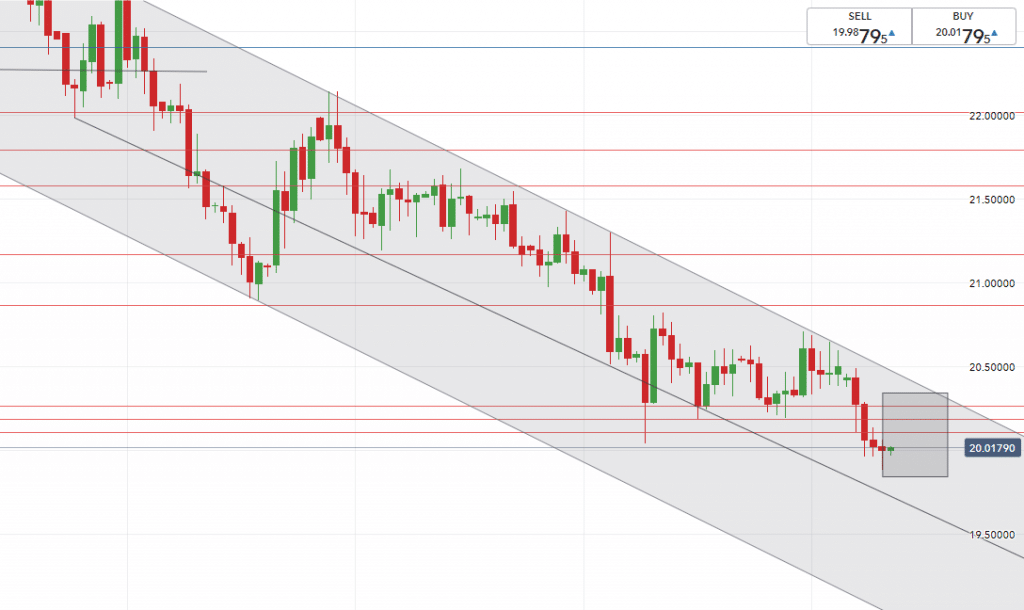

Rand News – After surprising improvements in our GDP data on Tuesday, the news saw a break on USD/ZAR under the R15.00/$ mark. In the coming week we will see a tug of war, strength for the rand from risk appetite and dollar strength once the vaccine is rolled out.

USD/ZAR News

The worlds most popular currency fell to a new 30 month low this week and remained soft against most major currency pairs.

Selling pressure on the dollar can be blamed on the discussion of economic stimulus in US congress, while additional stimulus in the eurozone also applied negative weight on the greenback.

A job crisis is casting a shadow on the US as weekly employment data showed an increase of 137,000 was added to the jobless claims figures.

This increase has been the highest since September adding to the US growing list of economic troubles.

Despite the grim outlook, positivity is expected to arise for the dollar as the Covid-19 vaccine is to be introduced to the US as soon as this weekend.

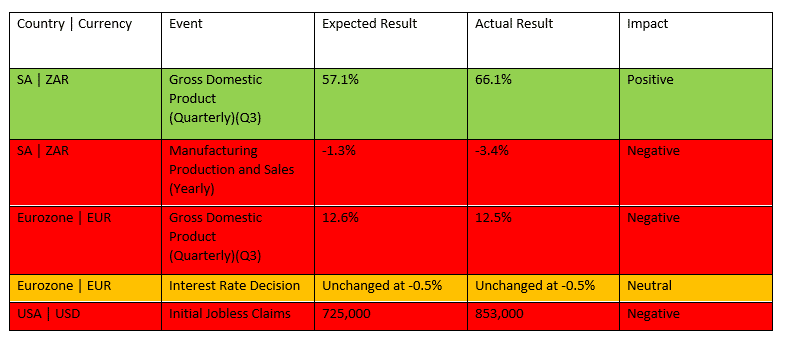

Technical direction forecast

On USDZAR we remain in a fixed gradual downward channel which started from Nov 6th, however we theorize that the dollar can see two possible outcomes next week :

1 – due to strength from a vaccine in the US, the USDZAR may push up and retrace back toward the key level of R15.20/$.

2 – as a result of purely technical movements, the USDZAR may break down lower and test levels like R14.75/$ as the week’s low.

EUR/ZAR News

We cited last week that the European Central Bank is a supporter for fiscal stimulus and this week the ECB stayed true to that title by extending their Quantitative Easing scheme yesterday during the rate decision announcement.

The ECB’s expanded asset initiative rose to a total of €1.85 trillion after yesterday’s reveal of a further €500bn in funding.

Brexit negotiations are also weighing on the euro, as the EU and UK continue to differ on issues like the rule of laws of provisions.

