Rand News – The current vaccine surge has been flourishing for almost a fortnight, and the rand can only be grateful as it shrugged off a DOUBLE downgrade with focus being on a weak dollar and an uptick in global sentiment.

USD/ZAR News

The dollar began the week on a weak note with the vaccine rally positively affecting riskier assets and adversely turning investors cautious against the greenback.

Economic outlooks improved due to the announcement of a third vaccine early in the week, inspiring market players to seek out high yielding emerging market currencies.

A key event occurred when the General Services Administrator acknowledged president-elect Joe Biden as the US election triumphant.

The gradual confirmation of Biden’s presidency and progress of his transition to power may strengthen the dollar in the long term once a sense of certainty is abound, however currently market runners seem to be distracted by Biden’s promises of larger taxation on corporates and huge stimulus packages which may push investors into gold over the dollar to hedge against inflation.

All in all negative data, grim statements by the US Fed Chair on the economy and rising covid-19 cases keep the dollar walking on egg shells.

Technical direction forecast – An important level of R15.20/$ was broken this week, further pushing us beyond R15.12/$ and thus leading us to test a low of R15.10/$.

A technical reversal is expected as the downward trend has been ongoing, however dollar weakness remains persistent.

Looking ahead on USDZAR, a channel between R14.83/$ and R15.55/$ may form with each end being a strong level. Should we break decisively through R15.10/$ which is a sturdy support level then we may test under R15.00/$.

EUR/ZAR News

Travel bans are piling up against European countries as coronavirus cases continue to rise in the EU.

Germany has become a hotspot as infections surpass one million cases and the daily death toll broke a record over of 400.

Moods are low with oncoming Christmas season approaching with restrictions increasing and holiday resorts being called to close.

The emerging market rally has not aided euro strength and is keeping investors seeking better prospects in risk-on environments.

November PMI releases in the eurozone shows signs of an economic threat due to newly introduced business restrictions sweeping across Europe to contain a rise in cases – such grim uncertainty will not be euro positive.

Technical direction forecast – Downtrend was our friend on the EURZAR this week, hitting the lower region of our forecast.

As of today the euro finds support around R18.10/€, the high of the past week was R18.31/€ and having maintained below this level has turned it into a strong resistance.

Should the downward trend continue and we break R18.06/€ then we may see a R17.98/€ being tested – alternatively should a pull back occur due to news occurrences then we may test the highs of upper ranges.

GBP/ZAR News

A seesaw of back and forth continue as the week started for the pound with Bank of England governor Bailey citing that a no deal Brexit would impact the UK economy deeper in the long term than the pandemic has.

The looming stress of a long drawn out adjustment to find new trade deals, implement regulations and issue new tariffs is weighing on the pound – restrictions are expected to not aid this process and thus prospect of a certain vaccine would bring great relief to the UK’s troubles.

Budget deficits are expected to rise to a fifth of GDP as the UK is spending more than any time since the 2nd World War – recovery in the economy is expected to be deep into the distant horizon.

Technical direction forecast – GBPZAR once again lands spot center in our forecasted channel this past week having found support around R20.40/£.

We bottomed out at R20.20/£ and failed to break through R20.18/£ which is a big support level. Breaking that would see us possibly moving further to R20.10/£. It seems a sideways trend may form between R20.50/£ and R20.12/£ with bias being towards the downside due to the UK’s turmoil.

South African Rand News

The current vaccine surge has been flourishing for almost a fortnight, and the rand can only be grateful as it shrugged off a double downgrade with focus being on a weak dollar.

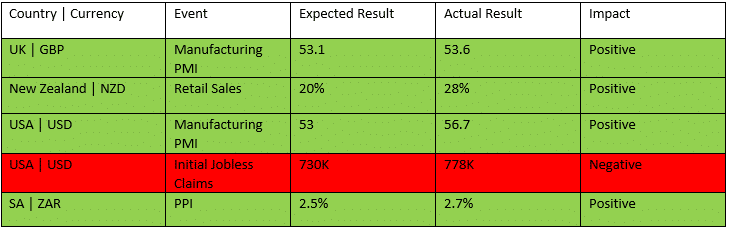

The rand was being manipulated by market players around key data announcements like CPI and PPI this week with muted movements in price action followed by spontaneous rushes of about 10 cents.

This week the rand breached support levels and experienced its best buying levels since February, reversals maybe setting up as the rand bottoms out however the ZAR will remain around better levels than seen in the previous couple of months.

A surprise announcement of an official vote of no confidence against President Ramaphosa has been set for the 3rd of December, such votes have historically been rand negative if the result is against the head of state – however we expect Ramaphosa to come out unscathed

EUR/ZAR

· High – R18.40/€

· Support – R18.15/€

· Low – R17.80/€

GBP/ZAR

· High – R20.53/£

· Support – R20.35/£

· Low – R20.10/£

If your business makes or receives foreign payments then you could save time and money using FX Paymaster Online. Have you tried our free demo system? Our registered clients also get the latest Rand News every morning to their mailbox.

CLICK HERE TO REGISTER YOUR FREE DEMO ACCOUNT