Daily Rand Traders View 11th July 2018

In overnight US trade the Rand strengthened to as low as R 13,25 before returning to its current comfort zone of R 13,40 to the US Dollar.

This really highlights the potential of using limit orders to target particular levels outside of normal trading hours. Its not like we won’t see that level again because I think we will, but it may take time. For those of you who have got payments to make you might want to consider using a limit order to target (and take advantage) of better buying levels should they become available overnight. For more information about Limit Orders feel free to call our dealing desk on 011 888 0125.

USD/ZAR

I thought we would see the market consolidate more yesterday but it looks like we’re seeing a bit of that pull back this morning as traders undoubtedly wait for more information before taking up their positions again.

We’re in the middle of nowhere at the moment, your long bull traders are more than likely waiting for the Rand to trade down to the support line before buying again and your short traders are probably thinking about taking profits at these levels.

In the interim we could see the rates push back to R 13,50 – R 13,55. If you’re looking for a buying level, R 13,20 to the USD should be your target to buy at this stage. Based on the daily USDZAR graph I would consider that our best short-term target.

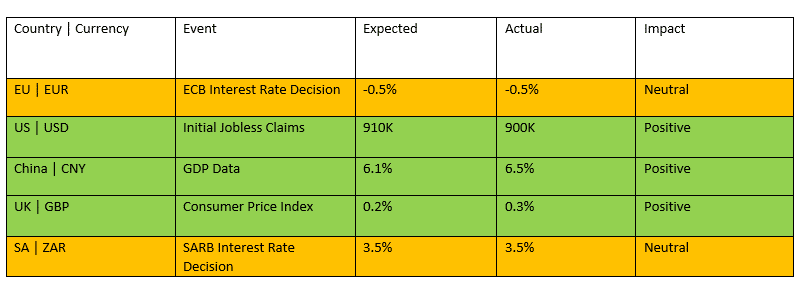

I don’t think the recent rally is going to be enough to break that lower support line. Again, where the Rand is concerned, we tend to focus more on the technical data rather than the underlying fundamentals as the market usually just shrugs off poor SA data. We will be looking at tomorrows US CPI data though as the inflation numbers have a direct impact on interest rates.

This Information is provided by fx paymaster. Our Daily Rand Traders view is intended to give you information about the foreign exchange market. The information contained in this currency report is based on our views and opinions. When trading you should always rely on your own judgement.