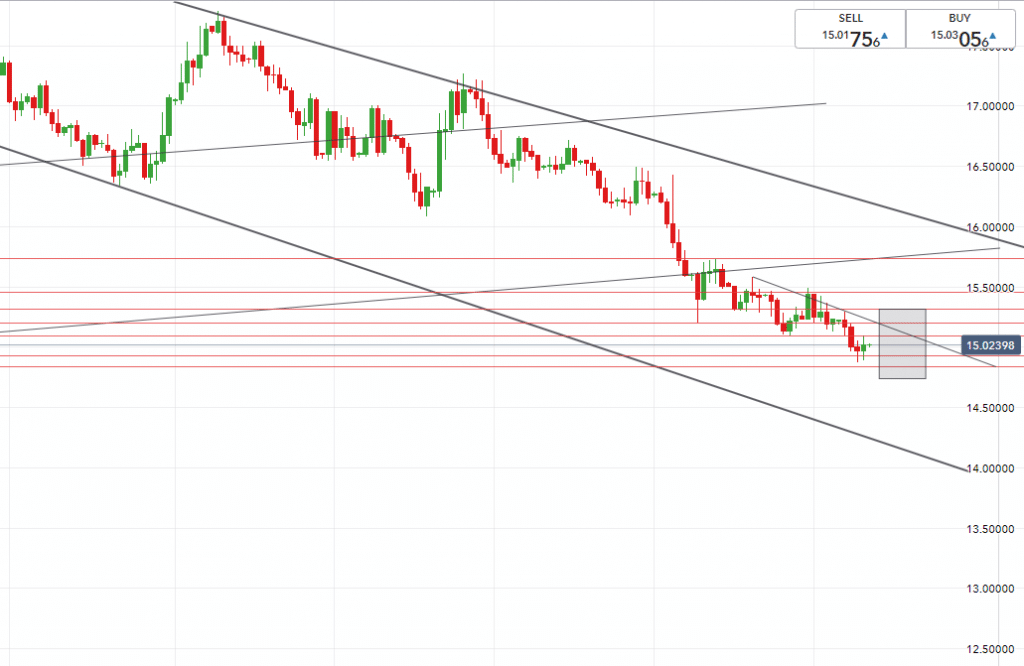

Technical direction forecast

The Euro stayed well within our channel this week until it broke out to test new lows. We expect a steady range of around 50cents on the EURZAR in the coming week.

Should we continue on a downward trend then we may test levels such as R17.93/€, if we break toward and through R17.99/€.

GBP/ZAR News

As per our daily market report yesterday, we are still “Brexiting” with the sterling gearing up for a no trade-deal Brexit outcome.

Yesterday Prime Minister Boris Johnson fueled doubts by citing that there is a “strong possibility” that Britain would fail to implement a trade deal.

A deadline for Sunday has been set, should no new trade deal be agreed upon then it would certainly be a chaotic break and cause turmoil for the pound.

The sterling has a tough road ahead, even if a deal is reached there will be many difficulties and if no deal is reached then the UK economy will receive a huge body blow followed by forced rate cuts and anticipated trade disruptions.

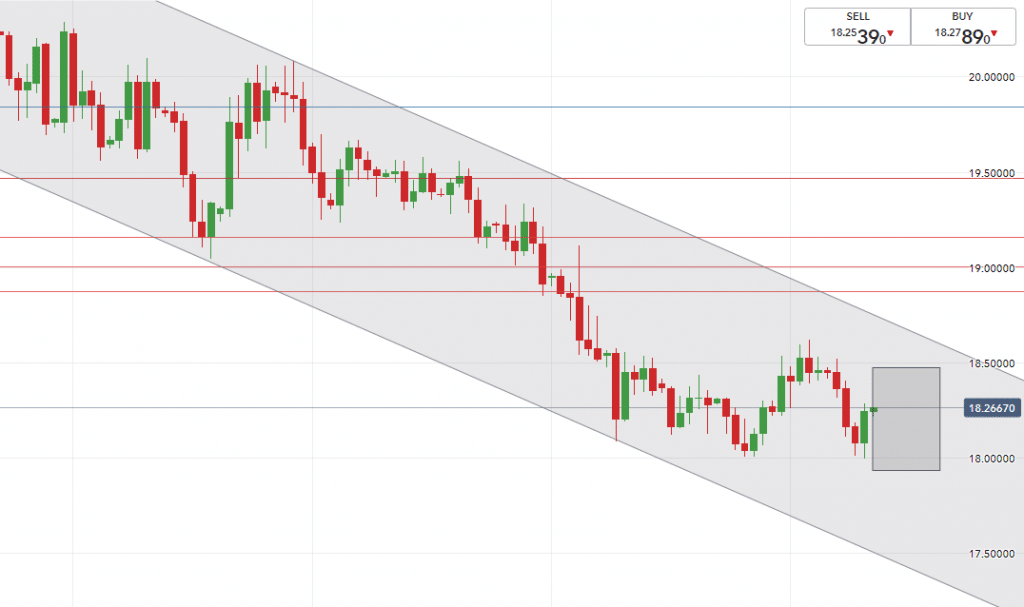

Technical direction forecast

A moderately strong level has been founded at R20.00/£ mark, staying above or below this support will give good indication of our next move.

Possibilities of bad Brexit news causing GBPZAR to break down and test lows of R19.93/£ and then consequently R19.84/£ are largely in play.

See our graph below with expected ranges on GBPZAR for a technical range.

South African Rand News

The Rand experienced more boosting this week from the risk appetite caused by the vaccine rally on emerging markets.

Our ZAR was also lifted by surprising improvements in our GDP data on Tuesday, the news saw a break on USDZAR under the R15.00/$ mark.

Some controversy has arisen from a discrepancy in the construction sector’s figures, a drop was shown in growth however sales rose distinctively and thus Statistics SA has announced it believes it may have underestimated certain activity.

Yesterday the rand had a wobble up and tested highs of an expected R15.08/$ after SA manufacturing productions figures showed an unexpected decline at -3.4%; which was 2.1% more of a drop than anticipated.

In the coming week we will see a tug of war, strength for the rand from risk appetite and dollar strength once the vaccine is rolled out – we will have to keep our eyes peeled to see how the clash affects USDZAR.

EUR/ZAR

- High – R18.47/€

- Support – R18.25/€

- Low – R17.93/€

GBP/ZAR

- High – R20.34/£

- Support – R20.10/£

- Low – R19.83/£

Have you tried our NEW free Demo to Live system? Register here for a free trial account to explore our platform

CLICK HERE FOR A FREE DEMO TO LIVE ACCOUNT